Products You May Like

There’s no other way around it. The Fed will be a major focus in the market next year and will likely dominate the bond market and dollar landscape for months on end.

But with the midterm elections in November, be wary that there might be a considerable amount of political risk also at play depending on how things turn out in the run up to that.

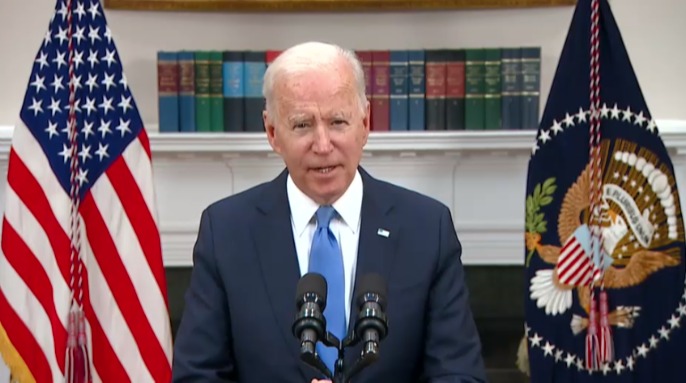

As things stand, the Democrats are already seemingly quite apprehensive about current sentiment. I mean despite Biden’s best efforts, his approval rating is less than ideal – in fact very much negative. For all the talk of displacing Trump and turning the US around, the pandemic has been a major thorn for Biden and his administration.

Adding to that now is all the anti-work movement and socioeconomic issues that have been rising across the country, which will not be helped by a divided Congress if the Democrats lose out in the midterms.

That will force Biden to focus more on geopolitical issues without pushing for meaningful changes domestically.

In turn, that will be a risk to consider for the dollar as legislative bottlenecks start to become the norm once again.