Products You May Like

Sentiment is mixed in Asia with heavy selling seen in stock markets of Hong Kong and China, while Nikkei and Singapore Strait Times are recovering. US President Joe Biden announced to impose an immediate ban on imports of Russian Energy. Commercial big names like McDonald’s, Coca-Cola, and Pepsi also finally joined to halt businesses in Russia.

Gold failed to break through all-time high in first attempt but stays firm at around 2050 for now. WTI crude oil’s rally attempt is also capped by 131.82 temporary top, but looks ready to have another take any time. In the currency markets, Euro remains in consolidative mode, digesting recent losses, together with Sterling. Yen, Aussie and Kiwi are the softer ones for today so far. Dollar is attempting to stage a broad based rally, but momentum is not too convincing yet.

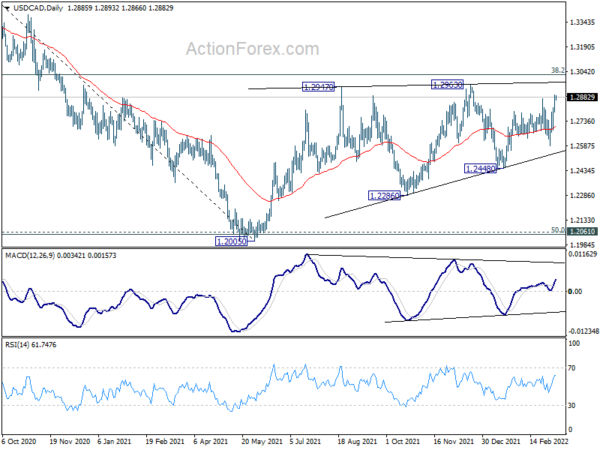

Technically, USD/CAD’s break of 1.2876 resistance suggests resumption of rise from 1.2448, and further rally should be seen to 1.2963. AUD/USD is holding well above 0.7093 near term support despite a deep retreat, and so there is no sign of bearish reversal. USD/CHF and USD/JPY are both bounded in familiar range. Hence, while the greenback remains strong against Euro and Sterling, there is no sign of broad based strength yet, at least until range breakout in USD/CHF and USD/JPY.

In Asia, at the time of writing, Nikkei is up 0.74%. Hong Kong HSI is down -1.76%. China Shanghai SSE is down -0.77%. Singapore Strait Times is up 0.84%. Japan 10-year JGB yield is up 0.0148 at 0.170. Overnight, DOW dropped -0.56%. S&P 500 dropped -0.72%. NASDAQ dropped -0.28%. 10-year yield rose 0.121 to 1.872.

RBA Lowe: A rate hike this year is plausible

RBA Governor Philip Lowe reiterated in a speech that Australia has the “scope to wait and assess incoming information” before working on interest rates.

He highlighted two issues that policymakers are “paying close attention to”. The first is the “persistence of supply-side price shocks” and the extent of impact from Russia’s invasion of Ukraine. Secondly, that’s “how labor costs in Australia evolve”.

He noted that “given the outlook, though, it is plausible that the cash rate will be increased later this year.” There is both a risk to “waiting too long” and “moving too early”. But Low finished with the point that “it is only possible to achieve a sustained period of low unemployment if inflation remains low and stable”. And, “recent developments in Europe have added to the complexities here.”

Australia Westpac consumer sentiment dropped to 96.6 in Mar, worst since Sep 2020

Australia Westpac consumer sentiment index dropped -4.2% to 96.6 in March, down from 100.8. That’s the worst reading since September 2020, which was also the last time thee index was below the 100-level.

Westpac said: “The latest monthly fall comes as no surprise. The war in Ukraine; the floods in south- east Queensland and Northern NSW; ongoing concerns about inflation and higher interest rates were all likely to impact confidence, although the size of the decline is still notable.”

Westpac maintained the view that the first RBA rate hike in the tightening cycle will start on August 2, following two more inflations reports of Q1 and Q2.

China PPI slowed to 8.8% yoy in Feb, CPI unchanged at 0.9% yoy

China PPI slowed from 9.1% yoy to 8.8% yoy in February, above expectation of 0.8% yoy. Senior National Bureau of Statistics statistician Dong Lijuan said, PPI was “affected by the increased commodity prices globally such as crude oil and non-ferrous metals”.

CPI was unchanged at 0.9% yoy, above expectation of 0.8% yoy. affected by the Chinese New Year holiday and the fluctuation of international energy prices, CPI saw a bigger month on month increase,” added Dong after CPI rose by 0.6 per cent month on month.

Fitch downgrades Russia rating to C, sovereign default is imminent

Fitch Ratings has downgraded Russia’s Long-Term Foreign Currency Issuer Default Rating (IDR) to ‘C’ from ‘B’. The ‘C’ rating reflects Fitch’s view that a sovereign default is imminent.

The rating agency said developments since March 2, the last downgrade to “B”, “further undermined Russia’s willingness to service government debt.”

It added, “the further ratcheting up of sanctions, and proposals that could limit trade in energy, increase the probability of a policy response by Russia that includes at least selective non-payment of its sovereign debt obligations.

Elsewhere

New Zealand manufacturing sales rose 12.0% in Q4. Japan GDP growth was finalized at 1.1% qoq in Q4, below expectation of 1.4% qoq.

Looking ahead, Italy industrial output and US oil inventories are the major releases in a light day.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2823; (P) 1.2862; (R1) 1.2928; More…

USD/CAD’s break of 1.2876 resistance suggests that rise from 1.2448 has resumed, and revives near term bullishness. Intraday bias is back on the upside for 1.2963 resistance first. Break there will target key long term fibonacci level at 1.3022. On the downside, below 1.2794 minor support will turn intraday bias neutral and mix up the outlook again.

In the bigger picture, focus stays on 38.2% retracement of 1.4667 (2020 high) to 1.2005 (2021 low) at 1.3022. Sustained break there should confirm that the down trend from 1.4667 has completed after defending 1.2061 long term cluster support. Further rise would then be seen towards 61.8% retracement at 1.3650. However, rejection by 1.3022 will maintain medium term bearishness. Break of 1.2005 will resume the down trend from 1.4667 and that carries larger bearish implications too.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Manufacturing Sales Q4 | 12.00% | -2.20% | ||

| 23:30 | AUD | Westpac Consumer Confidence Mar | -4.20% | -1.30% | ||

| 23:50 | JPY | GDP Q/Q Q4 F | 1.10% | 1.40% | 1.30% | |

| 23:50 | JPY | GDP Deflator Y/Y Q4 F | -1.30% | -1.30% | -1.30% | |

| 23:50 | JPY | Money Supply M2+CD Y/Y Feb | 3.60% | 3.50% | 3.60% | |

| 01:30 | CNY | CPI Y/Y Feb | 0.90% | 0.80% | 0.90% | |

| 01:30 | CNY | PPI Y/Y Feb | 8.80% | 8.70% | 9.10% | |

| 06:00 | JPY | Machine Tool Orders Y/Y Feb | 61.40% | |||

| 09:00 | EUR | Italy Industrial Output M/M Jan | 0.00% | -1.00% | ||

| 15:30 | USD | Crude Oil Inventories | -1.1M | -2.6M |