Products You May Like

Overall market sentiments stabilized in Asia, after the massive risk-off trades in the US overnight. While Asia indexes are still down, losses are limited. Yen and Swiss franc are paring some gains but remain the overwhelmingly strongest ones. Commodity currencies are the weakest as led by Canadian Dollar. Dollar and Euro are mixed for now, stuck in between. Focuses will remain on whether concerns over delta variants of COVID-19 would spread further.

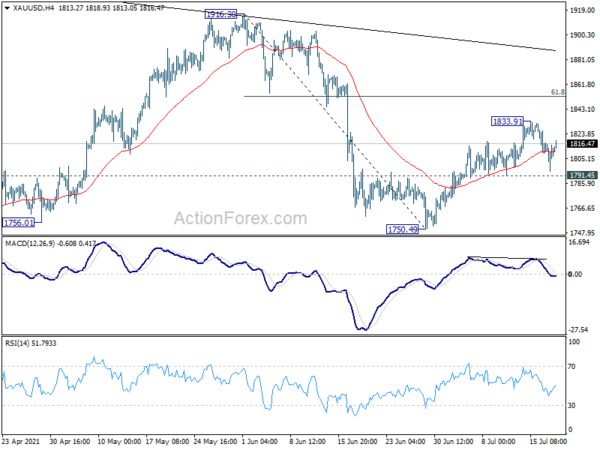

Technically, one development to note is that Gold has rebounded notably after defending 1791.45 support. Rise from 1750.49 might not be over yet and is still in slight favor to resume through 1833.91 at a later stage. That also indicates some uncertainty over Dollar’s strength, which is also reflected in lack of follow through selling in EUR/USD. We’d continue to monitor developments in Gold to double confirm the next move in the greenback.

In Asia, at the time of writing, Nikkei is down -0.32%. Hong Kong HSI is down -0.39%. China Shanghai SSE is down -0.64%. Japan 10-year JGB yield is down -0.0072 at 0.011. Overnight, DOW dropped -2.09%. S&P 500 dropped -1.59%. NASDAQ dropped -1.06%. 10-year yield dropped -0.119 to 1.181.

RBA Minutes: Conditions for rate hike won’t be met until 2024

In the minutes of July 5 meeting, RBA reiterated that the “central scenario implied that the conditions for an increase in the cash rate would not be met until 2024”. However, “fast-than expected” recovery over the course of 2021 had “widened the range of alternative plausible scenarios for the economic outlook”, and thus, “the cash rate over the period to November 2024”. Hence, it decided to retain April 2024 bond as the target bond, rather than extending the horizon to November 2024 bonds.

On the decision on the size of weekly bond purchases, it noted that “the economic outcomes had been materially better than earlier expected and the outlook had improved”. And, “in light of these improvements and the agreed decision-making framework, members decided to adjust the weekly purchases from $5 billion to $4 billion and agreed to review the rate of purchases at the November 2021 meeting.”

US 10-year yield dropped to 1.18 on delta variant worries

As worries over the impact of delta variant grew, US stocks and treasury yields tumbled sharply overnight. Markets appeared to be pricing out some of the more optimistic growth scenarios for the quarters ahead. Instead, investors turned cautious as restrictions could still come back, which is happening in some countries like Australia already, even though the economy is more adapted to it after more than a year of “drills”.

10-year yield closed down -0.119 at 1.181, breaking 1.2 handle for the first time since February. The strong break of 38.2% retracement of 0.504 to 1.765 at 1.28 was a surprise to us, which indicates rather pessimistic developments too. The fall from 1.765 would now be targeting 61.8% retracement at 0.9857, which is close to 1% handle. We’d expect strong support from there to finish the correction, as we’re just back to reality.

On the data front

Japan CPI core rose to 0.2% yoy in June, up from 0.1% yoy, matched expectation. Swiss trade balance, Germany PPI and Eurozone current account will be released in European session today. US will release housing starts and building permits.

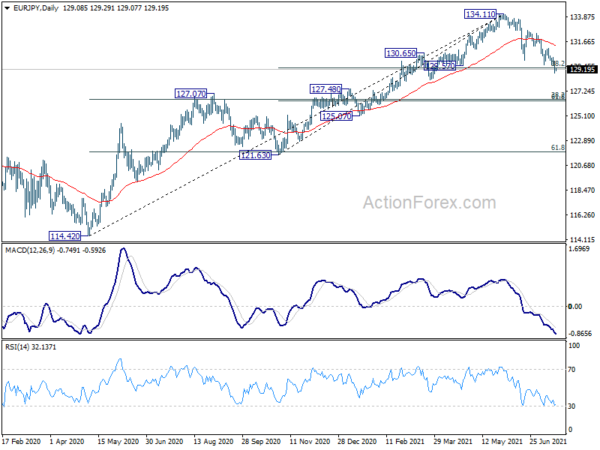

EUR/JPY Daily Outlook

Daily Pivots: (S1) 128.70; (P) 129.35; (R1) 129.81; More….

EUR/JPY’s fall from 134.11 resumed by breaking through 129.60 and hit as low as 128.87 so far. Intraday bias is back on the downside for deeper fall. Sustained trading below 38.2% retracement of 121.63 to 134.11 at 129.34 will argue that it’s already corrective the whole up trend from 114.42. Deeper decline would be seen back to 127.07 resistance turned support. On the upside, above 129.60 minor resistance will turn intraday bias neutral first. But risk will stay on the downside as long as 131.07 resistance holds.

In the bigger picture, rise from 114.42 is seen as a medium term rising leg inside a long term sideway pattern. As long as 127.07 resistance turned support holds, further rise is still expected to retest 137.49 (2018 high) However, firm break of 127.07 will argue that the medium term trend has reversed, and open up the case for retesting 114.42.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Core Y/Y Jun | 0.20% | 0.20% | 0.10% | |

| 01:30 | AUD | RBA Minutes | ||||

| 06:00 | CHF | Trade Balance (CHF) Jun | 5.12B | 4.95B | ||

| 06:00 | EUR | Germany PPI M/M Jun | 1.20% | 1.50% | ||

| 06:00 | EUR | Germany PPI Y/Y Jun | 8.50% | 7.20% | ||

| 08:00 | EUR | Eurozone Current Account May | 24.3B | 22.8B | ||

| 12:30 | USD | Housing Starts Jun | 1.59M | 1.57M | ||

| 12:30 | USD | Building Permits Jun | 1.69M | 1.68M |