Products You May Like

Recall from yesterday, the Nasdaq index moved higher ahead of the open on the back of what is perceived as a peaking of inflation (after the higher than expected CPI data).

However, as the day went on, the pair gave up those gains and then sold off into the close. The index closed near the lows for the day.

Today, the price moved to session lows shortly after the open and has stepped higher and higher. A new high has been made in the current hourly bar at 13644.17. The current price is trading around 13640 that’s up nearly 2% on the day

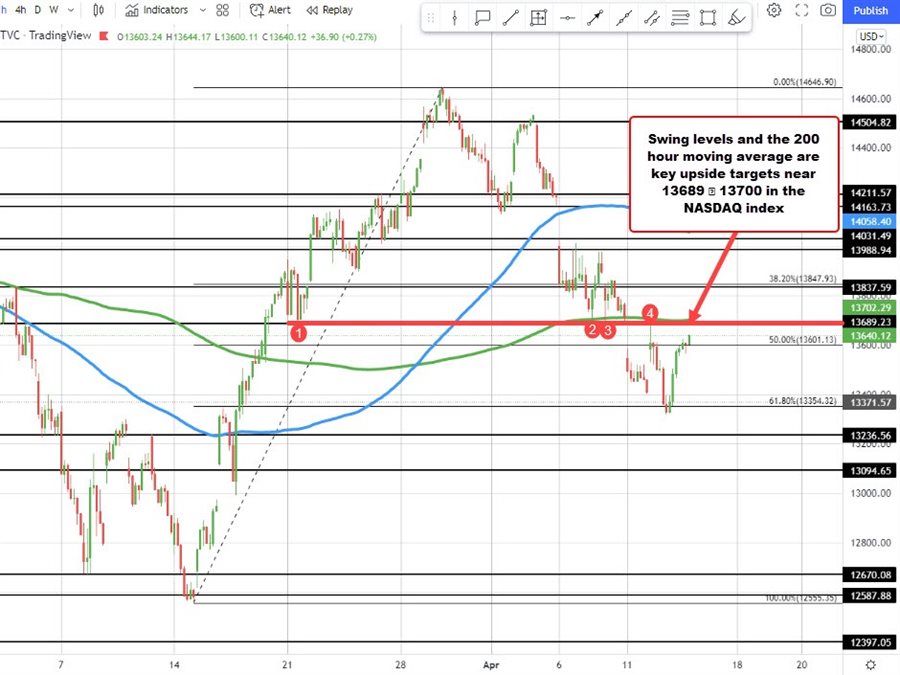

Technically, the price is moving back above the 50% midpoint of the move up from the March 14 low. That level comes in at 13601.13. On the topside, the 200 hour moving average at 13702.26 was the next major target to get to and through. Watch 13689 area as well. That was a swing low from April 7 and near the swing high from yesterday’s trade. Move above those levels would increase the bullish bias.

Also helping the market sentiment is that the low price reached yesterday was still comfortably above the current corrective cycle low from March 15 at reached 12555.35. The low from yesterday was near 6% from that cycle low. The idea that the “worst is behind us” might be sneaking into the market at least in the near term.

The bulls/buyers are back.