Products You May Like

The JPY is the strongest of the major currencies, while the AUD is the weakest. That has the AUDJPY as the biggest mover of the day. The pair is currently down -1.35% at 91.52.

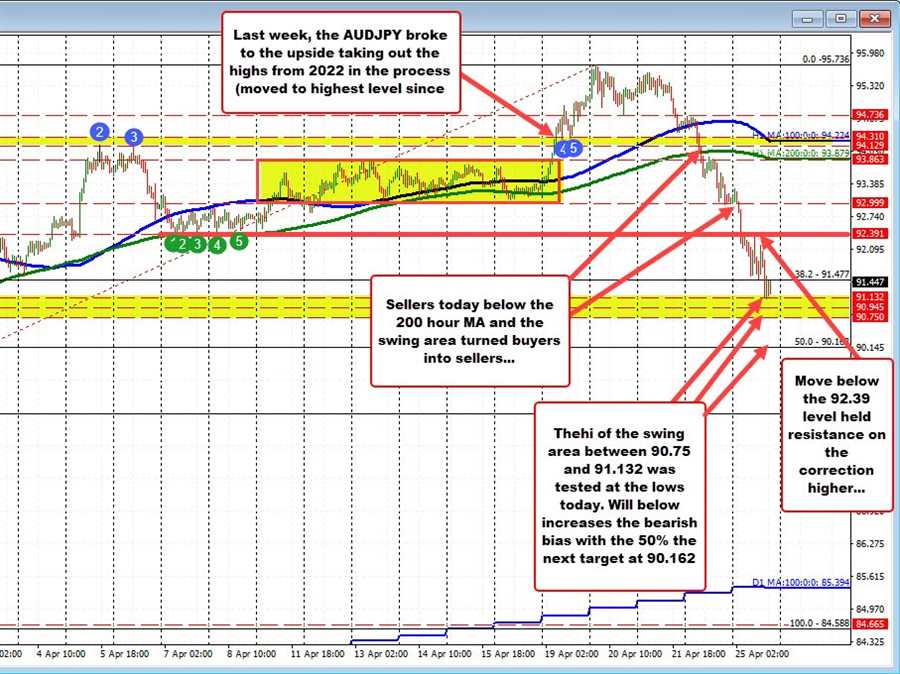

It wasn’t five trading days ago that the AUDJPY pair was breaking to the upside as (see post here). On the day I wrote:

“…the pair has now moved to the highest level since June 2015 – surpassing the previous swing high for the 2022 at 94.31 from March 28 and the April 5 high at 94.16. The high price just reached 95.009 so far. The current price trades at 94.69.”

Also on that day, I commented that:

“The buyers are in firm control, and would take a move below 94.31 and 94.1292 to give sellers some minor confidence.”

Looking at the hourly chart, that swing area is home to the swing highs from March (see blue numbered circles).

On Friday, the price did move back below that swing area. It also fell below the rising 100 and 200 hour moving average (blue and green lines in the chart above). Those technical breaks in the AUDJPY , tilted the short term bias back to the downside.

The low price on Friday reached the swing low of a non-trending range from March 11 to March 19 (between 92.99 and 93.863 – see the yellow tinted red box on the chart above).

Today, the price opened near that 93.00 level, moved briefly to the upside in the Asian session before breaking lower and finding additional momentum. There was a corrective consolidation started near the 38.2% retracement at 91.477. The high price off of that low reached 92.391. Which was also near a old floor from April 7 and April 8 (see green numbered circles).

The price moved down to test yet another swing area between 90.750 and 91.132 (see red numbered circles). Buyers came in against the high of that area and the price has been trading roughly between that low, and the broken 38.2% and 91.477.

The buyers were in firm control last week in the AUDJPY, but could not maintain the momentum. The China news has certainly helped the trend move back to the downside. The technicals certainly showed the way as corrective levels to the downside were taken out one by one. The pair is near another support target. Move below 90.75 and the 50% retracement of the move up from the March 14 below would become the next target.

Alternatively, hold support near the lower swing area a move back above 91.477 could see traders start to look back toward the 92.39 level where another decision will be made by market traders.