Products You May Like

Yen drops broadly today as markets turn back into risk-on mode. It has indeed become the worst performing one for the week. Dollar is also staying to look a bit vulnerable against European majors and commodity currencies. Canadian Dollar is firm and shrug off retail sales data, which shows contraction. Question is now on whether S&P 500 and NASDAQ could make new record highs before weekly close.

Technically, USD/JPY’s break of 110.33 resistance now suggests that correction from 111.65 has completed at 109.05 already. But that’s more due to Yen’s weakness then Dollar’s strength. We’d now see if EUR/JPY and GBP/JPY could extend the rebound from 128.58 and 148.43 respectively.

In Europe, at the time of writing, FTSE is up 0.77%. DAX is up 0.96%. CAC is up 0.40%. Germany 10-year yield is up 0.023 at -0.400. Earlier in Asia, Hong Kong HSI dropped -1.45%. China Shanghai SSE dropped -0.68%. Singapore Strait Times dropped -0.07%. Japan was on holiday, as Olympics starts.

Canada retail dales dropped -2.1% in May, more contraction expected in June

Canada retail sales dropped -2.1% mom to CAD 53.8B in May, better than expectation of -3.0% mom decline. The largest declines occurred at building material and garden equipment and supplies dealers (-11.3%) and motor vehicle and parts dealers (-2.4%). Sales decreased in 8 of 11 subsectors, representing 65.6% of retail trade. Advance estimate showed further -4.4% mom contraction in retail sales in June.

ECB dissenter Wunsch not comfortable taking a commitment for five or six years

ECB Governing Council member Pierre Wunsch confirmed to CNBC that he voted against the central bank’s new forward guidance. But he urged that “my dissent shouldn’t be dramatized,” as “we all agree we want to be supportive in this phase of the recovery, we all actually want to go to 2%”.

“The most important conclusion of the retreat actually, and our new strategy, is what I would call a ‘no regret’ conclusion, in that we all agree that what we have been doing in the last few years was necessary and proportional,” Wunsch said.

“The question is whether this proportionality test that we are going to have to make in the future — whether we can remain proportional in what we do and take commitments over a long period of time, like five or six years in the future.”

“We might be faced with issues of fiscal dominance, issues of financial dominance, and I just, at the end of the day, did not feel comfortable taking a commitment for five or six years.”

ECB SPF sees higher inflation and growth in 2021 and 2022

In the ECB Survey of Professional Forecasters (SPF) for Q3, inflation expectations for Eurozone were revised up for 2021 and 2022. Growth projections were upgraded across the horizon while unemployment forecasts were revised down.

Inflation forecast:

- For 2021 at 1.9% (revised up from Q2 forecast at 1.6%).

- For 2022 at 1.5%, (up from 1.3%).

- For 2023 % 1.5% (unchanged).

Real GDP growth forecast:

- For 2021 at 4.7% (up from 4.2%).

- For 2022 at 4.6% (up from 4.1%).

- For 2023 at 2.1% (up from 1.9%).

Unemployment rate forecast:

- For 2021 at 8.1% (down from 8.5%).

- For 2022 at 7.8% (down from 7.8%).

- For 2023 at 7.5% (down from 7.7%).

Eurozone PMI composite rose to 60.6, 21-yr high, enjoying a summer growth spurt

Eurozone PMI Manufacturing dropped from 63.4 to 62.6 in July, above expectation of 62.5. PMI Services rose from 58.3 to 60.4, above expectation of 59.6, a 181-month high. PMI Composite rose from 59.5 to 60.6, highest in 252 months.

Chris Williamson, Chief Business Economist at IHS Markit said: “The eurozone is enjoying a summer growth spurt as the loosening of virus-fighting restrictions in July has propelled growth to the fastest for 21 years. The services sector in particular is enjoying the freedom of loosened COVID-19 containment measures and improved vaccination rates, especially in relation to hospitality, travel and tourism.”

Germany PMI composite rose to record 62.5, remains in the fast lane

Germany PMI Manufacturing rose from 65.1 to 65.6 in July, above expectation of 64.1. PMI Services rose from 57.5 to 62.2, above expectation of 59.5, record high since June 1997. PMI Composite rose from 60.1 to 62.5, record high since Jan 1998.

