Products You May Like

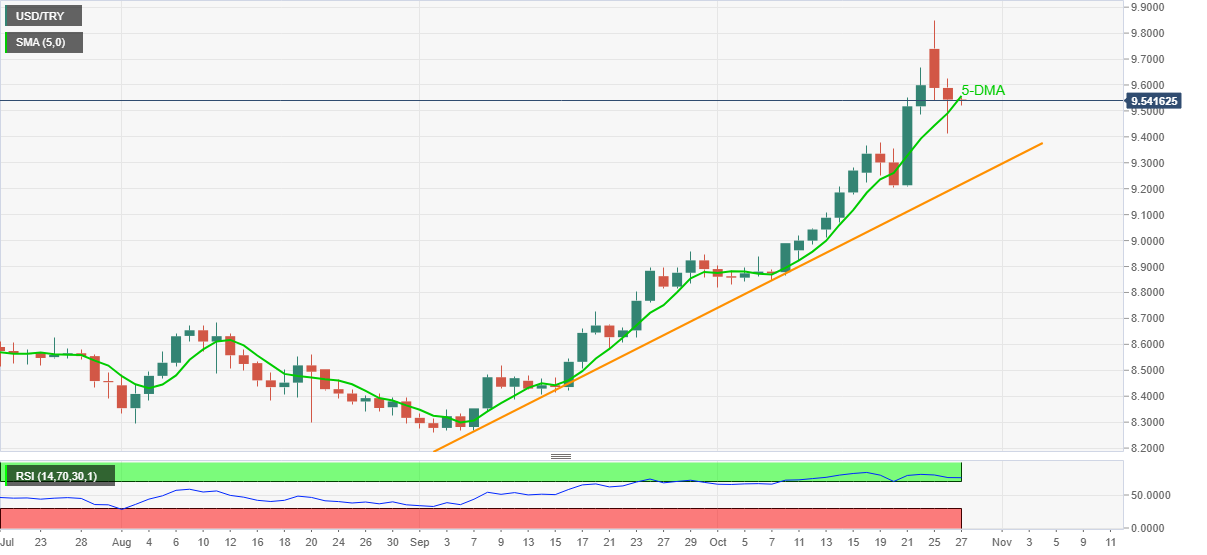

- USD/TRY sellers take a breather following two-day downtrend.

- Overbought RSI, SMA breakdown signals further pullback.

- Seven-week-old support line challenges the bears, bulls eye record top.

USD/TRY seesaws near $9.5430-25, keeping the previous day’s 5-DMA breakdown ahead of Wednesday’s European session. The Turkish Lira (TRY) pair dropped during the last two days after refreshing the all-time high earlier in the week.

Although overbought RSI and the near-term moving average breakdown favor USD/TRY sellers, an upward sloping support line from September 07, near $9.2170, restricts immediate downside.

Even if the pair sellers conquer the $9.2170 level, the $9.000 threshold and September’s peak around $8.9590 will question the further downside.

Meanwhile, recovery moves need to cross the 5-DMA hurdle of $9.5590 to recall the USD/TRY bulls.

Following that, the $9.6000 and $9.6660 may prone the advances before the all-time high of $9.8505.

In a case where the USD/TRY run-up remains intact beyond $9.8505, the $9.9000 psychological magnet will be in focus.

USD/TRY: Daily chart

Trend: Bullish