Products You May Like

Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium didn’t disappoint. He did what the markets expected, affirming the openness for beginning tapering this year, without indicating the need for an imminent start. Just as Philadelphia Fed President Patrick Harker described, Powell laid out where the center of the FOMC is in terms of policy. US stocks cheered the speech with S&P 500 and NASDAQ closing at record highs.

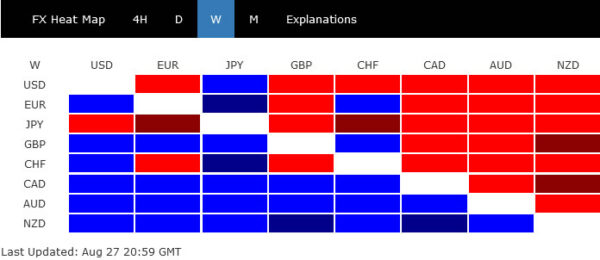

In the currency markets, Dollar was sold off notably after Powell and end the week as the second worst performer. Yen was the weakest following rebound in major global yields, while Swiss Franc was third. On the other hand, commodity currencies closed as the strongest ones, led by New Zealand Dollar.

Development in Gold suggests that more downside in now in favor in the greenback. We’d like to see break of 1.1804 resistance in EUR/USD and 1.3785 resistance in GBP/USD very soon to affirm this case. Meanwhile, Aussie has the potential to outperform ahead, given that vaccination is speed up and investors are starting to look through the current lockdowns.

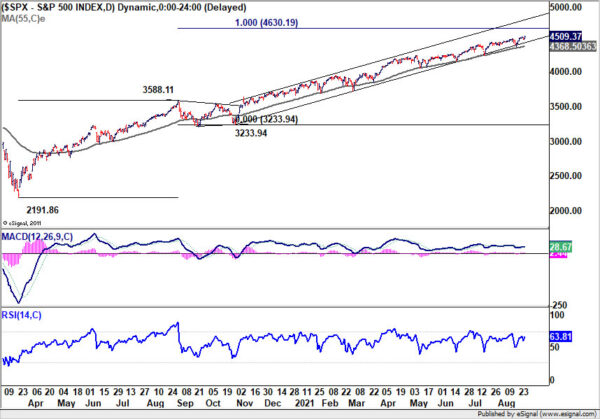

NASDAQ and S&P closed at new record highs, more upside ahead

After some initial hesitation, NASDAQ surged on Friday to close at new record high at 15129.50 last week. Most importantly, it managed to close well above 15000 handle, as well as 61.8% projection of 10822.57 to 14175.11 from 13002.53 at 15074.39. Daily MACD is trending up, suggesting there might be some upside acceleration ahead.

In any case, near term outlook will stay bullish as long as last week’s low as 14776.98 holds. We might see NASDAQ picking up momentum further and target 100% projection at 16355.07 next.

S&P 500 also closed at 4509.37 record high, and above 4500 handle. Near term outlook will also stay bullish as long as last week’s low at 4450.29 holds. It’s on track to next target at 100% projection of 2191.86 to 3588.11 from 3233.94 at 4630.19.

10-year yield failed 55 day EMA again, to extend sideway trading

10-year yield tried to rally last week but again failed to sustain above 55 day EMA. Near term outlook is mixed for the moment. 50 % retracement of 0.504 to 1.765 at 1.134 should provide a solid floor in case of another decline, unless we have something drastic happening. However, TNX will still need to sustain above 55 day EMA, and break through 1.142 resistance decisively, to confirm completion of correction of 1.765. Otherwise, more sideway trading is likely, suggesting some relative indecisiveness among investors.

Focus back on 92.47 near term support in DXY after decline

Focus in the Dollar index is back to 92.47 near term support after last week’s decline. Firm break there, and sustained trading below 55 day EMA (now at 92.37), will argue that rise from 89.53 might be completed at 93.72 already. More importantly, that should be an early sign that whole consolidative pattern from 89.20 has completed, after failing 38.2% retracement of 102.99 to 89.20 at 94.46. Further break of 91.78 support will pave the way back to 89.20/53 support zone.

