Products You May Like

Yen is trading broadly lower this week, and remain soft in Asian session, following the rally in US stocks overnight. Dollar is also weak in risk-on markets, while Euro is not far away. On the other hand, Sterling is so far the strongest one, followed by Aussie. The economic calendar is very light in the holiday-shortened week. The movements in currencies will more likely follow overall risk sentiment than not.

Technically, we’ll keep an eye on the development in CAD/JPY in the next few days. Correction from 93.00 appears to be complete at 87.42 after drawing support from medium term trend line. Break of 90.34 resistance will affirm this case and bring stronger rally back to retest 93.00 high. Such development, if happens, will help affirm the return of medium term weakness in Yen.

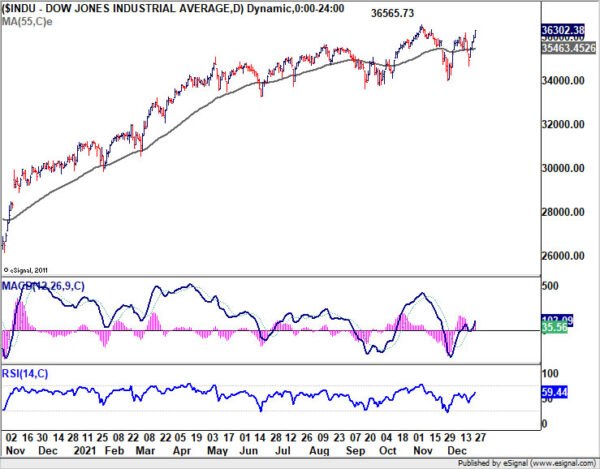

In Asia, at the time of writing, Nikkei is up 1.10%. Hong Kong HSI is down -0.09%. China Shanghai SSE is down -0.16%. Singapore Strait Times is up 0.50%. Japan 10-year JGB yield is down -0.0006 at 0.064. Overnight, DOW rose 0.98%. S&P 500 rose 1.38%. NASDAQ rose 1.39%. 10-year yield dropped -0.012 to 1.481.

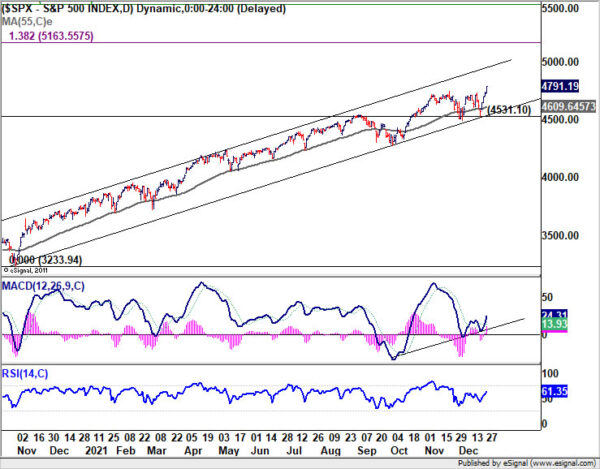

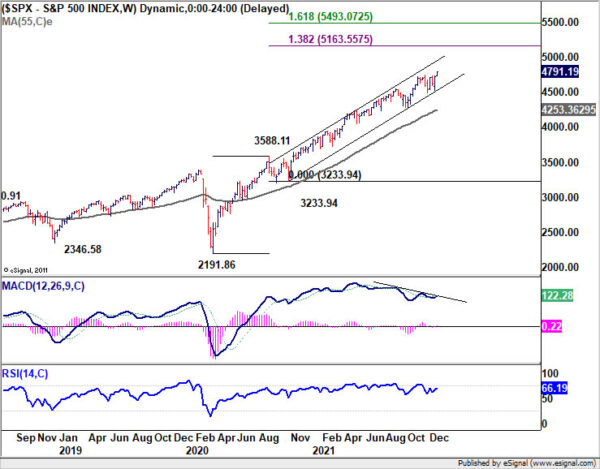

S&P 500 surged to new record, heading to 5000 and above

S&P 500 rose 1.38% to new record at 4791.19 overnight. The development confirmed resumption of whole up trend from 202 low at 2191.86. For now, outlook will stay bullish as long as 4531.10 support holds. Next medium term target is 138.2% projection of 2191.86 to 3588.11 from 3233.94 at 5163.55, which is slightly above 5000 handle. That would be a key level for S&P 500 to overcome in the early part of next year.

