Products You May Like

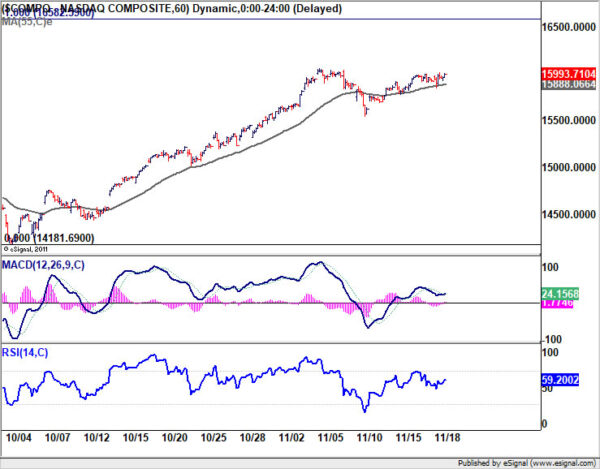

Dollar’s retreat continues in Asian session, but it remains one of the strongest for the week, just next to Sterling. On the other hand, while Euro is recovering, it’s still the worst performing one followed by Aussie. Overall, the markets are staying in a near term consolidative phase with mixed performance in stocks and yield, while gold and silver are range bound. As week end approaches, we’ll see if NASDAQ could ride on yesterday’s buying pace to make new record, and set the risk sentiment tone for next week.

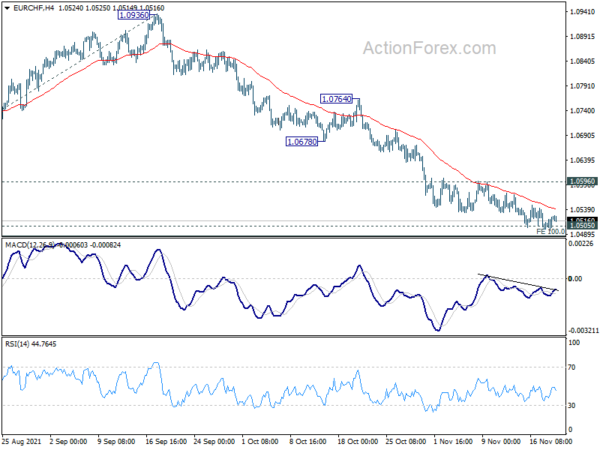

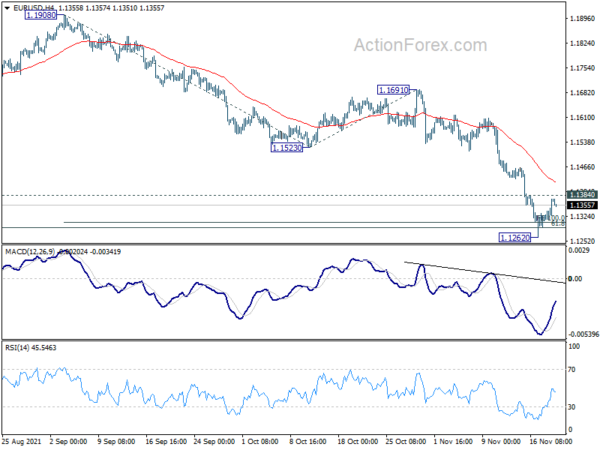

Technically, Euro continues to pare back recent losses against other major currencies. We’ll keep an eye on 1.1384 minor resistance in EUR/USD and 130.58 minor resistance in EUR/JPY. Break of these levels could trigger some short covering ahead of the weekend and lift Euro generally higher. On the other hand, intensified selling in EUR/CHF through 1.0505 key support could hammer Euro down elsewhere too.

In Asia, at the time of writing, Nikkei is up 0.41%. Hong Kong HSI is down -1.71%. China Shanghai SSE is up 0.43%. Singapore Strait Times is down -0.13%. Japan 10-year JGB yield is down -0.0030 at 0.081. Overnight, DOW dropped -0.17%. S&P 500 rose 0.34%. NASDAQ rose 0.45%. 10-year yield dropped -0.015 to 1.589.

Fed Bostic: Appropriate to normalize interest rate by summertime next year

Atlanta Fed President Raphael Bostic said on Thursday, “right now, our projections suggest that by the summertime of next year, the number of jobs that we have in the economy will be pretty much where we were pre-pandemic.”

