Products You May Like

GBP/USD Weekly Forecast: Recovery time? UK inflation and jobs data could counter dollar surge

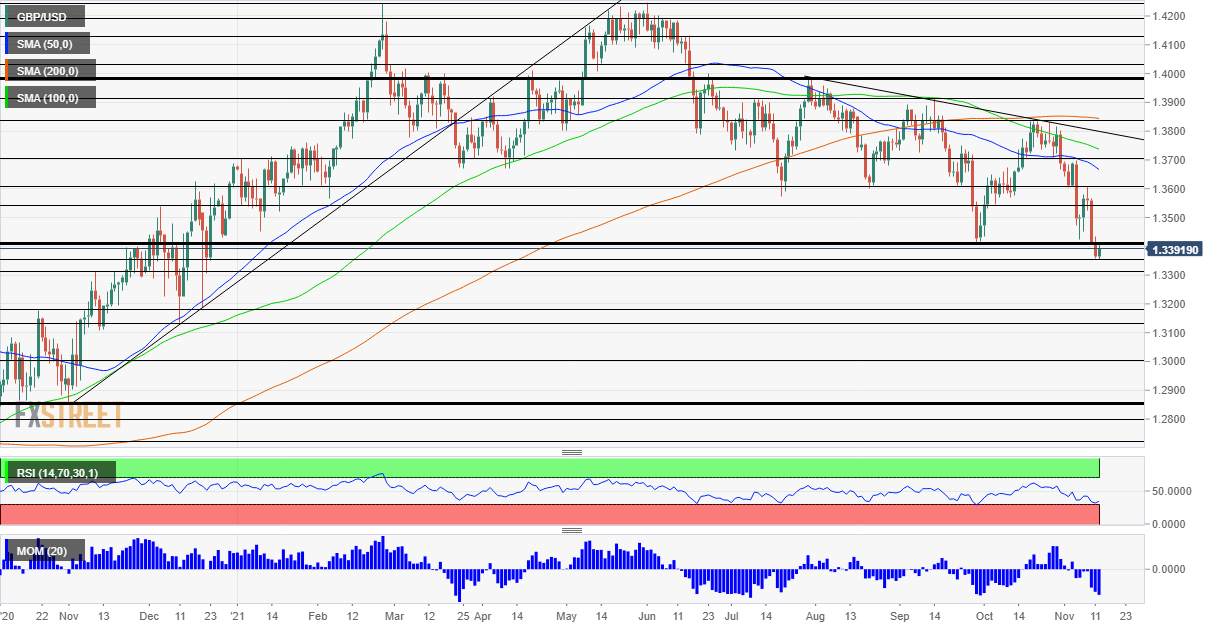

GBP/USD has been extending its decline in response to high US inflation data. Highest since 1990 – US inflation has hit 6.2%, reaching not only a historic peak but also sending the dollar substantially higher. The mix of Brexit acrimony and disappointing UK growth figures contributed to a downfall for GBP/USD. What’s next? Critical data for the subsequent rate decisions stand out in the upcoming week. Read more…

GBP/USD Forecast: Can renewed Brexit optimism save the pound?

GBP/USD has been having a tough time staging a rebound. GBP/USD has extended slide to a fresh 2021 low early Friday before going into a consolidation phase. The pair’s potential recovery depends on Brexit developments as the dollar is likely to hold its ground with investors pricing a 72% chance of a Federal Reserve rate hike by June 2022. Read more…

GBP/USD Price Analysis: Failure at 1.3430 opens the door for a further downfall, towards 1.3200

The British pound bounces off year-to-date lows at 1.3352, edges up 0.40%, trading at 1.3418 during the New York session at the time of writing. In the last three days, cable lost almost 2%, driven mainly by US dollar strength, influenced by higher inflation figures in the US economy, reported by the Labor Department. Also, a dovish stance perceived by investors in the last Bank of England (BoE) monetary policy meeting fueled the slide of the GBP. Read more…