Products You May Like

As much as central banks and many are expecting ‘peak inflation’ to hit in Q2 before easing later in the year, it may not necessarily be enough.

I’ve mentioned before that a distinction needs to be made between inflation falling back to 2% and inflation hitting a peak but then staying at elevated levels. If anything else, the latter looks more likely at this stage and that is something that central banks can’t really fall back on too much.

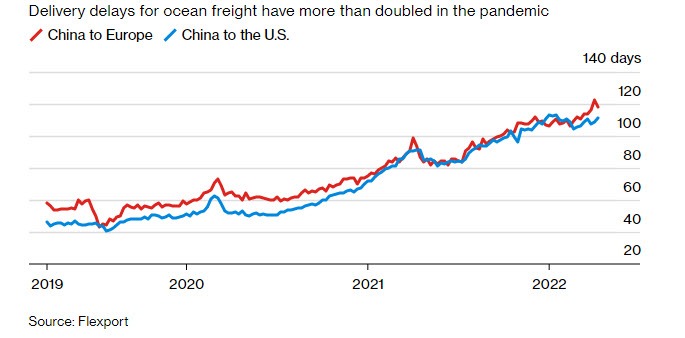

The biggest issue at the moment is China. The country’s ‘zero COVID’ policy is continuing to cause supply chain disruptions with Beijing now the latest to be dragged into the debacle. Shipping and manufacturing delays were already evident when Shanghai had to go into lockdown and we’re now moving from that to Beijing, which will keep the cycle running.

This is quite a neat chart highlighting the issue from Bloomberg:

The biggest issue here is that the inflation spike is going to be more persistent and carry through to next year. I don’t see how businesses will be able to tolerate that too much and in order to maintain profit margins, it will be at the expense of consumers.

Inflation is all the rage now but we’ll be starting to talk about the pain on the consumption front and the drag of the economy in the weeks/months to come surely; if we haven’t already that is.