Phil Smith, Associate Director at IHS Markit said: “Germany’s private sector economy remains in the fast lane to recovery, according to July’s flash PMI survey. Buoyed by a resurgent service sector, the survey’s headline index is now at a record high and signals that the recovery still possesses strong momentum at the start of the third quarter.”

France PMI manufacturing dropped to 58.1, services dropped to 57.0

France PMI Manufacturing dropped from 59.0 to 58.1, below expectation of 58.3. PMI Services dropped form 57.8 to 57.0, below expectation of 59.0. PMI Composite dropped from 57.4 to 56.8.

Joe Hayes, Senior Economist at IHS Markit said: “It’s perhaps slightly disappointing to see the headline composite output figure dip slightly in July, but as the French economy normalises to a state of looser lockdown restrictions, it is not so much of a surprise. Regardless, the PMI pointed to another strong month-on-month rate of output growth, with service providers outperforming their manufacturing counterparts once again.”

UK PMI composite dropped to 57.7, Delta variant overshadowed freedom day

UK PMI Manufacturing dropped from 63.9 to 60.4, below expectation of 62.7. PMI Services dropped from 62.4 to 57.8, below expectation of 62.0. PMI Composite dropped from 62.2 to 57.7.

Chris Williamson, Chief Business Economist at IHS Markit, said: “July saw the UK economy’s recent growth spurt stifled by the rising wave of virus infections, which subdued customer demand, disrupted supply chains and caused widespread staff shortages, and also cast a darkening shadow over the outlook.

“Concerns over the Delta variant have meanwhile overshadowed the passing of “freedom day”, and were a key factor alongside Brexit and rising costs behind a sharp slide in business expectations for the year ahead, which slumped to the lowest since last October. The PMI indicates that GDP growth will likely have slowed in the third quarter, after having rebounded sharply in the second quarter.”

UK retail sales rose 0.5% mom in Jun, boosted by Euro 2020 start

UK retail sales rose 0.5% mom in June, matched expectations. Sales were up 9.5% comparing to pre-pandemic level in February 2020. ONS said, “the largest contribution to the monthly increase in June 2021 came from food stores where sales volumes rose by 4.2%, with anecdotal evidence suggesting these increased sales may be linked with the start of the Euro 2020 football championship.”

The volume of sales for the three months to June was 12.2% higher than in the previous three months. That’s driven in large part of particularly strong sales in April.

UK Gfk consumer confidence rose to -7, gradual release of pent-up demand

UK Gfk Consumer Confidence rose from -9 to -7 in July. The index has improved for six months in a row. Personal financial situation over next 12 months was unchanged at 11. General economic situation over the next 12 months dropped from -2 to -5. However, major purchase index rose from -5 to 2.

Joe Staton, Client Strategy Director GfK, says: “The healthy seven-point rise in the major purchase measure aligns with strong retail growth figures that reflect the gradual unlocking of the UK high street and release of pent-up demand as Brits hit shops, restaurants and venues. However, threats from increasing consumer price inflation, rising COVID infection figures, and the looming end of furlough and the Job Retention Scheme could put the brakes on this rebound.

Australia PMI composite dropped to 45.2, growth streak brought to a halt

Australia PMI Manufacturing dropped from 58.6 to 56.8 in July, a 4-month low. PMI Services dropped from 56.8 to 44.2, a 14-month low. PMI Composite dropped from 56.7 to 45.2, also a 14-month low.

Jingyi Pan, Economics Associate Director at IHS Markit, said: “Latest indications from the IHS Markit Flash Australia Composite PMI suggested that Australia’s growth streak had been brought to a halt in July, and perhaps no surprise given the renewed lockdowns aimed to bring the COVID-19 situation under control.”

