Products You May Like

Its US jobs report Friday, previews:

China

was once again out on holiday today. Combined with the wait for the

upcoming US January jobs report (nonfarm payroll, previews in the

bullets above)

much

of

major

FX traded in small ranges.

EUR/USD

was a bit of an exception. After the ECB and President Lagarde’s

less dovish remarks the euro rose on Thursday (Europe/US time). That

rise extended just a little here in Asia as markets reassess how much

policy divergence there is likely to be ahead between the US and

Eurozone. EUR/USD ticked around 30 points higher during the session.

Cable,

too found a few bids during Asia, its up around 20 points off its

early in the session low.

The

RBA,

Australia’s

central bank,

released

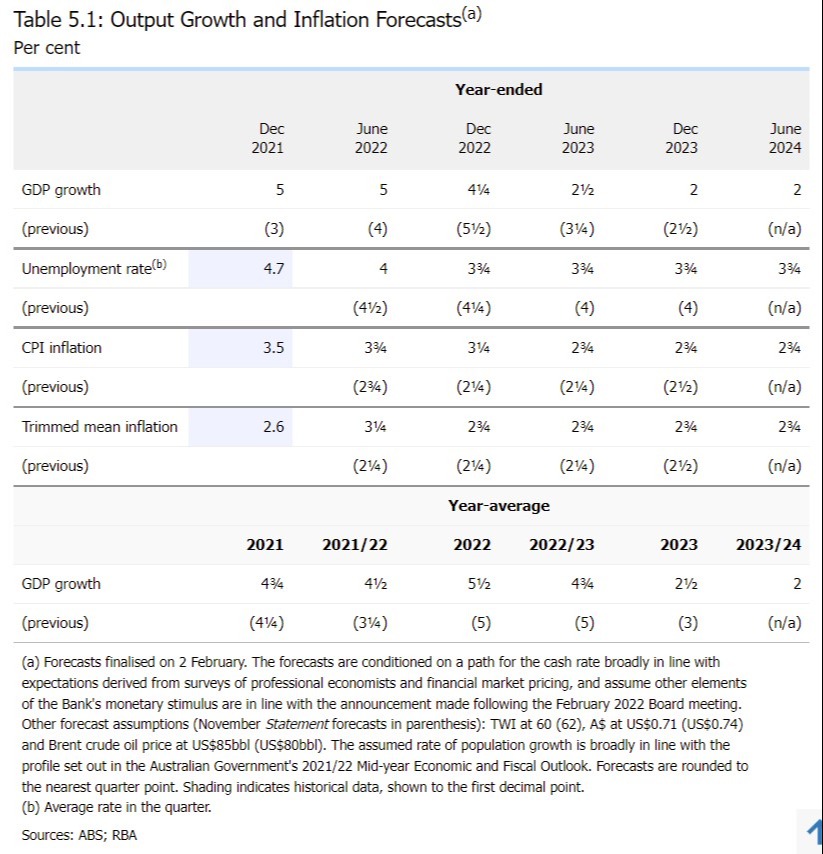

its February Statement on Monetary Policy.

The

SoMP is published four times a year. In today’s publication the

Bank

upgraded its inflation and employment outlook for the quarters ahead,

while still

expecting

only a slow build ahead for wage pressures. The Bank reiterated its

patient view on policy adjustment ahead. AUD/USD is little changed on

the session.

Equities

benefited from a strong report from Amazon after regular (US) trading

hours and a subsequent circa 15%+ jump for the shares.

New RBA forecasts (in summary):