Products You May Like

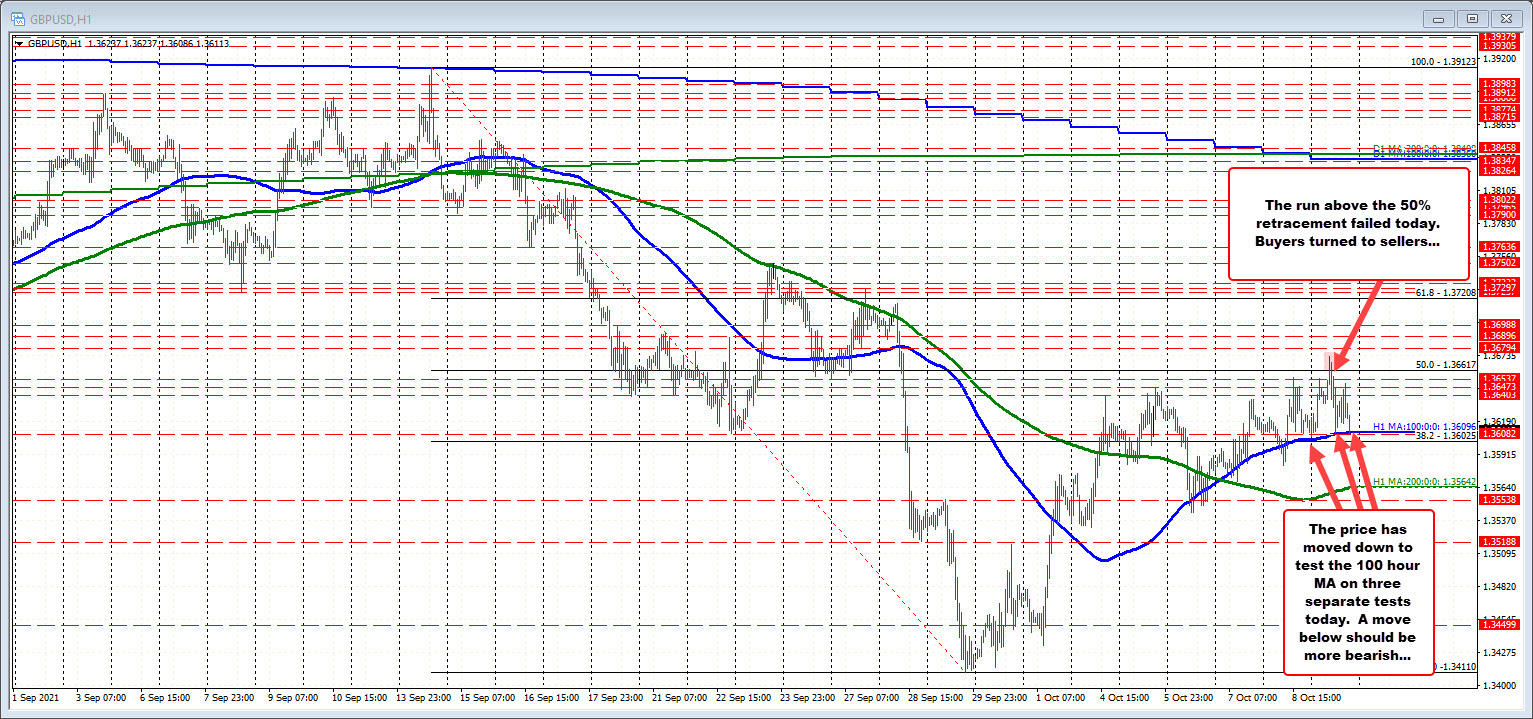

The failure above the 50% turned buyers to sellers.

Late on Friday, I outlined the key levels for the GBPUSD to eye going into the new week.

I wrote:

“The GBPUSD traded to the highest level since September 28 today at 1.3655. That move got close to the 50% midpoint of the move down from the September 14 high at 1.3662. The price rotated lower and stalled at 1.3609. That was just above the 100 hour moving average at 1.3604.”

“With the 50% retracement above at 1.3662, and the 100 hour moving average below 1.3604, those two levels become the targets to get to and through. Break below the 100 hour moving average and stay below is more bearish. Hold the 100 hour moving average and move up and through the 50% retracement, increases the bullish bias.”

In the early Asian session, the price of the GBPUSD indeed tested the 100 hour MA (blue line in the chart above), held and moved higher.

The move higher WAS able to extend above the 50% target at 1.36617. However, buyers could not sustain momentum and the buyers on the break turned to sellers on the disappointment.

The price since has seen two additional tests of the lower 100 hour MA (blue line). The first came in the London morning session. The second is happening now.