Products You May Like

The New York Fed Empire State manufacturing index came in at 24.6 versus -11.8 in March. The estimate was for a rise to 0.50. Much better-than-expected report as new orders, prices paid (a new record), shipments lead the way higher.

- New orders 25.1 versus -11.2 in last month

- prices paid +86.4 a new record versus 73.8 last month

- prices received 49.1 versus 56.1 last month

- employment index +7.3 versus +14.5 last month

- average employee workweek 10.0 verse 3.5 last month

- shipments 34.5 versus -7.4 last month

- unfilled orders 17.3 versus 13.1 last month

- delivery time 21.8 versus 32.7 last month

- inventories 13.6 versus 21.5 last month

Six month forward-looking guidance shows came in weaker than the March number but is still positive with inflation expectations six-month forward still elevated.

- six month business conditions index +15.2 versus +36.6 in March

- new orders 15.0 versus 41.1 last month

- shipments 13.4 versus 42.3 last month

- unfilled orders -5.5 versus 50.9 last month

- delivery time a .2 versus 18.7 last month

- inventories -4.5 versus 13.1 last month

- prices paid 72.7 versus 72.9 last month

- prices received 55.5 versus 58.9 last month

- number of employees 25.8 versus 27.0 last month

- average employee workweek 5.5 versus 50.0 last month

- capital expenditures 31.8 verse 35.5 last month

- technology spending 27.3 versus 23.4 last month

Of note in the forward guidance is a vast majority of the respondents still expect prices paid in prices received to be higher six-month forward. Concerns about inflation remaining embedded with inflation expectations rising makes these numbers a concern.

For the full report click here

From the NY Fed:

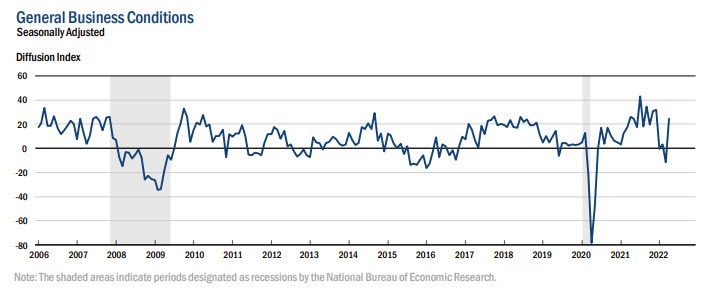

Business activity picked up markedly in New York State, according to firms responding to the April 2022Empire State Manufacturing Survey. The headline general business conditions index surged thirty-six points to 24.6. New orders and shipments grew strongly, and unfilled orders increased. Delivery times lengthened, though at a slower pace than in recent months, and inventories rose. Labor market indicators pointed to a small increase in employment and the average workweek. The prices paid index hit a record high, and the prices received index remained elevated. Plans for capital and technology spending were solid. Looking ahead, firms were significantly less optimistic about the six-month outlook than in recent month.

/ inflation