Products You May Like

New Zealand Dollar weakens in Asian session after RBNZ rate hike, and leads other commodity currencies lower. Dollar firms up mildly as it’s ready to extend recent rally, except versus Yen for now. European majors are mixed, with Sterling have a mild upper hand against Euro and Swiss Franc. Gold is treading water below 1800 handle for now, while WTI crude oil is trying to regain 78 level.

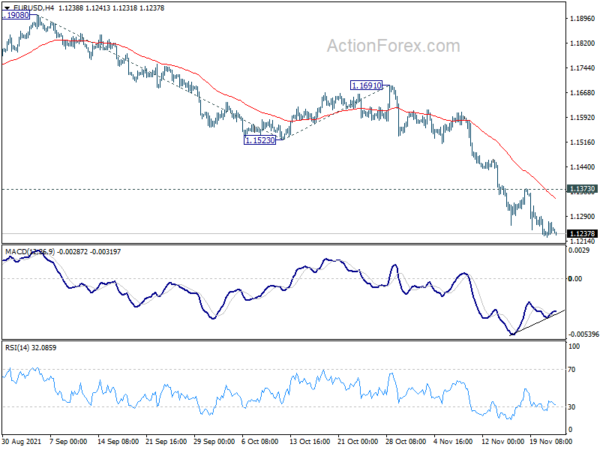

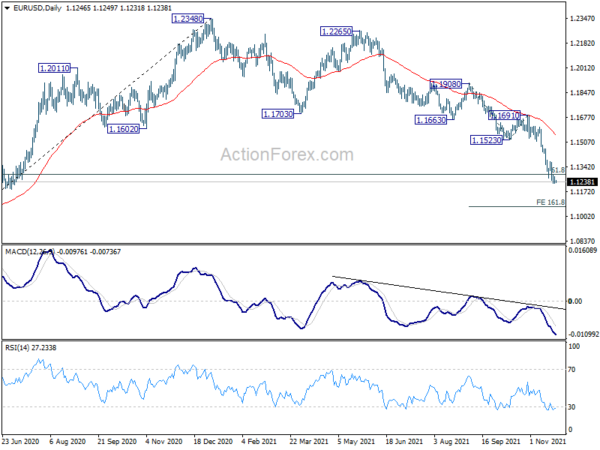

Technically, the main focus will be on Dollar against European majors. While EUR/USD broke key support level around 1.13, there is no downside acceleration yet. GBP/USD’s break of 1.3351 support also looks non-committal. We’d see if today’s set of data and FOMC minutes could finally prompt more sustainable buying in the greenback against Europeans.

In Asia, at the time of writing, Nikkei is down -1.64%. Hong Kong HSI is down -0.06%. China Shanghai SSE is down -0.10%. Singapore Strait Times is up 0.15%. Japan 10-year JGB yield is up 0.0122 at 0.087. Overnight, DOW rose 0.55%. S&P 500 rose 0.17%. NASDAQ dropped -0.50%. 10-year yield jumped 0.042 to 1.667.

RBNZ hikes OCR to 0.75%, maintains hawkish bias

RBNZ raised the Official Cash Rate to by 25bps to 0.75% as expected. It also maintained a hawkish bias, noting that ” further removal of monetary policy stimulus is expected over time given the medium term outlook for inflation and employment.”

The central bank also said that despite recent nationwide lockdown, “underlying economic strength remains supported by aggregate household and business balance sheet strength, fiscal policy support, and strong export returns.” Capacity pressured have “continued to tighten” with employment “above its sustainable level”. A broad range of economic indicators highlight the economy “continues to perform above its current level”.

Headline CPI is expected to be “above 5 percent in the near term” before returning towards 2% midpoint “over the next two years.

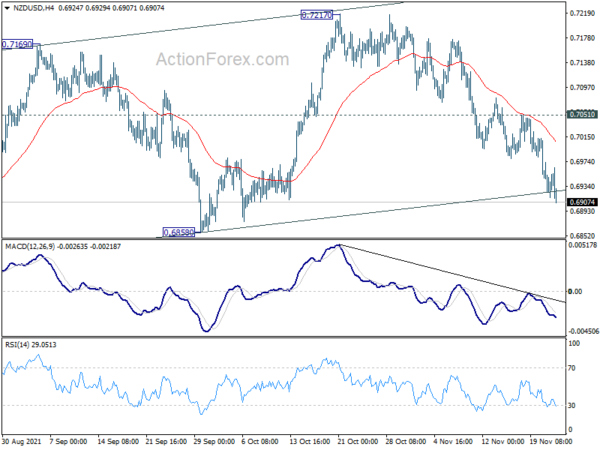

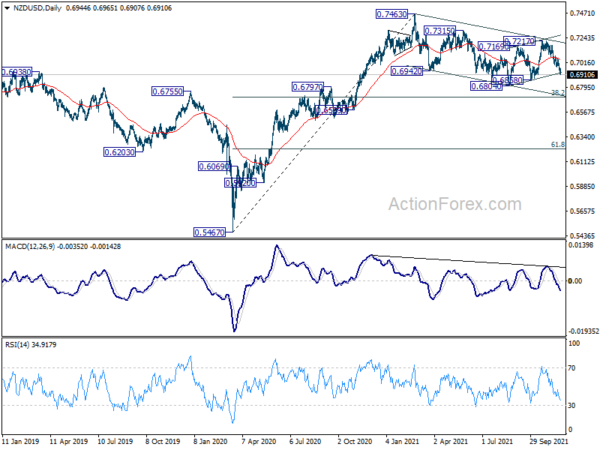

NZD/USD dips after RBNZ hike, staying mildly bearish

NZD/USD softens slightly after RBNZ rate hike and near term outlook stays mildly bearish with 0.7051 resistance intact. Deeper fall should be seen to 0.6858 support first. Break there will affirm the case that larger down trend from 0.7463 is resuming. Further decline should then be seen through 0.6804 support to 38.2% retracement of 0.5467 to 0.7463 at 0.6731 next.

Japan PMI manufacturing rose to 54.2, services rose to 52.1

Japan PMI Manufacturing rose to 54.2 in November, up from 53.2, but missed expectation of 54.5. PMI Services rose to 52.1, up from 50.7. PMI Composite rose to 52.5, up from 50.7.

Usamah Bhatti, Economist at IHS Markit, said:

“Flash PMI data indicated that activity at Japanese private sector businesses rose for the second month running in November. Growth in output quickened from October and was the quickest recorded since October 2018. By sector, service providers noted the sharpest rise in activity since September 2019, while manufacturers indicated the fastest rate of growth for six months.

“Firms across the Japanese private sector reported intensifying price pressures. Input prices across the private sector rose at the fastest pace for over 13 years with businesses attributing the rise to higher raw material, freight and staff costs amid shortages and deteriorating supplier performance.

“As vaccination rates rose and economic restrictions eased, Japanese private sector companies were strongly optimistic that business activity would rise in the year ahead. Positive sentiment was the strongest on record and stemmed from hopes that the end of the pandemic and lifting of international restrictions would provide a broad-based boost to activity.”

Looking ahead

Germany Ifo business climate is the main feature in European session. Later in the day, the pre-holiday US calendar is very busy with Q3 GDP revision, jobless claims, goods trade balance, durable goods orders, personal income and spending, new home sales featured. Fed will also release FOMC minutes.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1226; (P) 1.1250; (R1) 1.1275; More…

Intraday bias in EUR/USD remains on the downside despite some loss of downside momentum. Current down trend from 1.2348 should target 161.8% projection of 1.1908 to 1.1523 from 1.1691 at 1.1068 next. On the upside, break of 1.1373 resistance is needed to indicate short term bottoming. Otherwise, outlook will stay bearish in case of recovery.

In the bigger picture, there are various ways of interpreting the fall from 1.2348 (2021 high). It could be a correction to rise from 1.0635 (2020 low), the fourth leg of a sideway pattern from 1.0339 (2017 low), or resuming long term down trend. In any case, outlook will now stay bearish as long as 1.1703 support turned resistance holds. Sustained break of 61.8% retracement of 1.0635 to 1.2348 at 1.1289 would pave the way back to 1.0635.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | AUD | Construction Work Done Q3 | -0.30% | -3.10% | 0.80% | 2.20% |

| 0:30 | JPY | Manufacturing PMI Nov P | 54.2 | 54.5 | 53.2 | |

| 0:40 | AUD | RBA’s Bullock speech | ||||

| 1:00 | NZD | RBNZ Interest Rate Decision | 0.75% | 0.75% | 0.50% | |

| 2:00 | NZD | RBNZ Press Conference | ||||

| 9:00 | CHF | Credit Suisse Economic Expectations Nov | 15.6 | |||

| 9:00 | EUR | Germany IFO Business Climate Nov | 96.7 | 97.7 | ||

| 9:00 | EUR | Germany IFO Current Assessment Nov | 100.3 | 100.1 | ||

| 9:00 | EUR | Germany IFO Expectations Nov | 96.3 | 95.4 | ||

| 13:30 | USD | Initial Jobless Claims (Nov 19) | 260K | 268K | ||

| 13:30 | USD | GDP Annualized Q3 P | 2.20% | 2.00% | ||

| 13:30 | USD | GDP Price Index Q3 P | 5.70% | 5.70% | ||

| 13:30 | USD | Goods Trade Balance (USD) Oct P | -94.7B | -96.3B | ||

| 13:30 | USD | Wholesale Inventories Oct P | 1.20% | 1.40% | ||

| 13:30 | USD | Durable Goods Orders Oct | 0.20% | -0.30% | ||

| 13:30 | USD | Durable Goods Orders ex Transportation Oct | 0.50% | 0.50% | ||

| 15:00 | USD | Personal Income M/M Oct | 0.30% | -1.00% | ||

| 15:00 | USD | Personal Spending Oct | 0.90% | 0.60% | ||

| 15:00 | USD | PCE Price Index M/M Oct | 0.40% | 0.30% | ||

| 15:00 | USD | PCE Price Index Y/Y Oct | 4.60% | 4.40% | ||

| 15:00 | USD | Core PCE Price Index M/M Oct | 0.40% | 0.20% | ||

| 15:00 | USD | Core PCE Price Index Y/Y Oct | 4.10% | 3.60% | ||

| 15:00 | USD | New Home Sales Oct | 801K | 800K | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Nov F | 66.8 | 66.8 | ||

| 15:30 | USD | Crude Oil Inventories | -2.1M | |||

| 17:00 | USD | Natural Gas Storage | 26B | |||

| 19:00 | USD | FOMC Minutes |