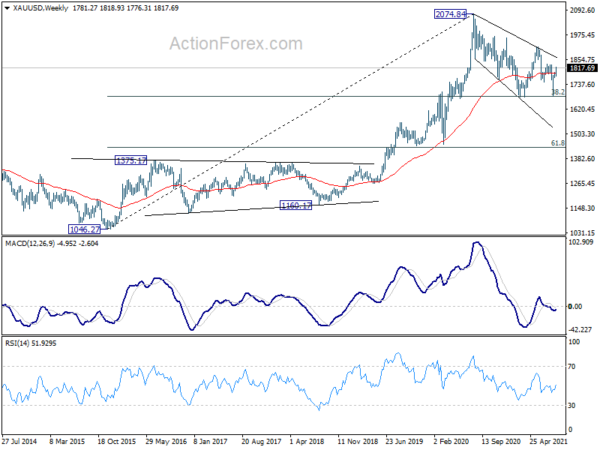

Gold closed above 55 day EMA, eyeing 1832.47 resistance next

Gold extended the rebound from 1682.60 last week. More importantly, it managed to close above 1800 handle as well as 55 day EMA. Further rise is now expected as long as 1799.91 minor support holds. Firm break of 1832.47 resistance will firstly add to the case the fall from 1916.30 has completed at 1682.60 already. Secondly, that would be an early sign that whole correction from 2074.84 has completed, after drawing support from 38.2% retracement of 1046.27 to 2074.84 at 1681.92. Further rise should be seen to retest 1916.30 resistance at least. Such development would be inline with more Dollar selloff ahead.

The tide for Aussie could have turned, a look at EUR/AUD and AUD/CAD

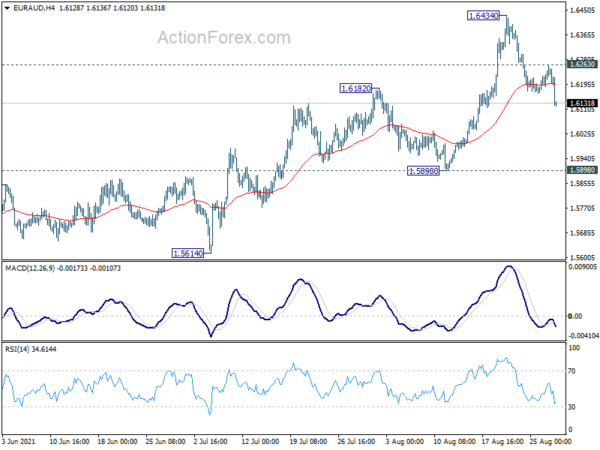

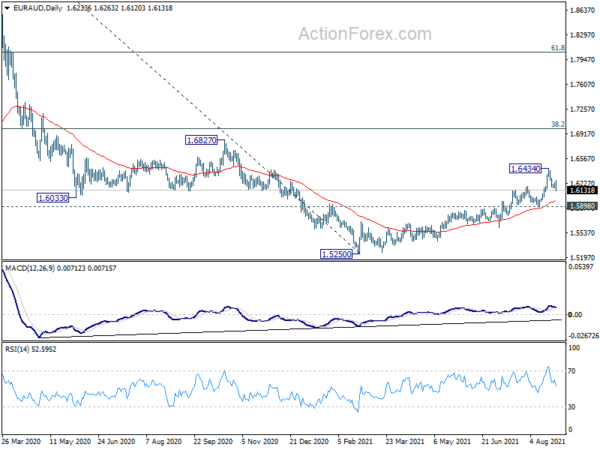

We’ve noted a few weeks ago that Aussie should be avoided in selling Dollar. But the tide for Aussie could have turned, even though it’s still a bit early to confirm. EUR/AUD’s break of 1.6182 resistance turned support firstly indicates short term topping at 1.6434 already. More importantly, that’s an early sign that choppy rise from 1.5250 has finished too. Deeper fall is now in favor as long as 1.6263 resistance holds, towards 1.5898 structural support. Sustained break there will confirm this bearish case and target a retest on 1.5250 low.