Meanwhile, to solidify the case of full return of risk-on sentiment, we’d like to see NASDAQ breaking through 16212.22 high and DOW through 36565.73.

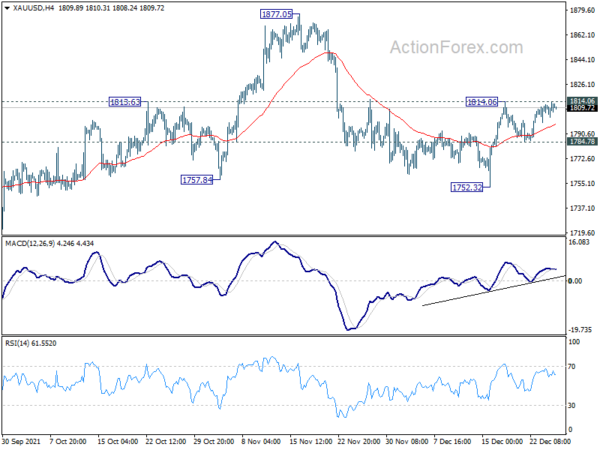

Gold pressing 1814 resistance, but losing momentum

Immediate focus is now on 1814.06 resistance in Gold. Firm break there will resume the rebound from 1752.32, and solidify the case that fall from 1877.05 has completed. In this case, stronger rally should be seen towards 1877.05 key structural resistance next.

However, note that Gold is already losing some upside momentum as seen in 4 hour 55 EMA. Rejection by 1814.06 will bring another falling leg to extend the pattern from 1814.06. But still, further rally will remain mildly in favor as long as 1784.78 support holds.

Japan industrial production surged record 7.2% mom in Nov

Japan industrial production rose 7.2% mom in November, well above expectation of 4.8% mom. That’s the biggest gain on record, going to back to as early as 1978. Comparing to the same month of 2020, industrial production was up 5.4% yoy.

Based on a poll of manufacturers, the Ministry of Economy, Trade and Industry expects output to advance 1.6% in December and climb 5.0% in January.

Also released, unemployment rate edged up to 2.8% in November, from October’s 2.7%.

Looking ahead

US will release S&P/Case Shiller house price, and house price index today.

GBP/JPY Daily Outlook

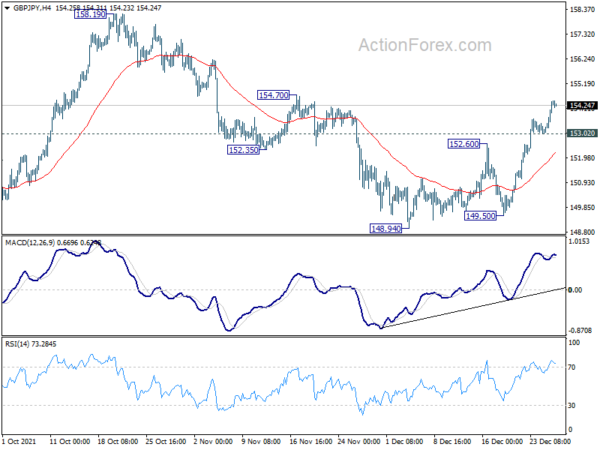

Daily Pivots: (S1) 153.57; (P) 154.02; (R1) 154.90; More…

GBP/JPY’s rise from 148.94 continues today and hit as high as 154.43 so far. Current development suggest that correction from 158.19 is complete after defending 148.93 support. Intraday bias stays on the upside for 154.70 resistance. Firm break there should confirm this bullish case and target a test on 158.19 high. Nevertheless, break of 153.02 minor support will mix up the near term outlook and turn intraday bias neutral again first.

In the bigger picture, strong rebound from 148.93 key structural support will retain medium term bullishness. Firm break of 158.19 high will resume whole up trend from 123.94 (2020 low), to 61.8% retracement of 195.86 to 122.75 at 167.93. Nevertheless, firm break of 148.93 will bring deeper correction to 38.2% retracement of 123.94 to 158.19 at 145.10, and possibly further lower, as a correction to up trend from 123.94 at least

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Unemployment Rate Nov | 2.80% | 2.70% | 2.70% | |

| 23:50 | JPY | Industrial Production M/M Nov P | 7.20% | 4.80% | 1.80% | |

| 14:00 | USD | S&P/CS Composite-20 HPI Y/Y Oct | 18.50% | 19.10% | ||

| 14:00 | USD | Housing Price Index M/M Oct | 0.90% | 0.90% |