Products You May Like

Investors are back in risk-off mode after a week of volatility. Yen is rising broadly, followed by Swiss Franc and Dollar. On the other hand, commodity currencies are back under some pressure. Euro and Sterling are both mixed. The question is whether pre-weekend selloff in stocks would intensify and push Yen and Franc to end as the strongest ones.

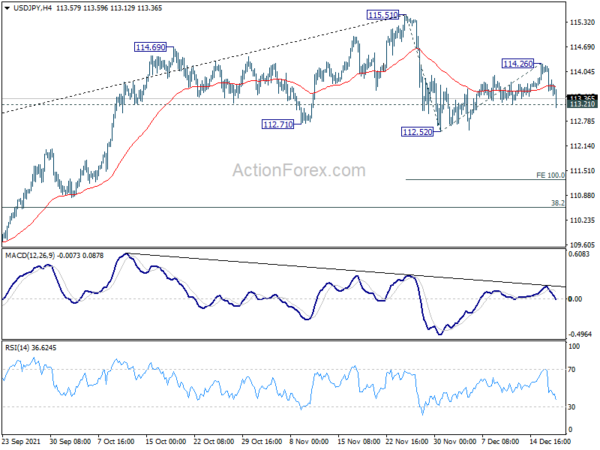

Technically, USD/JPY’s breach of 113.21 minor support is a sign that it’s resuming the corrective fall from 115.51. We’ll see if it would close below 112.52 support to set up for more decline next week. At the same time, we’ll also monitor if USD/CHF would break through 0.9156 support to align with the outlook too.

In Europe, at the time of writing, FTSE is up 0.04%. DAX is down -1.05%. CAC is down -1.27%. Germany 10-year yield is down -0.030 at -0.378. Earlier in Asia, Nikkei dropped -1.79%. Hong Kong HSI dropped -1.20%. China Shanghai SSE dropped -1.16%. Singapore Strait Times dropped -0.55%. Japan 10-year JGB yield rose 0.0058 to 0.050.

Germany Ifo business climate dropped to 94.7 in Dec, sentiment clouded over for Christmas

Germany Ifo Business Climate dropped from 96.6 to 94.7 in December, below expectation of 95.4. Current Assessment index dropped from 99.0 to 96.9, below expectation of 97.5. Expectations index dropped from 94.2 to 92.6, below expectation of 93.3. Looking at some more details, manufacturing rose from 16.7 to 17.3. Services dropped from 11.6 to 4.5. Trade dropped from 2.7 to -4.1. Construction dropped from 11.7 to 7.4.

Ifo said: “Sentiment at German companies has clouded over for Christmas. The deteriorating pandemic situation is hitting consumer-related service providers and retailers hard. The ifo Business Climate Index fell from 96.6 points in November to 94.7 points in December. Companies assessed their current business situation as less positive. Pessimism regarding the first half of 2022 also increased. The German economy isn’t getting any presents this year.”

Eurozone CPI finalized at 4.9% in Nov, EU at 5.2%

Eurozone CPI was finalized at 4.9% yoy in November, up from October’s 4.1%. The highest contribution came from energy (+2.57%), followed by services (+1.16%), non-energy industrial goods (+0.64%) and food, alcohol & tobacco (+0.49%).

EU CPI was finalized at 5.2%, up from October’s 4.4%. The lowest annual rates were registered in Malta (2.4%), Portugal (2.6%) and France (3.4%). The highest annual rates were recorded in Lithuania (9.3%), Estonia (8.6%) and Hungary (7.5%). Compared with October, annual inflation remained stable in one Member State and rose in twenty-six.

BoE Pill: More rate hikes to come if inflation persists

Asked on CNBC television if there would be “a lot more rate hikes to come,” if inflation remained at its current level, BoE Chief Economist Huw Pill replied, “well I think that’s true.”

He added, “underlying, more domestically generated inflation here in the UK, probably centered around wage pressures in a tightening labour market, are going to prove more persistent through time.”

UK retail sales rose 1.4% mom in Nov, ex-fuel sales rose 1.1% mom

UK retail sales rose 1.4% mom in November, above expectation of 0.8% mom. Sales were 7.2% higher than their pre-coronavirus February 2020 levels. Ex-automotive fuel sales rose 1.1% mom. For the 12 month period, headline sales rose 4.7% yoy while ex-automotive fuel sales rose 2.7% yoy.

Over the three months to November 2021, however, sales fell by -0.6% when compared with the previous three months.

UK Gfk consumer confidence dropped to -14, slightly depressed end of year

UK Gfk consumer confidence dropped from -14 to -15 in December. Personal financial situation over the next 12 months dropped from 2 to 1. General economic situation over the next 12 months dropped from -23 to -24. Major purchase index also dropped from -3 to -6.