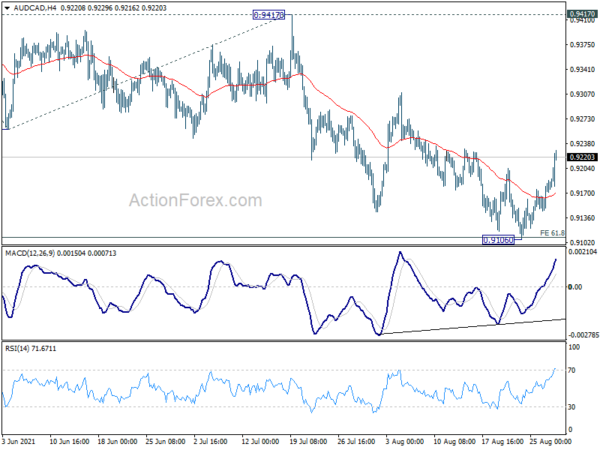

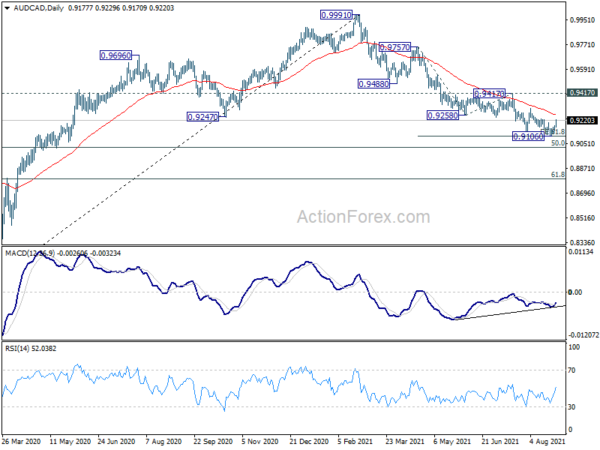

Considering bullish convergence condition in 4 hour MACD, a short term bottom should be formed at 0.9106 in AUD/CAD. That came after hitting 61.8% projection of 0.9757 to 0.9258 from 0.9417 at 0.9109. Immediate focus will now be on 55 day EMA (now at 0.9261) this week. Sustained break there would raise the chance that whole decline from 0.9991 has completed, and bring stronger rise to 0.9417 resistance for confirmation.

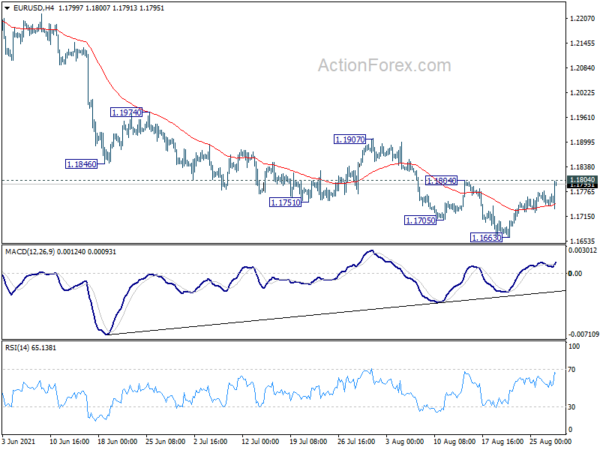

EUR/USD Weekly Outlook

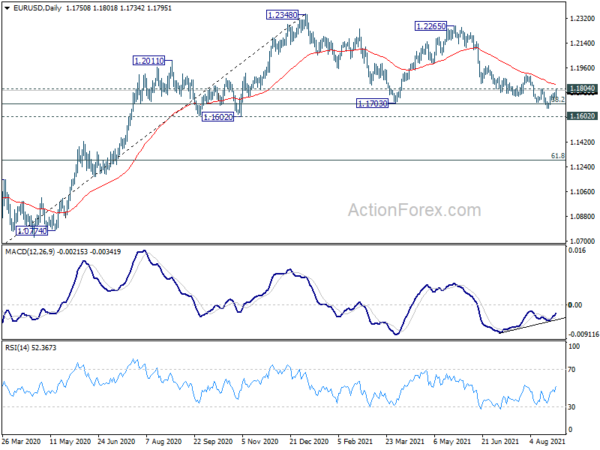

EUR/USD’s recovery from 1.1663 extended higher last week but stays below 1.1804 resistance. Initial bias is neutral this week first with immediate focus on 1.1804 resistance. Break there will bring stronger rise to 1.1907 resistance first. Firm break there will indicate that fall from 1.2265, as well as the consolidation pattern from 1.2348, have completed. Near term outlook will be turned bullish for 1.2265/2348 resistance holds. In case of another fall, we’d continue to look for strong support from 1.1602/1703 key support zone to bring rebound.

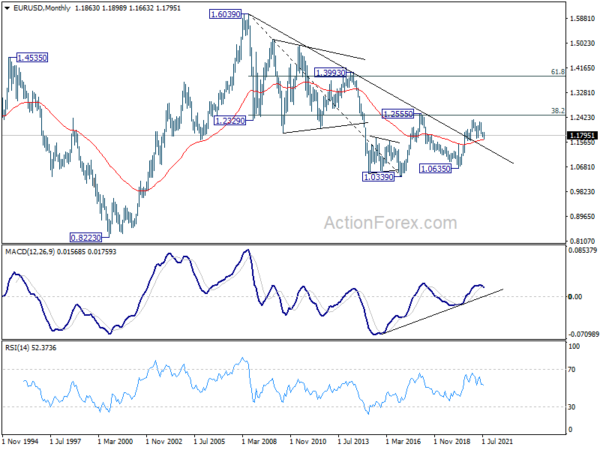

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally remains in favors long as 1.1602 support holds, to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). However sustained break of 1.1602 will argue that the rise from 1.0635 is over, and turn medium term outlook bearish again. Deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289 and below.

In the long term picture, focus remains on 1.2555 cluster resistance (38.2% retracement of 1.6039 to 1.0339 at 1.2516). Sustained break there should confirm long term bullish reversal and target 61.8% retracement at 1.3862 and above. However, rejection by 1.2555 will keep long term outlook neutral first, and raise the prospect of down trend resumption at a later stage.