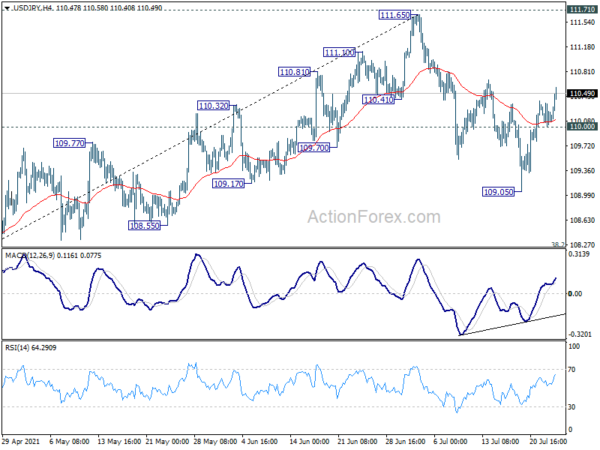

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 110.01; (P) 110.18; (R1) 110.36; More…

USD/JPY’s break of 110.33 resistance argues that correction from 111.65 has completed at 109.50 already. Intraday bias is back on the upside for retesting 111.65 high. On the downside, though, break of 110.00 minor support will turn bias back to the downside for 109.05. Break will target 38.2% retracement of 102.58 to 111.65 at 108.18.

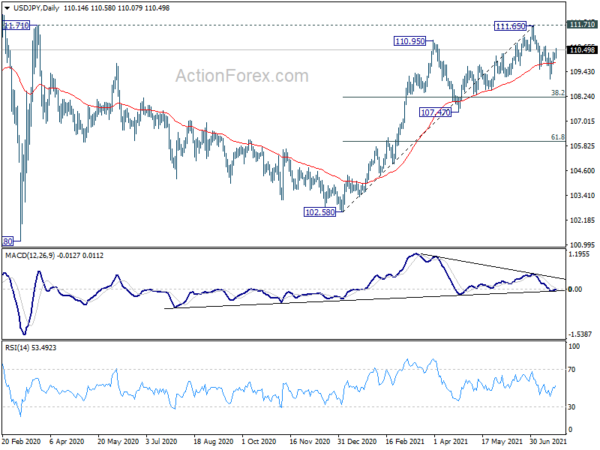

In the bigger picture, medium term outlook is staying neutral with 111.71 resistance intact. The pattern from 101.18 could still extend with another falling leg. Sustained trading below 55 day EMA will bring deeper fall to 107.47 support and below. For now, outlook won’t turn bullish as long as 111.71 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | Manufacturing PMI Jul P | 56.8 | 58.6 | ||

| 23:00 | AUD | Services PMI Jul P | 44.2 | 56.8 | ||

| 23:01 | GBP | GfK Consumer Confidence Jul | -7 | -9 | -9 | |

| 06:00 | GBP | Retail Sales M/M Jun | 0.50% | 0.50% | -1.40% | -1.30% |

| 06:00 | GBP | Retail Sales Y/Y Jun | 9.70% | 9.60% | 24.60% | |

| 06:00 | GBP | Retail Sales ex-Fuel M/M Jun | 0.30% | 0.70% | -2.10% | -2.00% |

| 06:00 | GBP | Retail Sales ex-Fuel Y/Y Jun | 7.40% | 7.80% | 21.70% | |

| 07:15 | EUR | France Manufacturing PMI Jul P | 58.1 | 58.3 | 59 | |

| 07:15 | EUR | France Services PMI Jul P | 57 | 59 | 57.8 | |

| 07:30 | EUR | Germany Manufacturing PMI Jul P | 65.6 | 64.1 | 65.1 | |

| 07:30 | EUR | Germany Services PMI Jul P | 62.2 | 59.5 | 57.5 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Jul P | 62.6 | 62.5 | 63.4 | |

| 08:00 | EUR | Eurozone Services PMI Jul P | 60.4 | 59.6 | 58.3 | |

| 08:30 | GBP | Manufacturing PMI Jul P | 60.4 | 62.7 | 63.9 | |

| 08:30 | GBP | Services PMI Jul P | 57.8 | 62 | 62.4 | |

| 12:30 | CAD | Retail Sales M/M May | -2.10% | -3.00% | -5.70% | |

| 12:30 | CAD | Retail Sales ex Autos M/M May | -2.00% | -5.00% | -7.20% | |

| 13:45 | USD | Manufacturing PMI Jul P | 62 | 62.1 | ||

| 13:45 | USD | Services PMI Jul P | 64.8 | 64.6 |