Products You May Like

The two big factors providing a strong tailwind for the dollar today are the meltdown in the Japanese yen after the BOJ pledged to maintain yield curve control, sending USD/JPY up to hit 130.00 and also the continued plunge in the Chinese yuan, weakening past 6.60 against the dollar.

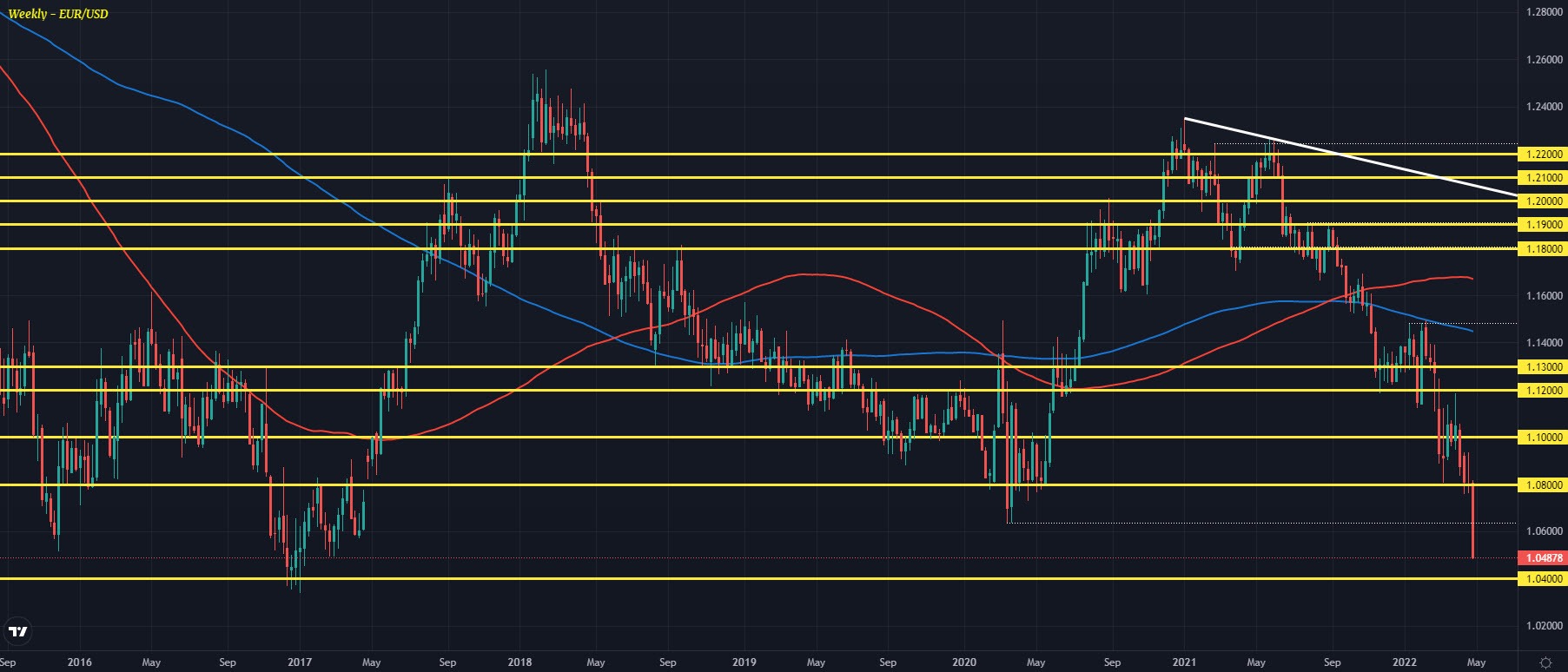

That is seeing the greenback post hefty gains across the board with EUR/USD hitting a fresh five-year low down to 1.0484:

The technicals are extremely favourable for the greenback at the moment with little in the way of a push towards 1.0400 next. Meanwhile, GBP/USD is also falling to fresh lows since July 2020:

The 1.2500 level is in focus now with the 61.8 retracement level of the pandemic rebound seen @ 1.2495. That will provide the next key layer of defense in trading this week.

Elsewhere, the dollar is also gaining strongly against the aussie and kiwi as highlighted here.

It’s all about the dollar as we head into month-end trading with little else to distract from the focus before we get to the FOMC meeting on 4 May next week.