“And at that point, I think it’s appropriate for us to try to normalize our interest rate policy,” he added.

Fed Evans: Inflation is not hair on fire

Chicago Fed President Charles Evans said he wouldn’t describe inflation as “hair on fire”. But he admitted, high inflation is “gone on longer”, and things are “not quite as clean as I was hoping for”.

Evans also tried to solidify the expectation that Fed won’t raise interesting rate before completing tapering. Also, there won’t be adjustment in the tapering pace, “state-contingent, we see a big change in the data.”

Japan CPI core rose 0.1% yoy in Oct, second month of rise

Japan all-time CPI dropped from 0.2% yoy to 0.1% yoy in October. CPI core (all-item ex food) was unchanged at 0.1% yoy. CPI core-core (all-item ex food and energy), dropped further from -0.5% yoy to -0.7% yoy.

The CPI core reading is now rising for the second straight month. Overall energy prices rose 11.3%. Gasoline prices surged at highest rate in over 13 years, up 21.4%, while kerosene also rose 25.9%. Accommodation fees gained 59.1%.

Bot CPI core-core was negative for the seventh straight month, as weighed down by record -53.6% fall in mobile communications fees.

UK Gfk consumer confidence rose to -14 despite higher inflation

UK GfK consumer confidence rose from -17 to -14 in November, better than expectation of -16. Expectation of personal financial situation over the next 12 months rose 1pt to 2. Expectation of general economic situation over the next 12 months rose 3 pts to -23.

Joe Staton, Client Strategy Director GfK, comments:”Headline consumer sentiment has ticked upwards this month despite decade-high inflation, fears of higher prices and worries over rising interest rates, and as the deepening cost-of-living squeeze leaves UK household finances worse off this winter.

Looking ahead

UK retail sales and public sector net borrowing will be released in European session, along with Germany PPI and Eurozone current account. Canada will release retail sales and new housing price index later in the day.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1333; (P) 1.1354; (R1) 1.1393; More…

Intraday bias in EUR/USD stays neutral at this point. On the upside, break of 1.1384 minor resistance will indicate short term bottoming at 1.1262, after defending 1.1289 long term fibonacci level. Intraday bias will be turned back to the upside for rebound back to 1.1523 support turned resistance first. On the downside, however, sustained break of 1.1289 will carry larger bearish implication, and extend the fall from 1.2348 to 161.8% projection of 1.1908 to 1.1523 from 1.1691 at 1.1068.

In the bigger picture, there are various ways of interpreting the fall from 1.2348 (2021 high). It could be a correction to rise from 1.0635 (2020 low), the fourth leg of a sideway pattern from 1.0339 (2017 low), or resuming long term down trend. In any case, outlook will now stay bearish as long as 1.1703 support turned resistance holds. Sustained break of 61.8% retracement of 1.0635 to 1.2348 at 1.1289 would pave the way back to 1.0635.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Core Y/Y Oct | 0.10% | 0.10% | 0.10% | |

| 00:01 | GBP | GfK Consumer Confidence Nov | -14 | -16 | -17 | |

| 07:00 | EUR | Germany PPI M/M Oct | 1.20% | 2.30% | ||

| 07:00 | EUR | Germany PPI Y/Y Oct | 12.70% | 14.20% | ||

| 07:00 | GBP | Retail Sales M/M Oct | 0.50% | -0.20% | ||

| 07:00 | GBP | Retail Sales Y/Y Oct | -0.40% | -1.30% | ||

| 07:00 | GBP | Retail Sales ex-Fuel M/M Oct | 0.20% | -0.60% | ||

| 07:00 | GBP | Retail Sales ex-Fuel Y/Y Oct | -2.60% | |||

| 09:00 | EUR | Eurozone Current Account (EUR) Sep | 16.2B | 13.4B | ||

| 09:30 | GBP | Public Sector Net Borrowing (GBP) Oct | 22.3B | 21.0B | ||

| 13:30 | CAD | Retail Sales M/M Sep | -1.60% | 2.10% | ||

| 13:30 | CAD | Retail Sales ex Autos M/M Sep | -1.00% | 2.80% | ||

| 13:30 | CAD | New Housing Price Index M/M Oct | 0.50% | 0.40% |