Products You May Like

The price of the USDJPY has been confined in a up and down range for nearly 4 weeks.

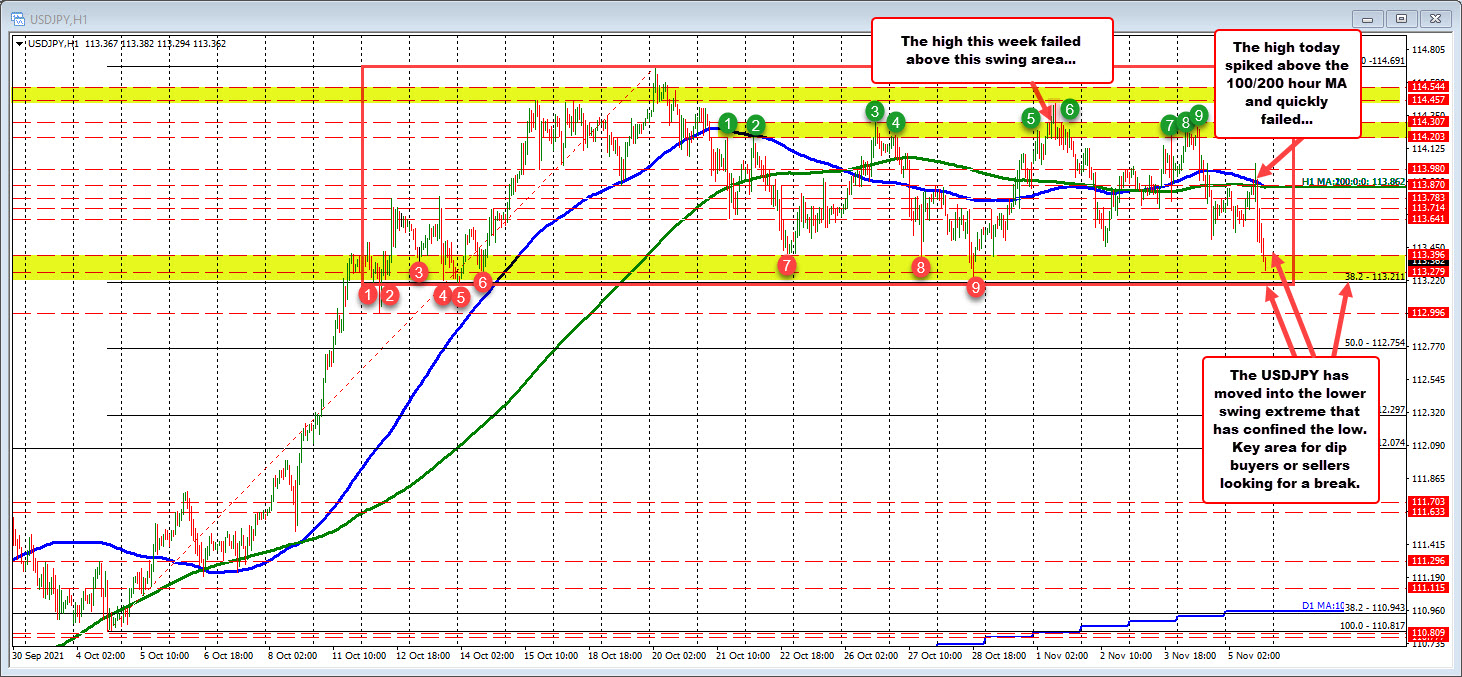

The USDJPY has been mired in an up and down trading range since October 12 between 113.21 (apart from two hourly bars) and 114.691. This week the high on Monday spiked above a swing area between 114.03 to 114.307. The high reached 114.438 before heading back down and reusing that swing area as resistance once again (green circles 6, 7, 8 and 9).

The price yesterday moved away from that swing area and traded back below the 100/200 hour MAs (blue and green lines currently converged at 113.86).

In trading today the price stay below those moving averages until the release of the US jobs report. The price spiked higher on the headline, but quickly reversed back to the downside. Since then, the price action has been slowly but steadily lower.

The pair has just reached a new intraday low of 113.29. That is also a new low for the week. The pair has entered into a swing area between the 38.2% retracement of the move up from the October 4 low at 113.21 up to 113.396. There have been a number of swing lows within that area going back to October 12. The last one was during trading last week (red numbered circles eight and nine).

A move below the 113.211 (and staying below), would increase the bearish bias for the pair. The next target would come at the 112.996 swing low from October 12 (call it 113.00). Below that and the 50% midpoint of the move up from the October 4 low comes in at 112.754.

Holding support near 113.21 is also a possibility given that risk can be defined and limited. Counter to that idea is that the price has now been within the trading range for nearly 4 weeks of trading (19 days). At some point traders get tired of trading a 140 pips trading range. They look to move from non-trending to trending.

As a result there is a possibility that the highs this week on Monday, and Wednesday, and Thursday and again today have shown more of a selling interest. Even the tries to the upside above resistance have run into quick sellers i.e. the move above 114.307 on Monday, and the move above the converged 100 and 200 hour moving averages today.