Products You May Like

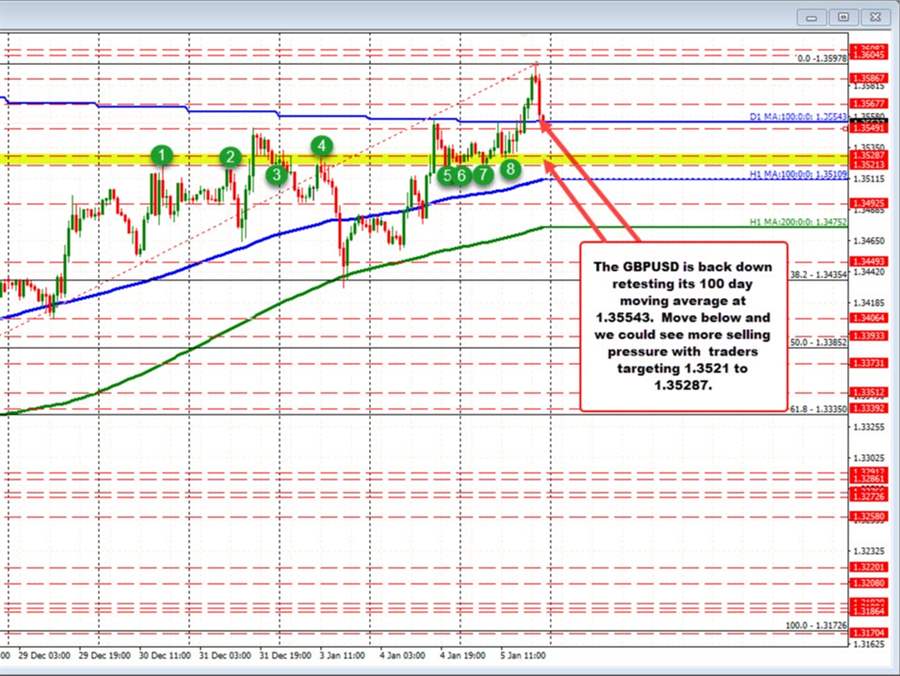

When the GBPUSD moved above its 100 day moving average earlier today, and showed some further upside momentum toward the next target near 1.3600, the risk level was reestablished at the broken 100 day MA at 1.35543.

Well… With the FOMC minutes showing the Fed not only is looking to taper, tighten, but is also looking to decrease the Fed balance sheet sooner than expectations, the USD has moved back to the upside, and the GBPUSD is back down retesting its 100 day moving average. A move back below the 100 day moving average will hurt the technical bias, and should see further downside selling momentum..

The next major downside target comes at the swing level at 1.35213 to 1.35287. Below that, the 100 hour moving average 1.35109 will be eyed.

On Monday, the price of the GBPUSD test its 200 hour moving average, but after breaking below the level, sellers turned the buyers pushed price back higher. The 200 hour moving average currently at 1.34752.

There is room to roam to the downside, but the 100 day moving average first needs to be broken.

PS the high price today stalled just short of the 1.3602 swing area (see red numbered circles in the chart below). Back in October, the price moved above the 100 day moving average on seven separate daily bars before giving up and moving lower. Today is the first attempt above that level since that time.