Products You May Like

More hawkish than expected FOMC minutes sent US stocks lower overnight, and the negative sentiment carries on in Asian session. Australian Dollar leads commodity currencies sharply lower. Yen recovers but buying is weak on strong treasury yields. Dollar is also mildly firmer together with Euro.

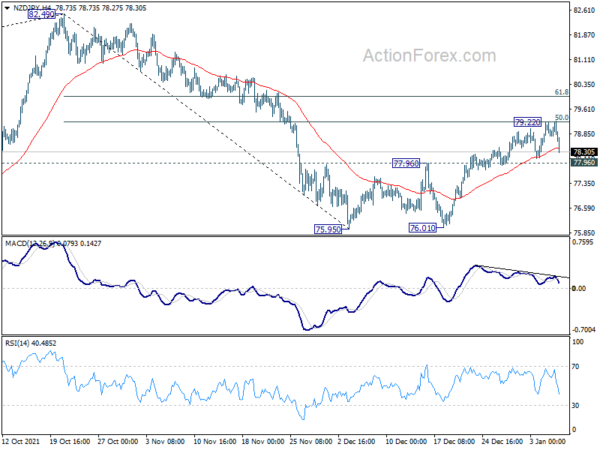

Technically, we’ll look at some Yen crosses to gauge if the overall risk sentiment is really turning. As long as 82.42 resistance turned support in AUD/JPY holds, we’d still expect rebound from 78.77 to resume through 84.27 at a later stage. Similarly, as long as 77.96 resistance turned support in NZD/JPY holds, we’d expect rise form 75.96 to continue through 79.22. However, firm break of 77.96 will argue that NZD/JPY has completed the rebound and bring retest of 75.95.

In Asia, at the time of writing, Nikkei is down -2.67%. Hong Kong HSI is down -0.49%. China Shanghai SSE is down -0.18%. Singapore Strait Times is up 0.53%. Japan 10-year JGB yield is up 0.0321 at 0.119. Overnight, DOW dropped -1.07%. S&P 500 dropped -1.94%. NASDAQ dropped -3.34%. 10-year yield rose 0.037 to 1.705.

10-year yield broke 1.7 after hawkish Fed minutes, DOW dropped

US stocks tumbled overnight and treasury yields surged after surprisingly hawkish minutes of December FOMC meeting. Firstly, “participants generally noted that, given their individual outlooks for the economy, the labor market, and inflation, it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated.

More importantly, “almost all participants agreed that it would likely be appropriate to initiate balance sheet runoff at some point after the first increase in the target range for the federal funds rate”. Also, once Fed starts to shrink its balance sheet, “the appropriate pace of balance sheet runoff would likely be faster than it was during the previous normalization episode” in October 2017.

More on FOMC minutes:

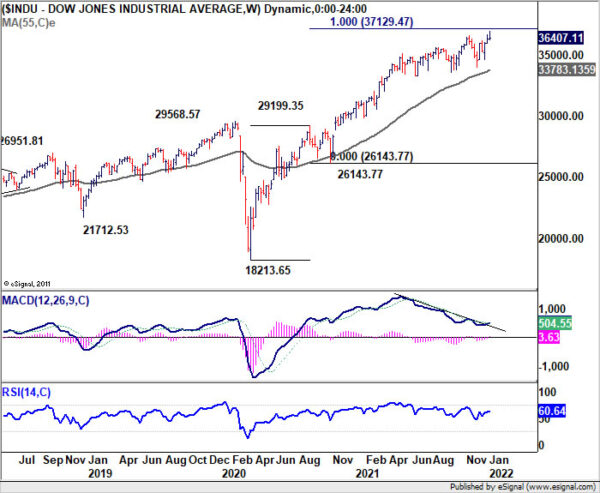

DOW closed down -1.07% or -392.54 pts at 36407.11. Despite the pull back, there is no threat to the up trend yet. However, it should not noted that DOW is close to an important fibonacci level of 100% projection of 18213.65 to 29199.35 from 26143.77 at 37129.47. Rejection by this level could trigger deep medium term correction through 55 week EMA (now at 33783.13).

