Products You May Like

US 10-year yields could hit the lowest levels since February

Is there a new-quarter repositioning ongoing?

US 10-year yields are nosediving today, falling 6.7 bps to 1.365%, which is just above the short-lived spike lower following the Fed.

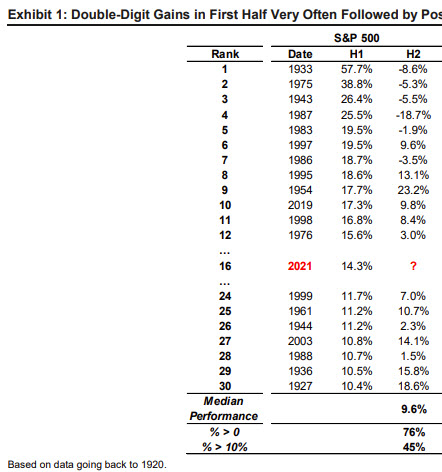

An optimist might think this is money flowing into fixed income at the start of the quarter after a good run in equities to start the year. That might be a mistake with Scotia data showing that a gain of around the 14.3% climb in H1 tends to follow through into H2.

A more pessimistic view — which is hard to ignore — is that the market is losing faith in the Fed’s willingness to run the economy hot and/or the Federal government’s ability to pass infrastructure stimulus and keep spending high.

Another view is that the deflationary dynamics of aging, technology and globalization will overwhelm any policy response.

Those are all big questions but for now the bigger one is whether 1.354% will hold.