Products You May Like

Australia’s critical first quarter Consumer Price Index data is out and the data has beaten expectations, lifting AUD higher towards a key resistance target on the hourly chart.

The data is key because the Australian central bank has dropped its patient stance and announced monetary policy would be data-dependent.

Australian quarterly inflation was expected to surpass the upper end of the RBA’s target.

Aussie CPI

- Q1trimmed mean CPI +1.4 pct QoQ (Reuters poll +1.2 pct).

- Q1 CPI (all groups) +2.1 pct QoQ (Reuters poll +1.7 pct).

- Weighted median CPI +1 pct QoQ (Reuters poll +1.1 pct).

- Trimmed mean CPI +3.7 pct YoY (Reuters poll +3.4 pct).

- Australia Q1 CPI (all groups) +5.1 pct YoY (Reuters poll +4.6 pct).

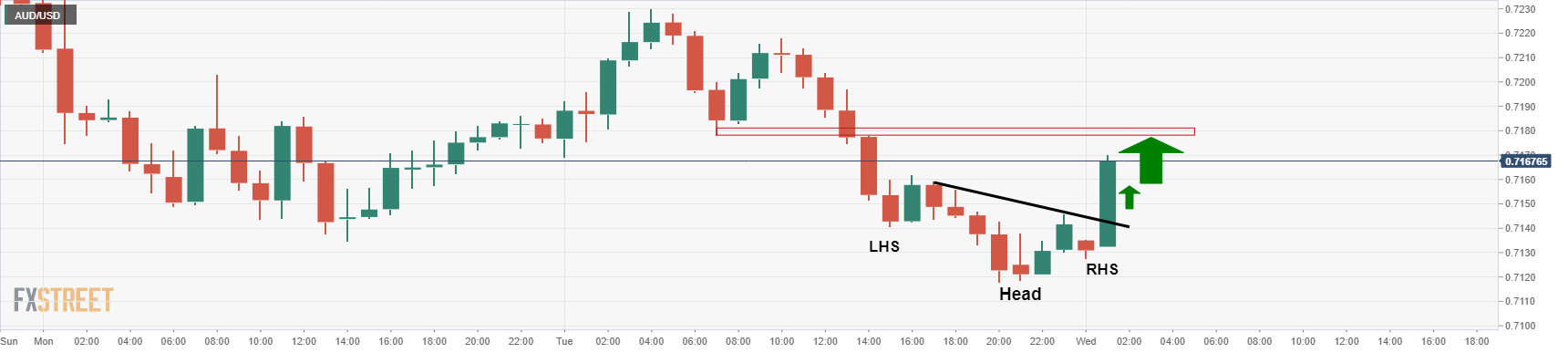

On the hourly chart, AUD/USD had been forming a bullish reverse head & shoulders ahead of the data as follows:

This is a reversal pattern and the neckline of the prior M-formation near 0.7180 could be targetted for the day ahead. The outcome has triggered a bid, so this validates the chart pattern, as follows:

About CPI

The Consumer Price Index released by the RBA and republished by the Australian Bureau of Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services . The purchase power of AUD is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. A high reading is seen as positive (or bullish) for the AUD, while a low reading is seen as negative (or Bearish).