Products You May Like

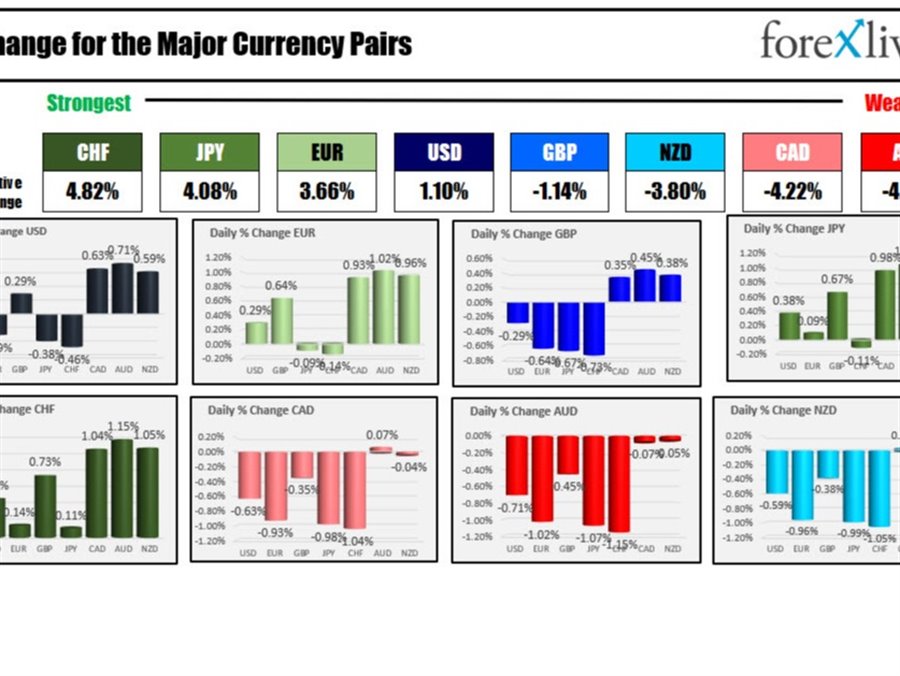

As the North American session begins (and so does the week), the USD is the strongest and the AUD is the weakest. The JPY and the CHF are also higher as “risk-off” sentiment controls the flows in the forex today.

The FOMC will start their two day meeting on Tuesday (decision at 2 PM ET on Wednesday). The Fed will debate whether they keep the taper where it is or speed things up (finish?) so that they can tighten sooner – and more often (every meeting after March?). The discussion on balance sheet reductions may also be discussed. Will they let the balance sheet run off naturally, or engage in quantitative tightening (QT) as well? If they engage in QT, will it be focused on the treasury notes and bonds or mortgage back securities?

US stocks in premarket trading are continuing the trend to the downside after the Dow and S&P had their worst week since October 20, 2020. The Nasdaq was the worst performer last week with a decline of -7.53%. The Russell 2000 traded at 52 week lows. The Nasdaq is leading the way again today. Earnings heat up this week. Scheduled to be report earnings this week include IBM, Verizon, American Express, Microsoft, Boeing, Intel, Tesla, ServiceNow, MasterCard, McDonald’s, Apple, Chevron, and Caterpillar.

US yields are mixed with the short end up a few basis points while the long end is lower as the yield curve flattens a bit more.

Tension in Ukraine continue to escalate along the border. US and UK instructed families of their diplomats to leave the country. The Biden administration is considering sending troops to the country as a deterrent to the Russian encouragement.

Crude oil prices are easing a bit. There is reports at Iran is close to an agreement on nuclear disarmament which could be good for the supply-side. Crude oil is trading down around $0.22 in early trading.

In other markets, the morning snapshot shows:

- Spot gold is trading up $4.27 or 0.23% at $1838.58

- Spot silver is down $0.25 or -1% at $24.02

- WTI crude oil is trading down $0.09 at $84.98

- Bitcoin tumbled lower and is currently trading at $33,377 and trades at the lowest level since since July 23

In the premarket for US stocks, the major indices are trading lower. All three major indices are trading down

- Dow industrial average -121 points after Friday’s -450.02 point decline

- S&P index down down -23.5 points after Friday’s -84.79 point decline

- NASDAQ index -119 points after Friday’s -385.10 point decline

In the European equity markets, major indices are trading lower across the board as a place catch up to the sharp decline in the US stock market afternoon session yesterday

- German DAX, negative 2%

- France’s CAC – -2%

- UK’s FTSE 100 -1.3%

- Spain’s Ibex -1.9%

- Italy’s FTSE MIB -2.5%

US yields are mixed as the yield curve flattens further. The two year is up 2.1 basis points while the 30 year is down -0.5 basis points and the 10 year is down -1.0 basis points. Investors are concerned about slower growth as the Fed tightenings. The FOMC will meet this weekend decide on policy going forward including taper, balance sheet, interest rates.

In the European debt market, the benchmark 10 year yields are down across the board. The German tenure yield after point with the parity level last week is trading down -0.089%.