Products You May Like

Yen and Swiss Franc turn softer today as overall sentiments stabilized. US stocks once again pared back much of earlier losses overnight and closed just slightly down. Asian markets were just mixed only, with Nikkei also reversing most of earlier losses. Dollar is currently the stronger one for today, followed by commodity currencies. As for the week, however, Yen and Swiss Franc remain the best performer followed by Dollar. Canadian Dollar is the worst one, followed by Aussie and Kiwi. A focus now is whether Canadian job data could give the Loonie some much needed lifts.

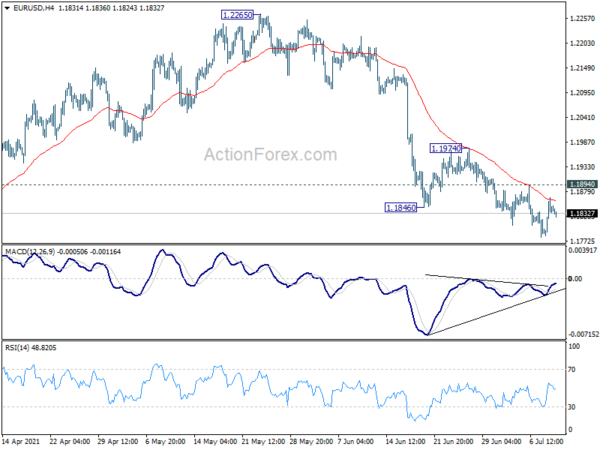

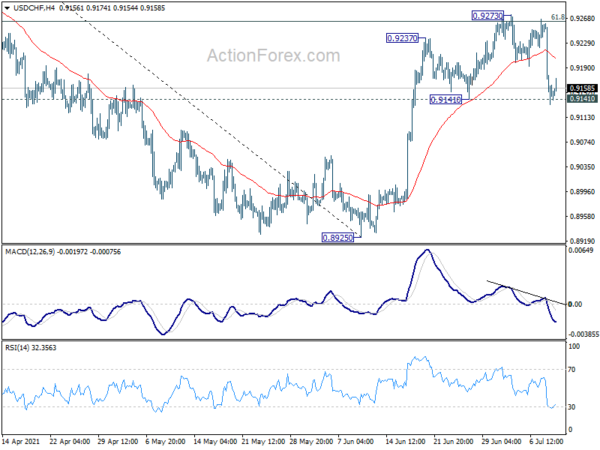

Technically, the lost of downside momentum in EUR/USD is a development to note. Bullish divergence condition is clear in 4 hour MACD. Break of 1.1894 resistance will suggest short term bottoming and target 1.1974 resistance for confirmation. Meanwhile, break of 0.9141 support in USD/CHF would also indicate short term topping at 0.9273 and bring deeper fall. Such developments, if happen, could signal near term bearish reversal in the greenback.

In Asia, Nikkei closed down -0.63%. Hong Kong HSI is up 0.72%. China Shanghai SSE is down -0.04%. Singapore Strait Times is up 0.68%. Japan 10-year JGB yield is up 0.0024 at 0.030. Overnight, DOW dropped -0.75%. S&P 500 dropped -0.86%. NASDAQ dropped -0.72%. 10-year yield dropped -0.033 to 1.288.

Fed Daly: We’re not through the pandemic, just getting through

San Francisco Fed President Mary Daly said in an FT interview, “I think one of the biggest risks to our global growth going forward is that we prematurely declare victory on Covid.” She emphasized, “we are not through the pandemic, we are getting through the pandemic.”

“If the global economy . . . can’t get . . . higher rates of vaccination, really get Covid behind, then that’s a headwind on US growth,” Daly said. “Good numbers on the vaccinations are terrific, but look at all the pockets where that isn’t yet happening.”

On stimulus withdrawal, she said, “we’re ready to taper at the appropriate time.” But she added, “then I’d like to see, how is that going? How does the economy respond to that? Because we can forecast, we can project, but we need to know in order to actually say, ‘oh, OK, now it’s time to move on to the next phase’, which is discussing policy normalization and the fed funds rate coming up a bit.”

