Products You May Like

No explicit taper timeline

The dollars move lower on the headlines from Fed chair Powell’s speech. No explicit taper timeline has sellers pushing the greenback lower. Yields are moving lower as well. The comments run counter to what most Fed officials have been saying which will make for an interesting September meeting. Of of course the jobs report in September will be a key talking point as well.

Looking around the markets:

- EURUSD: The EURUSD is moving up to test the swing highs from August 13 and August 16 between 1.1800 at 1.18044. The high price just reached 1.1799. A move above that level would target the 61.8% retracement of the move down from the July 30 high at 1.18146. The move to the upside cracked above the 50% retracement 1.17857 of the same move lower. That will now be eyed as a close support level.

- GBPUSD: THe GBPUSD it is trading at its highest level since August 18 breaking above the highs for the week at 1.37672 from yesterday’s trade. The 50% retracement of the move down from the July 30 high comes in at 1.37921. That is between a swing area from 1.3790 to 1.3802. The 200 day moving average is also within that range at 1.37927. Move above that area should increase the bullish bias for the pair.

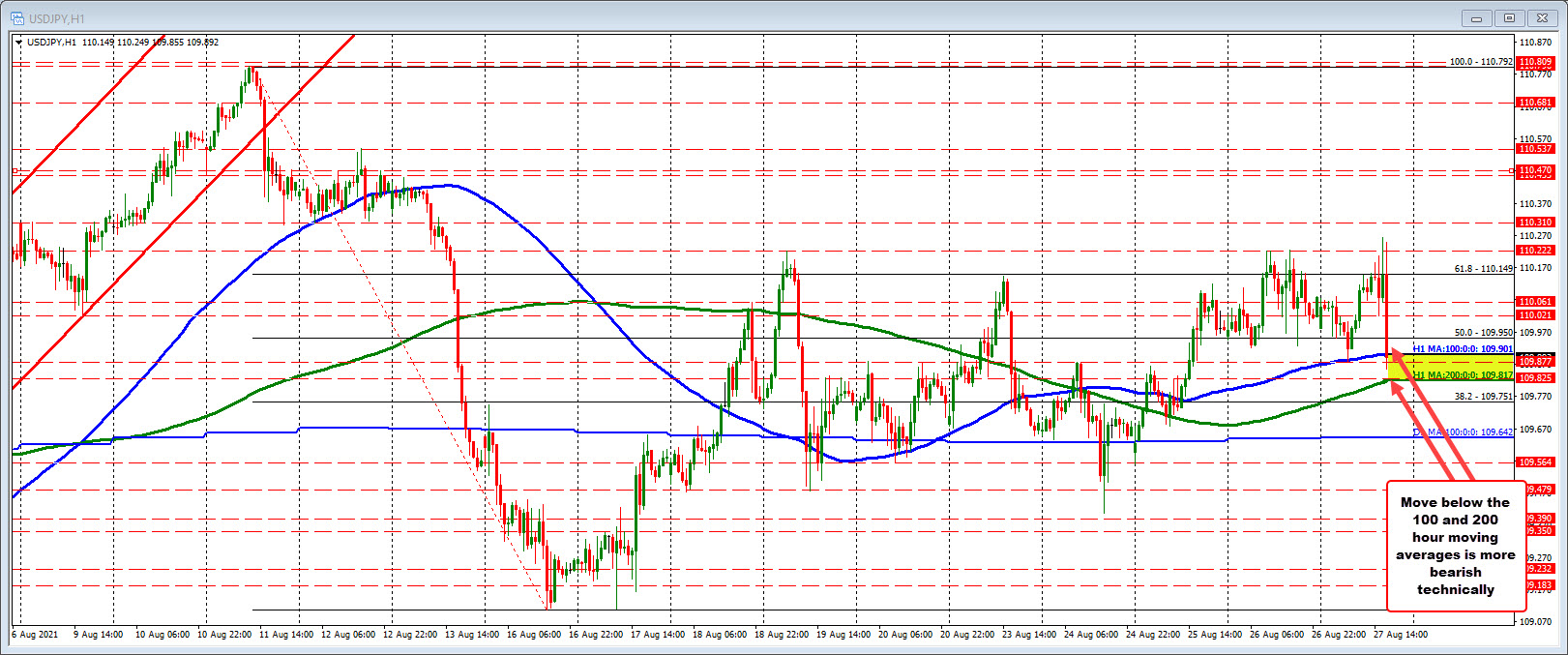

- USDJPY: The USDJPY has just moved below its 100 hour moving average at 109.90. The 200 hour moving averages is at 109.817. Getting below those levels would increase the bearish bias.

Looking at stocks, the major indices are moving sharply higher:

- the Dow Jones was up 97 points at the start of his speech. It is currently up 223 points

- the S&P index was up 13.5 points at the start and is currently up 33 points

- the NASDAQ index was up 37.26 points and is currently up 133 points

Looking at yields:

- two year was at 0.241%. It is currently at 0.223%

- five year was at 0.846%. It is currently at 0.824%

- 10 year was at 1.339%. It is currently at 1.331%

- 30 year was at 1.927% it is currently at 1.937%

This article was originally published by Forexlive.com. Read the original article here.