Products You May Like

The second leg of the treasury schedule this week

This week second leg of the treasury auction schedule with the auction of $39 billion of new 10 year notes. Yesterday the treasury auctioned off three year notes with below average demand.

The six month averages of the major component pieces of the auction shows:

- Bid to cover 2.54X

- Directs, 16.9%

- Indirects, 68.6%

- Dealers, 14.6%

The last month auction came in at 1.584% with a tale of -0.6 basis points.

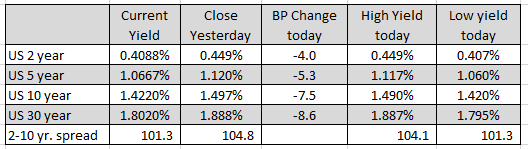

Yields in the US are lower across the board today. The current 10 year yield is trading at 1.422%. That is down -7.5 basis points on the day.

The lower yields today are not helping the US stocks as a still remain negative on the day. The NASDAQ index is down close to 100 points or -0.61% and 15885. The S&P index is down -21 points at 4680.84 and the Dow industrial average is down -180.5 points at 36251

This article was originally published by Forexlive.com. Read the original article here.