UK GDP grew 0.8% mom in May, still -3.1% below pre-pandemic level

UK GDP grew 0.8% mom in May, well below expectation of 1.9% mom. That’s still the fourth consecutive month of growth. Service sector grew 0.9% mom. Production grew 0.8% mom, returned to growth. Manufacturing contracted -0.1% mom. Construction contracted for a second consecutive month, by -0.8% mom.

Overall GDP was still -3.1% below pre-pandemic level seen in February 2020. Services was -3.4% low, production -2.6% lower, while manufacturing was -3.0% lower. But construction was 0.3% above the pre-pandemic level.

Elsewhere

China CPI slowed to 1.1% yoy in June, below expectation of 1.4% yoy. PPI slowed to 8.8% yoy, matched expectations. UK will also release trade balance today. Canada employment will be a major focus.

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9101; (P) 0.9181; (R1) 0.9228; More….

Intraday bias in USD/CHF stays neutral with focus on 0.9141 support. Firm break there will argue that whole rebound from 0.8925 has completed. Intraday bias will be turned to the downside for 55 day EMA (now at 0.9121). Sustained break there will pave the way back to retest 0.8925 low. On the upside, though, break of 0.9273 will resume the rally to 0.9471 key resistance instead.

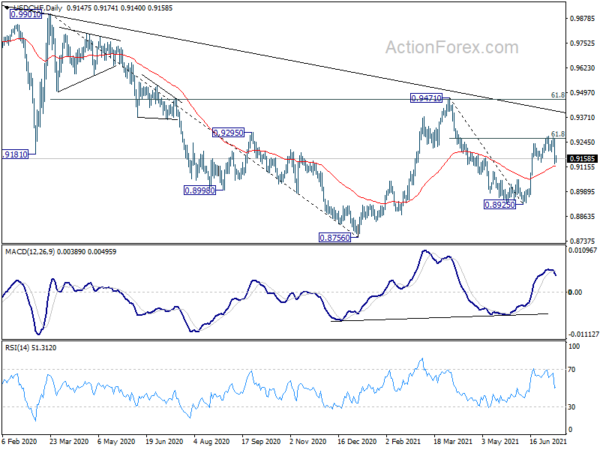

In the bigger picture, medium term outlook is currently neutral with focus on 0.9471 resistance. Sustained break there will indicate completion of whole decline from 1.0342 (2016 high). Medium term outlook will be turned bullish for a test on 1.0342 high. But, rejection by 0.9471 again will revive bearishness for another fall through 0.8756 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Money Supply M2+CD Y/Y Jun | 5.90% | 7.10% | 7.90% | |

| 1:30 | CNY | PPI Y/Y Jun | 8.80% | 8.80% | 9.00% | |

| 1:30 | CNY | CPI M/M Jun | -0.40% | 0.00% | -0.20% | |

| 1:30 | CNY | CPI Y/Y Jun | 1.10% | 1.40% | 1.30% | |

| 6:00 | GBP | GDP M/M May | 0.80% | 1.90% | 2.30% | 2.00% |

| 6:00 | GBP | Manufacturing Production M/M May | -0.10% | 1.00% | -0.30% | 0.00% |

| 6:00 | GBP | Manufacturing Production Y/Y May | 27.70% | 29.50% | 39.70% | 39.10% |

| 6:00 | GBP | Industrial Production M/M May | 0.80% | 1.50% | -1.30% | -1.00% |

| 6:00 | GBP | Industrial Production Y/Y May | 20.60% | 21.60% | 27.50% | 27.20% |

| 6:00 | GBP | Index of Services 3M/3M May | 3.90% | 4.30% | 1.40% | |

| 11:00 | GBP | Goods Trade Balance (GBP) May | -10.8B | -11.0B | ||

| 12:30 | CAD | Net Change in Employment Jun | 40.0K | -68K | ||

| 12:30 | CAD | Unemployment Rate Jun | 8.10% | 8.20% | ||

| 13:00 | GBP | NIESR GDP Estimate Jun | 3.80% | |||

| 14:00 | USD | Wholesale Inventories May | 1.10% | 1.10% |