Joe Staton, Client Strategy Director, GfK says: “News about the Omicron variant could not have arrived at a worse time for festive celebrations… We end 2021 on a slightly depressed note and it looks like it will be a bleak midwinter for UK consumer confidence possibly with new COVID curbs and little likelihood of any real uplift in the first months of 2022.”

BoJ keeps interest rates unchanged, scales back emergency funding

Under the yield curve control, BoJ kept short-term policy interest rate unchanged at -0.10%, and 10-year JGB target at around 0% without upper limit to purchases. It will continue to buy ETFs and J-REITs with upper limits of JPY 12T and JPY 180B respectively on annual paces.

The Special Program to Support Financing in Response to the Novel Coronavirus is extended in part by six months until the end of September 2022. The additional purchases of commercial paper and corporate bonds will be complete at the end of March 2022 as scheduled with outstanding amounts gradually drop back to pre-pandemic levels.

BoJ said, “Japan’s economy is projected to continue growing at a pace, albeit slower, above its potential growth rate.” Core CPI is “likely to increase moderately in positive territory in the short run,” and “projected to increase gradually as a trend”.

The course of COVID-19 continues to warrant attention”. There are “high uncertainties over whether the resumption of economic activity can progress smoothly”. Attentions should also be paid to risk that “effects of supply-side constraints seen in some areas will be amplified or prolonged.”

New Zealand ANZ business confidence dropped to -23.2, inflation expectations rose further

New Zealand ANZ business confidence dropped further to -23.2 in December, down from November’s -16.4. Own activity outlook dropped from 15.0 to 11.8. Export intentions dropped from 9.5 to 8.8. Investment intentions dropped from 16.3 to 11.4. Employment intentions dropped from 15.8 to 10.5. Pricing intentions dropped from 66.5 to 63.6. Inflation expectations rose further from 4.24% to 4.42%.

ANZ said: “Unfortunately the cloud of uncertainty that hangs over 2022 is not a great deal smaller, nor fluffier… Labour shortages and cost pressures rank high in firms’ list of concerns, and freight disruptions are getting worse… But having trouble meeting demand is probably a better problem to have than not having enough demand.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 113.42; (P) 113.83; (R1) 114.11; More…

USD/JPY’s breach of 113.21 minor support suggests that recovery from 112.52 has completed at 114.26. Corrective fall from 115.51 might be ready to resume. Intraday bias is back on the downside for 112.52 first. Break will confirm this case and target 100% projection of 115.51 to 112.52 from 114.26 at 111.27. Nevertheless, break of 114.26 will resume the rebound from 112.52 to retest 115.51 high.

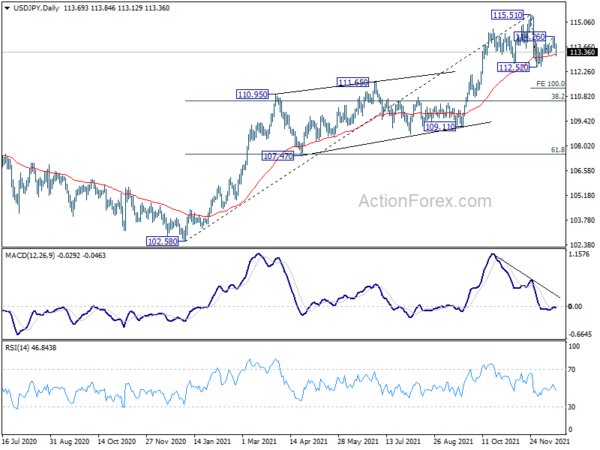

In the bigger picture, no change in the view that rise from 102.58 is the third leg of the up trend from 101.18 (2020 low). Such rally should target a test on 118.65 (2016 high) on resumption. However, firm break of 109.11 structural support will argue that the trend might have reversed and bring deeper fall to 107.47 support and possibly below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:01 | GBP | GfK Consumer Confidence Dec | -15 | -14 | ||

| 03:00 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 07:00 | EUR | Germany PPI M/M Nov | 0.80% | 1.40% | 3.80% | |

| 07:00 | EUR | Germany PPI Y/Y Nov | 19.20% | 19.80% | 18.40% | |

| 09:00 | EUR | Germany IFO Business Climate Dec | 94.7 | 95.4 | 96.5 | 96.6 |

| 09:00 | EUR | Germany IFO Current Assessment Dec | 96.9 | 97.5 | 99 | |

| 09:00 | EUR | Germany IFO Expectations Dec | 92.6 | 93.3 | 94.2 | |

| 10:00 | EUR | Eurozone CPI Y/Y Nov F | 4.90% | 4.90% | 4.90% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Nov F | 2.60% | 2.60% | 2.60% | |

| 13:30 | CAD | Foreign Securities Purchases (CAD) Oct | 23.92B | 18.50B | 20.02B | 19.78B |