Products You May Like

EUR/USD falls to a low of 1.1555 on the day, its lowest since July 2020

Higher yields and a focus on risk aversion is a potent combo (the latter is holding a bit more weight now) in keeping the dollar more bid in European morning trade so far, with the greenback extending gains across the board for the most part.

EUR/USD is seen falling further and taking out its lows from last week and at this point, it is getting tough to really pick at support levels for the pair.

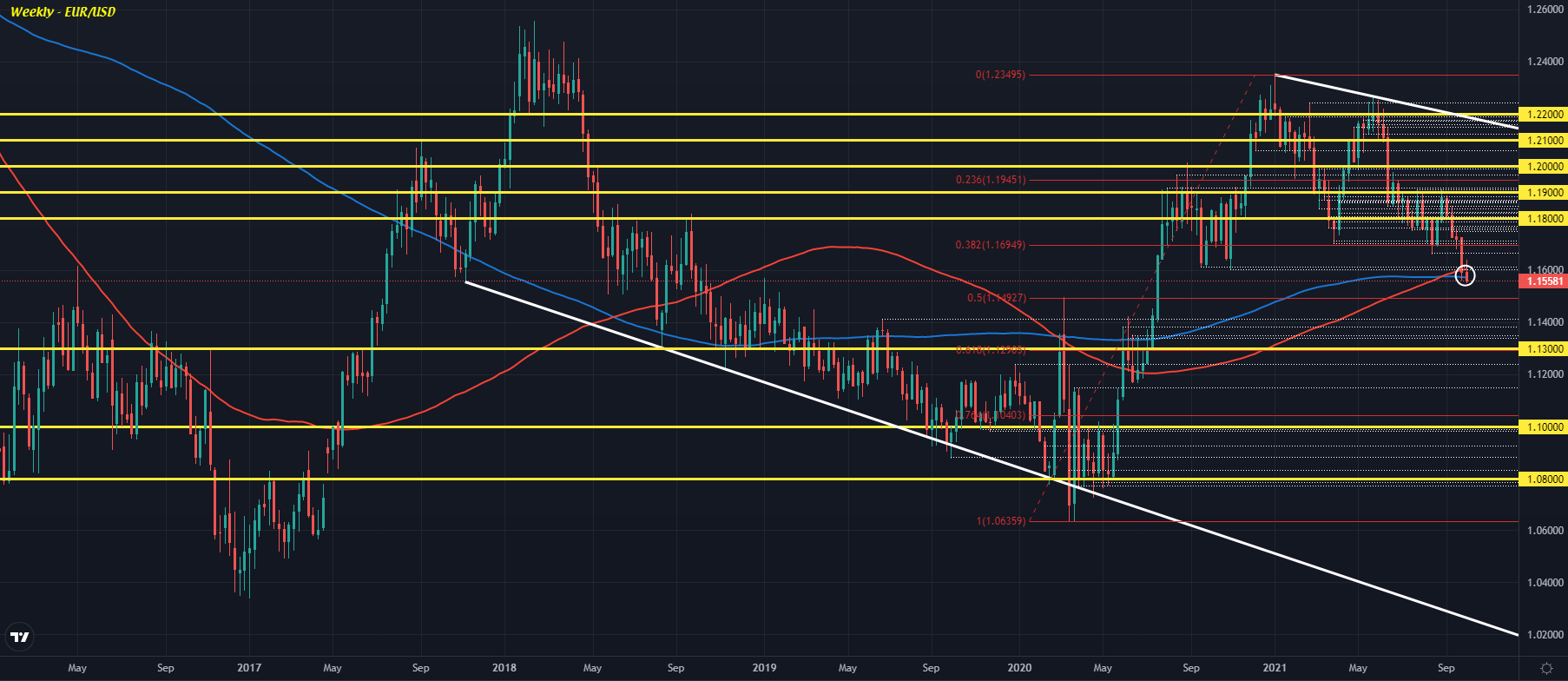

The weekly chart offers a better overview of the technical predicament:

The 200-week moving average (blue line) is one to watch in the days ahead to see if sellers have what it takes to establish the next downside leg and that sits @ 1.1571.

Beyond that, the 50.0 retracement level of the upswing from March last year to January this year @ 1.1493 may offer something for buyers but there aren’t much other levels to really pinpoint as key in case the downside move extends from here.

The US non-farm payrolls report will be a key risk event to watch but I’d argue that risk sentiment is perhaps the bigger driver of sentiment in the days/weeks ahead considering how much focus is put on the energy crisis and inflation at the moment.

As such, keep a close watch on energy price developments and yields/inflation expectations as those will help to outline the main focus in the market for the time being.