Products You May Like

- Ford stock steady after a recent surge to 20-year highs.

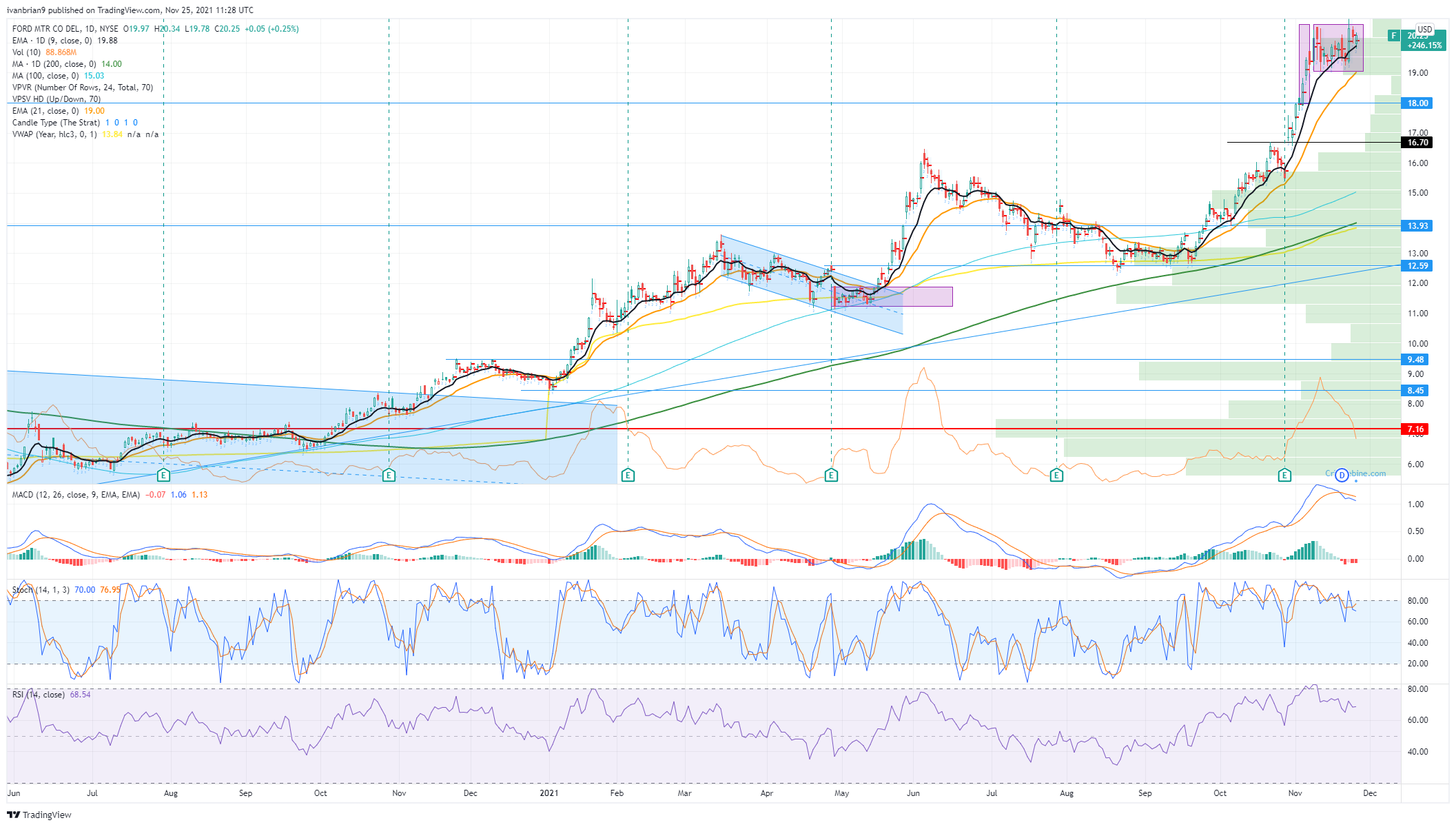

- F looks to be forming a bullish flag pattern.

- Rivian stake is flying.

Ford (F) stock was relatively quiet on Wednesday ahead of the shortened Thanksgiving week, but the stock remains strong and looks poised to build on recent gains that have taken it to a 20-year high. Ford has a stake in Rivian (RIVN) and the huge boost in that one has helped sentiment toward the Ford stock price.

RIVN more than doubled from its IPO price at $78, and while it has given up some gains it still is trading above $110. Rivian stock is now trading with a market cap of $98 billion. Ford has a 12% stake, meaning its stake in Rivian is now a $10 billion kicker. In a sign of the current valuation twilight zone we find ourselves in, Ford is worth some $18 billion less than Rivian with a market cap of $80 billion. That is a discussion for another day.

Ford (F) stock news

Ford and Rivian recently ended plans to jointly develop an electric vehicle. Ford confirmed the news last Friday. No further details were available on the reasoning. Ford is engaged in a continuous ramping up of its own electric vehicle (EV) production as consumers increasingly pivot to EV use. Auto stocks have benefitted from the passing of President Biden’s green energy plan with incentives for car manufacturers to produce increased electric vehicles. Perhaps it is less complicated for both companies to develop vehicles seperately. Both will have crossovers in their future model lineups.

The latest rally in the Ford share price from $16 to $20 was largely down to results on October 27. While revenue came in quite a bit behind estimates, $35.7 billion versus $38.2 billion expected, earnings per share (EPS) showed a big beat of $0.51 versus $0.27 expected. The forecasts of the full year 2021 were also raised and a dividend was reinstated. Ford surged 9% after earnings.

Ford (F) stock forecast

The strong move post-earnings was then added to by the successful Rivian IPO. Ford pushed on to 20-year highs above $20 and now looks to consolidate the gains from earnings. A consolidation phase is a continuation of the current trend, and the flag formed is a result of this recent price stall. Flag patterns though are usually continuation patterns. The rally is merely pausing and allowing for more price acceptance at the higher levels.

We would really like to see $18 held as this is the bottom of the flagpole and the second price explosion point. $18 is also a seven-year high and so significant in its own right. The first and other key support is at $16.70 – the earnings price explosion. These are key supports to hold the bullish trend. Breaking out of the consolidation or flag gives a target of $22 into year end. That is 10% above current levels.

The monthly chart below gives the big picture view. $22.72 is the low from all the way back to February and December of 2000 – yes, over 20 years ago. That is the next resistance and target of the flag breakout.

Ford 1-month chart