Products You May Like

- AUD/USD bears are waiting in the flanks to pounce on poor Chinese data.

- AUD/USD needs a lifeline, bulls look to 38.2% Fibo.

AUD/USD has been strongly offered overnight on a number of bearish fundamentals playing out and today sees key Chinese data in the next hour.

The following illustrates the potential outcomes in price action depending on the outcome and the markets take on it.

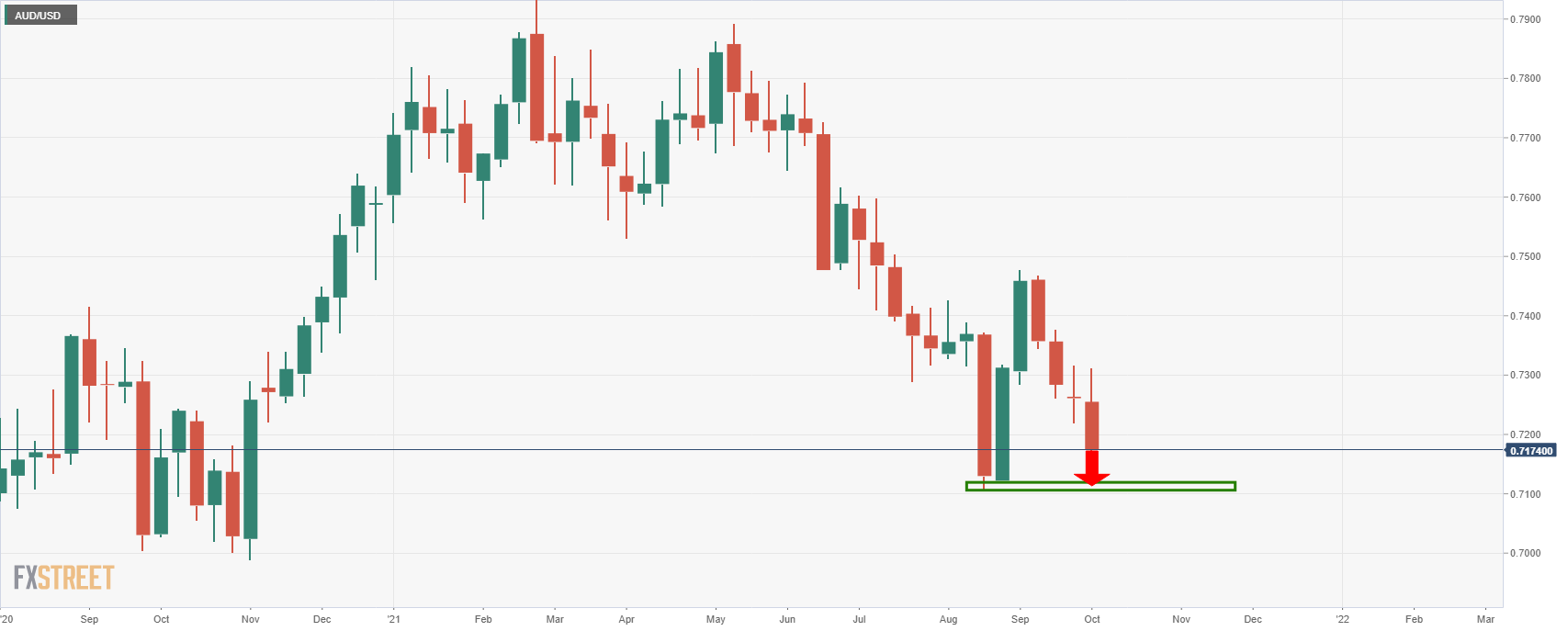

AUD/USD daily chart

The price is in need of a correction and the 38.2% Fibonacci is the first target that guards a slight confluence of prior lows and a 50% mean reversion.

From an hourly perspective, this can be taken advantage of and bulls will be looking for a bullish structure to form in the coming sessions:

However, the bulls will be in a precarious position over this data, for there is a lot of bearish sentiment supporting ing the Chinese economy and the knock-on effect to Australia amid geopolitical angst between the two trade partners nations.

Poor data for September will not be welcomed by the markets which could see AUD/USD sent lower in response to it. this exposes risk to 0.7105 weekly lows: