Products You May Like

Dollar retreats mildly in Asian session but remains the strongest one over the week. The rally in treasury yields appear to be taking a breather. But 10-year yield is holding firm above 1.54 handle, while 30-year yield is also above 2.0 handle. Canadian is following as the second strongest, and then Aussie. On the other hand, New Zealand Dollar is the worst performing, followed by Sterling and then Yen. As month end is approaching, traders might start to hold their bets for now until next week.

Technically, EUR/USD breached 1.1602 key medium term support level. GBP/USD also broke 1.3482 key medium term resistance turned support too. At the same time, USD/JPY also broke 111.71 key medium term structural resistance. Now, focus will be also whether Dollar could sustain above these level to confirm a medium to long term reversal.

In Asia, at the time of writing, Nikkei is down -0.14%. Hong Kong HSI is down -0.86%. China Shanghai SSE is up 0.37%. Singapore Strait Times is up 0.47%. Japan 10-year JGB yield is up 0.0036 at 0.073. Overnight, DOW rose 0.26%. S&P 500 rose 0.16%. NASDAQ dropped -0.24%. 10-year yield rose 0.007 to 1.541.

Fed Daly: Appropriate to start tapering by later this year

San Francisco Fed President Mary Daly said, “by the end of the year, if things continue as I expect them to with the economy, then I would expect us to hit that ‘substantial further progress’ goal, threshold, by later this year and it would be appropriate to start dialing back” asset purchases.

Daly also noted that Fed has set a different, higher bar for rate hike. “If we should get there in the time frame of next year that would be a tremendous win for the economy,” she said, but “I don’t expect that to be the case.”

ECB Lagarde: Higher energy prices to go out in first part of 22

In an online seminar hosted by ECB yesterday, President Christine Lagarde noted that “how long how those bottlenecks will take to be resolved” is one of the question marks. She expected the impact of higher energy prices to “go out in the first part of ’22”. Also, “the last of the uncertainties that we have to account for…is potential new waves of a pandemic that would be vaccine-resistant,”

In the same occasion, BoE Governor Andrew Bailey said, “I expect us to be back to the pre-pandemic level in the early part of next year, possibly a month or two later than we thought we would be at the start of August.”

Some analysts took a message from September MPC minutes that BOE could raise interest rate in November, while the asset purchase program is still in its final stages. Bailey declined to comment directly. But he noted, “the preferred tool will always be rates because we understand the effect of rates in the monetary policy transmission mechanism. But that’s not to pre-judge what we will decide in November,”

BoJ Governor Haruhiko Kuroda maintained said, “whatever fiscal, regulatory or any other policies the new government pursues, the BOJ will continue to maintain extremely accommodative monetary policy in order to achieve its 2% price stability target as soon as possible.”

“In coming years, we must achieve our 2% price stability target. That is true. But at this moment, (achieving) economic recovery and faster growth are the most important challenges faced by us,” Kuroda said.

Japan industrial production dropped -3.2% mom in Aug, auto production shrank

Japan industrial production dropped -3.2% mom in August, worse than expectation of -0.5% mom. Production in auto dropped -15.2% mom as affected by global semiconductor shortage and factory shutdowns in Southeast Asia. Output of electrical machinery and information and communication electronics equipment also dropped -10.6% mom.

The Ministry of Economy, Trade and Industry downgraded the assessment of industrial production, and said recovery “has paused. Nevertheless, based on a poll of manufacturers, production is expected to rise 0.2% mom in September and then 6.8% mom in October.

Also released, retail sales dropped -3.2% yoy in August, versus expectation of -1.3% yoy. That’s the first decline in six months.

China Caixin PMI manufacturing rose to 50, pandemic impacts demand, supply and circulation

China Caixin PMI Manufacturing rose from 49.2 to 50.0 in September, above expectation of 49.6. Caixin said new orders returned to growth. Output fell at softer pace. Inflation pressures picked up amid material shortages.

Wang Zhe, Senior Economist at Caixin Insight Group said: “On the one hand, the epidemic continued to impact demand, supply, and circulation in the manufacturing sector. The state of the epidemic overseas and the shortage of shipping capacity also dragged down total demand. Epidemic control measures have clearly impacted the logistics industry.”

Also released, the official NBS PMI Manufacturing dropped from 50.1 to 49.6 in September, versus expectation of 50.2. PMI Non-Manufacturing rose from 47.5 to 53.2, above expectation of 50.8.

New Zealand ANZ business confidence rose to -7.2, activity dropped to 18.2

New Zealand ANZ Business Confidence rose to -7.2 in September, up from August’s -14.5. Own Activity Outlook dropped to 18.2, down from 20.2. Looking at some details, export intentions dropped from 8.4 to 7.4. Investment intentions dropped from 15.4 to 9.2. Cost expectations dropped from 85.0 to 84.2. Employment intentions dropped from 17.9 to 14.1. Inflation expectations ticked down from 3.06% to 3.02%.

ANZ said: “The Auckland COVID outbreak drags on but businesses so far appear to be keeping their eyes on the prize. Spending has already bounced back quite a lot, particularly outside Auckland, and experience has shown momentum tends to recover quickly. In that context, interest rate increases may well prove more of a challenge. The housing market is vulnerable, with headwinds gathering, and there’s no question the housing market and construction more generally have been key drivers of growth over the past 18 months – for what’s definitely been a mix of better and worse.”

Looking ahead

UK GDP and current account, Swiss KOF economic barometer, Germany CPI flash and unemployment, France consumer spending, and Eurozone unemployment rate will be released in European session. Later in the day, US will release initial jobless claims, Chicago PMI, and Q2 GDP final.

USD/JPY Daily Outlook

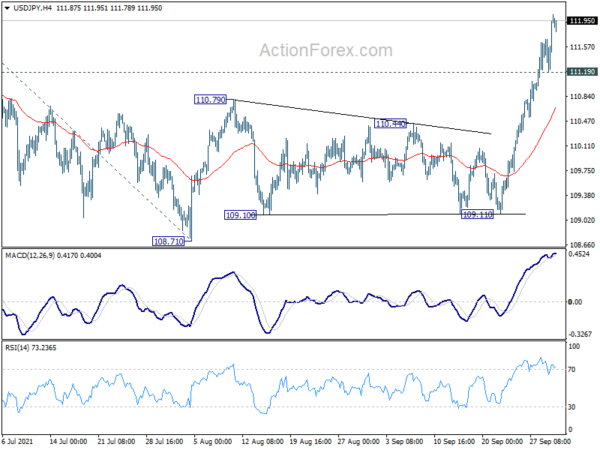

Daily Pivots: (S1) 111.44; (P) 111.75; (R1) 112.28; More…

USD/JPY’s rally is still in progress and reaches as high as 112.04 so far. The break of 111.71 medium term structural resistance is seen as a sign of long term bullish reversal. Intraday bias stays on the upside. Next target is 61.8% projection of 102.58 to 111.65 from 108.71 at 114.31. On the downside, below 111.19 minor support will turn bias neutral and bring retreat first, before staging another rally.

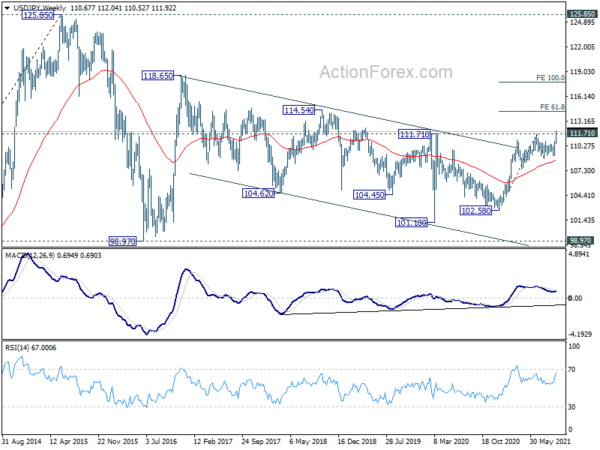

In the bigger picture, break of 111.71 resistance suggests that the whole corrective decline from 118.65 (2016 high) has completed at 101.18 (2020 low) already. Medium term bullishness is also affirmed as USD/JPY stays well above 55 week EMA (now at 108.60). Sustained trading above 111.71 will affirm this bullish case. Rise from 101.18 could then be resuming whole rally from 98.97 (2016 low) through 118.65. This will now be the preferred case as long as 108.71 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M Aug P | -3.20% | -0.50% | -1.50% | |

| 23:50 | JPY | Retail Trade Y/Y Jul | -3.20% | -1.30% | 2.40% | |

| 01:00 | CNY | NBS Manufacturing PMI Sep | 49.6 | 50.2 | 50.1 | |

| 01:00 | CNY | Non-Manufacturing PMI Sep | 53.2 | 50.8 | 47.5 | |

| 01:30 | AUD | Private Sector Credit M/M Aug | 0.60% | 0.50% | 0.70% | |

| 01:45 | CNY | Caixin Manufacturing PMI Sep | 50 | 49.6 | 49.2 | |

| 05:00 | JPY | Housing Starts Y/Y Aug | 9.60% | 9.90% | ||

| 06:00 | GBP | GDP Q/Q Q2 F | 4.80% | 4.80% | ||

| 06:00 | GBP | Current Account (GBP) Q2 | -16.6B | -12.8B | ||

| 06:30 | CHF | Real Retail Sales Y/Y Aug | -2.60% | |||

| 06:45 | EUR | France Consumer Spending M/M Aug | 0.10% | -2.20% | ||

| 07:00 | CHF | KOF Leading Indicator Sep | 110.3 | 113.5 | ||

| 07:55 | EUR | Germany Unemployment Change Sep | -40K | -53K | ||

| 07:55 | EUR | Germany Unemployment Rate Sep | 5.60% | 5.50% | ||

| 08:00 | EUR | Italy Unemployment Aug | 9.20% | 9.30% | ||

| 09:00 | EUR | Eurozone Unemployment Rate Aug | 7.60% | 7.60% | ||

| 12:00 | EUR | Germany CPI M/M Sep P | 0.10% | 0.00% | ||

| 12:00 | EUR | Germany CPI Y/Y Sep P | 3.90% | 3.90% | ||

| 12:30 | USD | Initial Jobless Claims (Sep 24) | 321K | 351K | ||

| 12:30 | USD | GDP Annualized Q2 F | 6.70% | 6.60% | ||

| 12:30 | USD | GDP Price Index Q2 F | 6.10% | 6.20% | ||

| 13:45 | USD | Chicago PMI Sep | 66.7 | 66.8 | ||

| 14:30 | USD | Natural Gas Storage | 86B | 76B |