Products You May Like

Market bears had multiple chances to probe a bearish reversal last week, riding on talks like Fed’s tapering, spread of Delta variants, and China’s crackdown on its own technology stocks, as well as foreign IPOs. Yet, the optimists just refused to give up and pushed US indexes to new record closes, after all the volatility. The tug of war should end that easily. But for now, it seems that the bulls are having a solid upper hand.

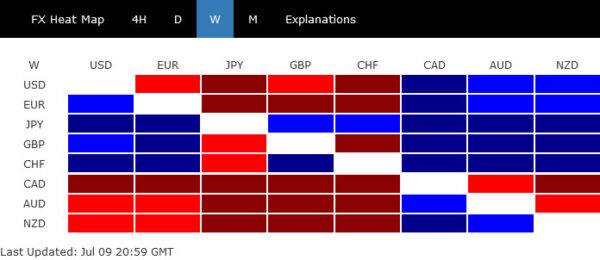

That brings us to note that while Yen and Swiss Franc ended as the strongest, late selloff argues that the near term moves are already reversing. Some Yen crosses, as noted below, could have completed their corrections near to medium term fibonacci support levels. Dollar also ended mixed after losing momentum and paring back much gains. There is prospect of more downside in Dollar for the near term. The question is whether commodity currencies, after ending the week as worst performers, could strike a come back. Or, it’s now time for Euro and Sterling to shine.

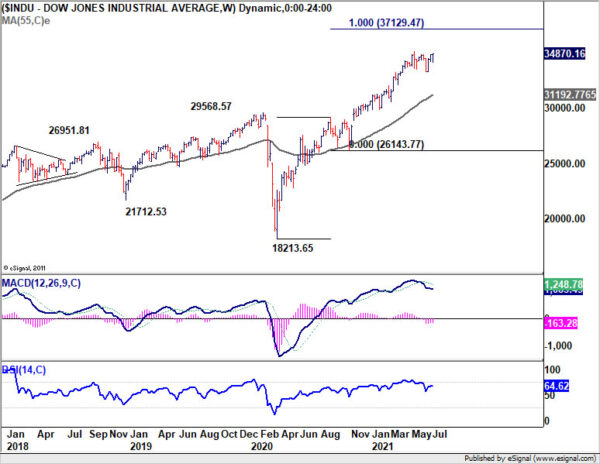

DOW ended at record close after volatile week

The intra-week selloff in stocks proved to be just a temporary blip. NASDAQ and S&P 500 eventually extended recent up trend to new record high. Even DOW ended the week at record close at 34870.16, even though it’s short of intraday record of 35091.56. More importantly, it also managed to hold above 55 day EMA (now at 34095.87) and stayed inside medium term channel. Thus, there is no change in the up trend despite all the shocks. Focus is back on 35091.56 in the coming days. Firm break there will resume larger up trend from 18213.65, towards 100% projection of 18213.65 to 29199.35 from 26143.77 at 37129.47.

FTSE and DAX range bound, Nikkei holding on to fibonacci support

Development in major European indexes were also not back. FTSE was just range bound, and repeated drew support from rising 55 day EMA. Similarly, DAX also just engaged in sideway consolidation, holding on to rising 55 day EMA. Both indexes are staying in healthy medium term up trend for upside breakout any time.

Nikkei’s development was a little bit more shaky, as dragged down China’s crackdown on its own technology sector. Yet, it’s holding on to 23.6% retracement of 16378.94 to 30714.52 at 27331.32. The risk of deeper, medium-term scale, correction is there, but not overwhelmingly high yet.

10-year yield rebounded after diving to 1.268

Back to the US markets, 10-year yield dived sharply to as low as 1.268 last week but recovered notably from there to close at 1.356. Some support was seen from 38.2% retracement of 0.504 to 1.765 at 1.283. Such level is also close to 55 week EMA (now at 1.309). The conditions are there to complete the correction from 1.765. If TNX could quickly rise back above 1.436 resistance the support later in the month, overall market sentiment would be seen as normalized.

Dollar index continued to lose upside momentum

As for the Dollar index, it continued to lose upside momentum as seen in Daily MACD. 55 week EMA (now at 92.50) is too much for DXY to break through decisively. Risk of a near term reversal is increasing. Break of 91.51 support would bring deeper fall through 55 day EMA (now at 91.34), back to retest 89.20/53 support zone. Also, even in case of another rise, as we’re seeing it as in sideway consolidation pattern from 89.20, there is little upside potential above 93.43 resistance

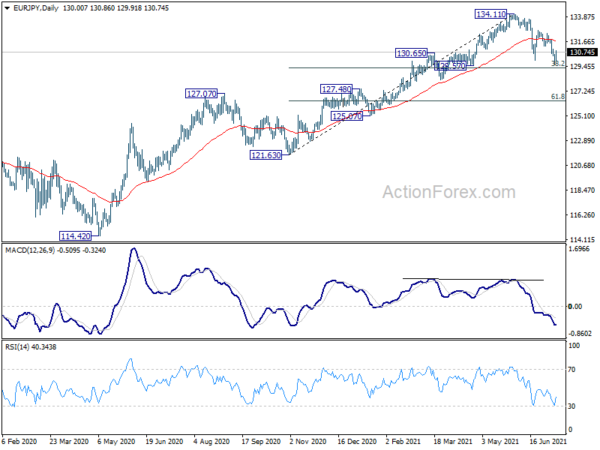

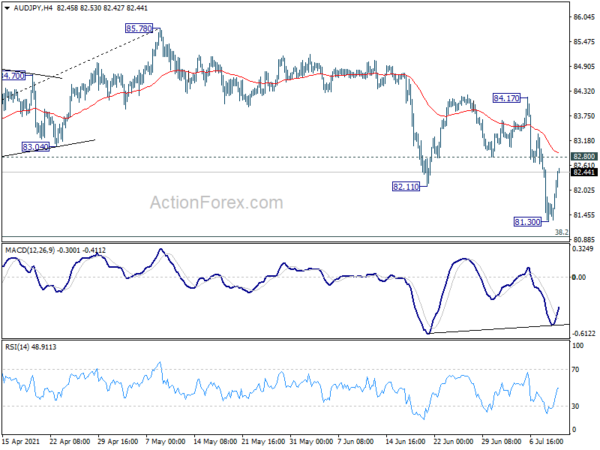

Yen crosses might have finished correction with last week’s falls

Yen crosses are worth some attention in the coming days. Near term correction could have completed after last week’s deep decline and late rebound. EUR/JPY’s focus will be on 131.02 minor resistance this week. Firm break there will argue that correction from 134.11 has completed with three waves down to 129.60, on bullish convergence condition in 4 hour MACD. That came just ahead of 38.2% retracement of 121.63 to 134.11 at 129.34. Stronger rebound would then be seen to 132.68 resistance to confirm.

Similarly, AUD/JPY’s focus will be on 82.80 support turned resistance this week. Firm break there will argue that correction from 85.78 has completed at 81.30, on bullish convergence condition in 4 hour MACD. That came just above 38.2% retracement of 73.12 to 85.78 at 80.94. Further rise should then be seen to 84.17 resistance to confirm.

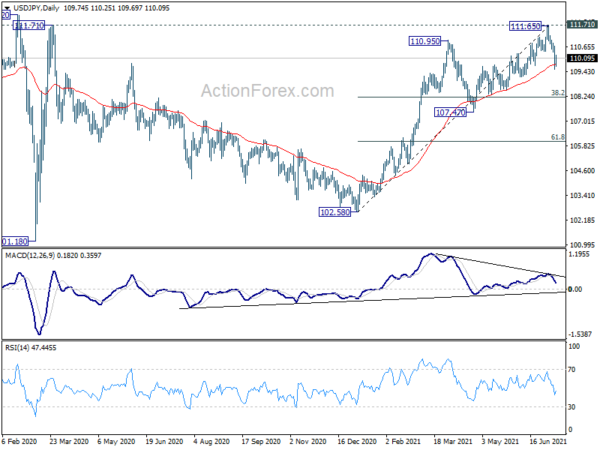

Development of USD/JPY would be less clear, depending on the relative reactions if risk appetite continues strongly. Bearish divergence condition in Daily MACD gives a warning that it was rejected firmly by 111.71 key resistance already. Yet, it’s not giving up on 55 day EMA yet. Risk will be mildly on the downside, but the pair has to break through last week’s low at 109.52 to confirm that selling is back first.

EUR/USD Weekly Outlook

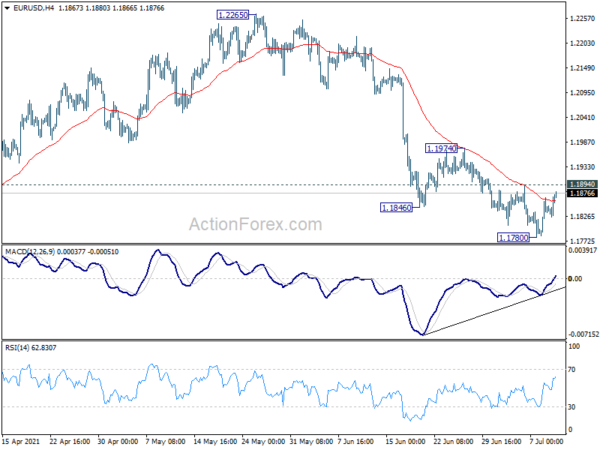

EUR/USD’s decline from 1.2265 extended to as low as 1.1780 last week but recovered again. Initial bias remains neutral this week first. Break of 1.1780 will bring another decline, to extend the corrective pattern from 1.2348, to retest 1.1703 support. However, considering bullish convergence condition in 4 hour MACD. Break of 1.1894 minor resistance will indicate short term bottoming. Intraday bias will be turned back to the upside for 1.1974 resistance first. Sustained break there will pave the way back to 1.2265/2348 resistance zone.

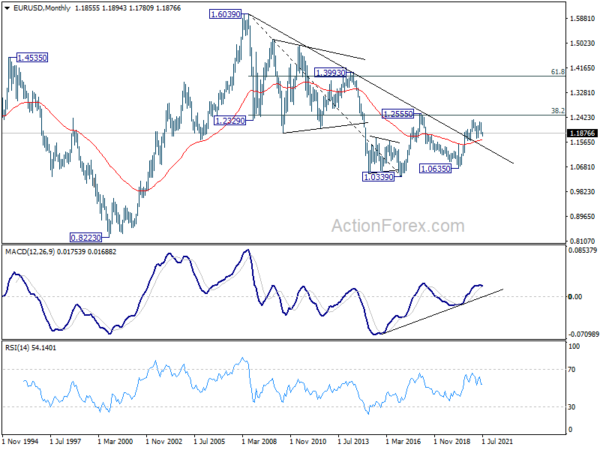

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. Reaction from 1.2555 should reveal underlying long term momentum in the pair. However sustained break of 1.1602 will argue that the rise from 1.0635 is over, and turn medium term outlook bearish again.

In the long term picture, focus remains on 1.2555 cluster resistance (38.2% retracement of 1.6039 to 1.0339 at 1.2516). Sustained break there should confirm long term bullish reversal and target 61.8% retracement at 1.3862 and above. However, rejection by 1.2555 will keep medium term outlook neutral first, and raise the prospect of down trend resumption at a later stage.