Products You May Like

DOW and S&P 500 eked out new record highs again overnight. But Asian markets are not following, with the exception of rally in Nikkei. Activities in the currency markets are generally quiet. Nevertheless, Aussie is strengthening with other commodity currencies. Yen and Swiss Franc are weak, followed by Euro. Dollar is mixed together with Sterling.

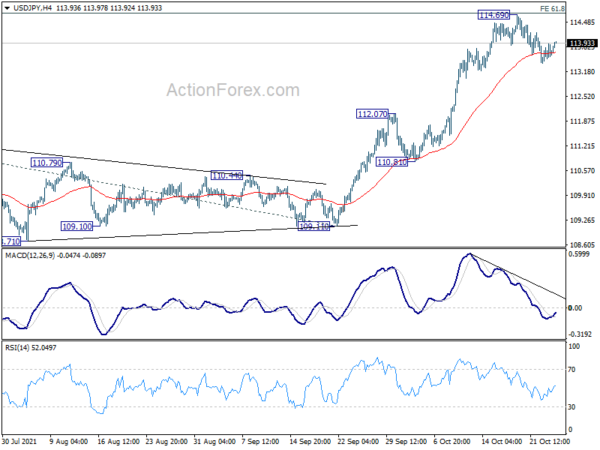

Technically, the retreats in Yen crosses slowed notably, as USD/JPY, EUR/JPY and GBP/JPY are all drawing support from 4 hours 55 EMA respectively. Our focus will now on be whether Yen crosses would rebound from current levels. In that case, we’ll see if USD/JPY would have another take on 114.69 resistance quickly.

In Asia, at the time of writing, Nikkei is up 1.85%. Hong Kong HSI is down -0.38%. China Shanghai SSE is down -0.11%. Singapore Strait Times is down -0.16%. Japan 10-year JGB yield is up 0.0018 at 0.102. Overnight, DOW rose 0.18%. S&P 500 rose 0.47%. NASDAQ rose 0.90%. 10-year yield dropped -0.020 to 1.635.

EUR/AUD downside breakout, EUR/CAD and EUR/GBP to follow?

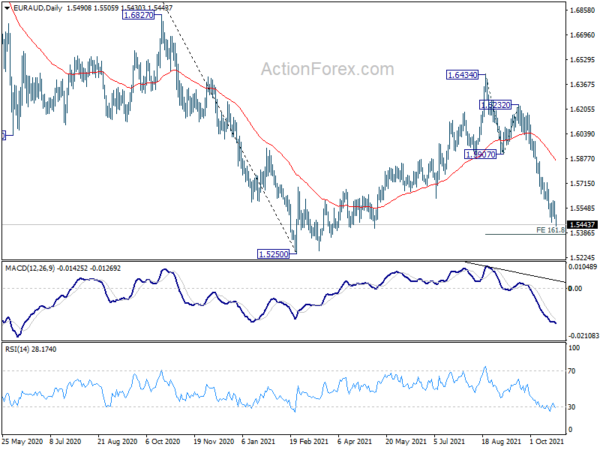

While Euro looks weak in some crosses, most are still bounded in very tight range, except EUR/AUD, which breaks through 1.5456 temporary. It remains to be seen if that’s a signal of more broad based selling in Euro, or buying in Aussie.

EUR/AUD breaks to the downside today as fall from 1.6434 resumes. Next focus is 161.8% projection of 1.6434 to 1.5907 from 1.6232 at 1.5379. Sustained trading there would pave the way back to retest 1.5250. low.

At the same time, attention will also be on 1.4317 temporary low in EUR/CAD. Firm break there will resume larger down trend towards 100% projection of 1.5783 to 1.4580 from 1.5096 at 1.3839.

Meanwhile, break of 0.8420 temporary low in EUR/GBP will resume the medium term down trend towards 0.8276 key support next.

US Yellen frankly raised issues of concern to China

US Treasury Secretary Janet Yellen held a virtual meeting with Chinese Vice Premier Liu He yesterday. In a statement, the US side said they “discussed macroeconomic and financial developments”, and “frankly raised issues of concern”.

On the Chinese side, it described in a statement that the meeting as “pragmatic, candid and constructive”. China expressed concerns on US tariffs, sanctions and urged fair treatment of Chinese companies.

Both sides agreed to further communications.

On the data front

Japan corporate service price index rose 0.9% yoy in September, versus expectation of 1.0% yoy. European calendar is empty today. US will release house price index and new homes sales. But main focus will be on consumer confidence.

AUD/USD Daily Report

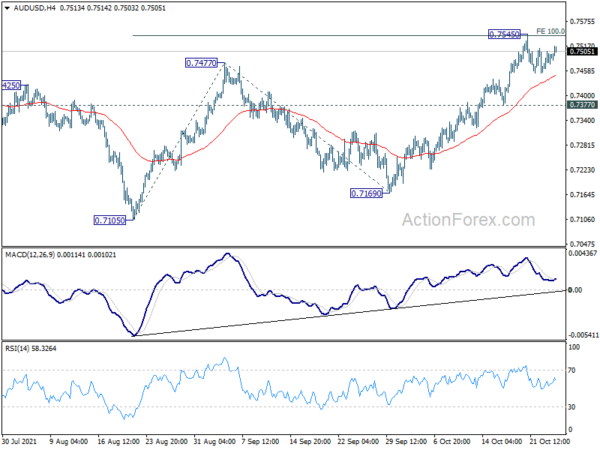

Daily Pivots: (S1) 0.7468; (P) 0.7487; (R1) 0.7509; More…

AUD/USD is staying in consolidation from 0.7545 temporary top and intraday bias remains neutral. In case of another retreat, downside should be contained by 0.7377 support to bring another rally. On the upside, break of 0.7454 will resume the rise from 0.7105 to 161.8% projection of 0.7105 to 0.7477 from 0.7169 at 0.7771.

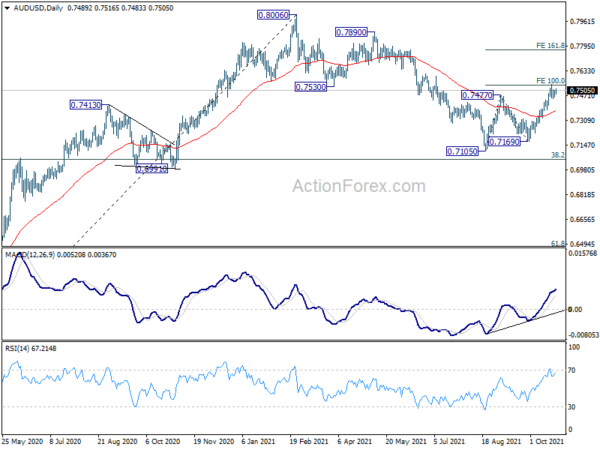

In the bigger picture, with 0.6991 cluster support (38.2% retracement of 0.5506 to 0.8006 at 0.7051) intact, we’re seeing price action from 0.8006 as a correction only. That is, up trend from 0.5506 low would resume after the correction completes. In that case, main focus will be 0.8135 key resistance (2018 high). Sustained break there will carry larger bullish implications. However, sustained break of 0.6991 will argue that the whole medium term trend has indeed reversed.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Sep | 0.90% | 1.00% | 1.00% | |

| 13:00 | USD | S&P/CS Composite-20 HPI Y/Y Aug | 20.00% | 19.90% | ||

| 13:00 | USD | Housing Price Index M/M Aug | 1.30% | 1.40% | ||

| 14:00 | USD | Consumer Confidence Oct | 108.4 | 109.3 | ||

| 14:00 | USD | New Home Sales Sep | 763K | 740K |