Meanwhile, 10-year yield rose strongly by 0.037 to close at 1.705, breaking 1.693 near term resistance. The development is inline with the view that consolidation from 1.765 has completed after testing 55 week EMA. Up trend from 0.398 should be ready to resume. Break of 1.765 would send TNX through 2% handle to 61.8% retracement of 3.248 to 0.398 at 2.159.

China PMI services rose to 53.1, composite rose to 53.0

China Caixin PMI Services rose from 52.1 to 53.1 in December, above expectation of 51.9. PMI Composite rose from 51.2 to 53.0.

Wang Zhe, Senior Economist at Caixin Insight Group said: “To sum up, the economy recovered in December with improvements in demand and supply of manufacturing and services. Inflationary pressure eased. But the job market was still under pressure and businesses were less optimistic, raising questions about the stability of the economic recovery. The repeated Covid-19 flare-ups and sluggish overseas demand were challenges to stability.”

Looking ahead

Germany will release factory orders and CPI flash. UK will release PMI services final. Later in the day, US will release ISM services, jobless claims, trade balance and factory orders.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7201; (P) 0.7237; (R1) 0.7257; More…

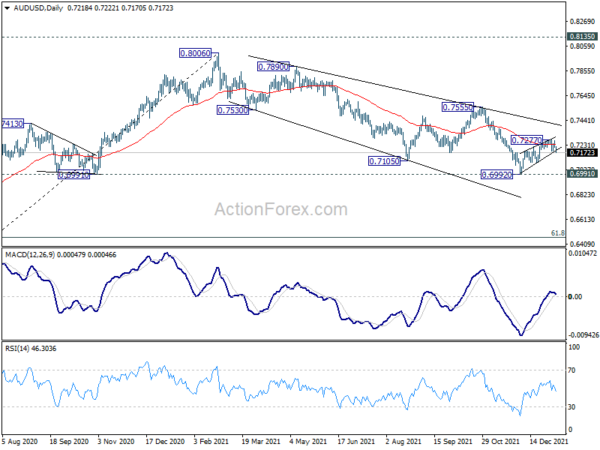

AUD/USD drops sharply today but stays above 0.7081. Intraday bias remains neutral first. On the downside, break of 0.7081 support will indicate that corrective rebound from 0.6992 has completed with three waves up to 0.7277, after hitting 55 day EMA. Intraday bias will be back on the downside for retesting 0.6991/2 support zone. Firm break there will resume larger down trend from 0.8006. On the upside, through, break of 0.7277 will turn bias to the upside to resume the rebound.

In the bigger picture, strong rebound from 0.6991 key structural support will retain medium term bullishness. That is, whole up trend from 0.5506 is still in progress. Firm break of 0.7555 resistance will target 0.8006 high and above. However, sustained break of 0.6991 will argue that the whole up trend from 0.5506 might be finished at 0.8006, after rejection by 0.8135 long term resistance. Deeper decline would then be seen back to 61.8% retracement of 0.5506 to 0.8006 at 0.6461.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:45 | CNY | Caixin Services PMI Dec | 53.1 | 51.9 | 52.1 | |

| 07:00 | EUR | Germany Factory Orders M/M Nov | 2.50% | -6.90% | ||

| 09:30 | GBP | Services PMI Dec F | 53.2 | 53.2 | ||

| 13:00 | EUR | Germany CPI M/M Dec P | 0.40% | -0.20% | ||

| 13:00 | EUR | Germany CPI Y/Y Dec P | 5.10% | 5.20% | ||

| 13:30 | CAD | Trade Balance (CAD) Nov | 1.4B | 2.1B | ||

| 13:30 | USD | Initial Jobless Claims (Dec 31) | 199K | 198K | ||

| 13:30 | USD | Trade Balance (USD) Nov | -73.5B | -67.1B | ||

| 15:00 | USD | ISM Services PMI Dec | 67.2 | 69.1 | ||

| 15:00 | USD | ISM Services Prices Paid Dec | 82.3 | |||

| 15:00 | USD | ISM Services Employment Index Dec | 56.5 | |||

| 15:00 | USD | Factory Orders M/M Nov | 1.50% | 1.00% | ||

| 15:30 | USD | Natural Gas Storage | -55B | -136B |