Products You May Like

Dollar is paring some gains today but remains the strongest one for the week. Canadian Dollar is currently the second best. Euro is trying to recover but remains the second worst, just next to Sterling. Yen is trying to recover against Dollar too, but stays weak against European majors. Aussie and Kiwi are mixed for now but there is prospect of more recovery before the week ends.

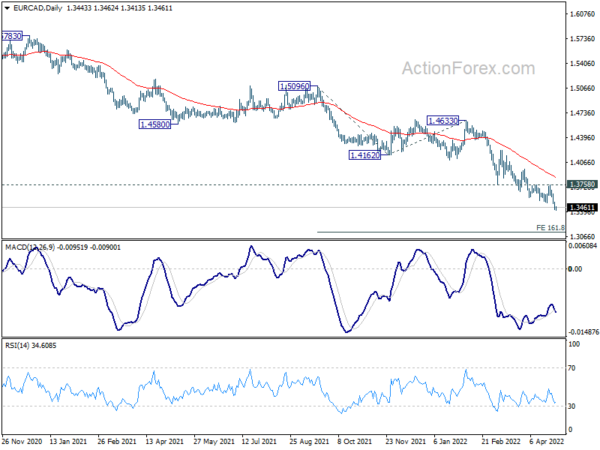

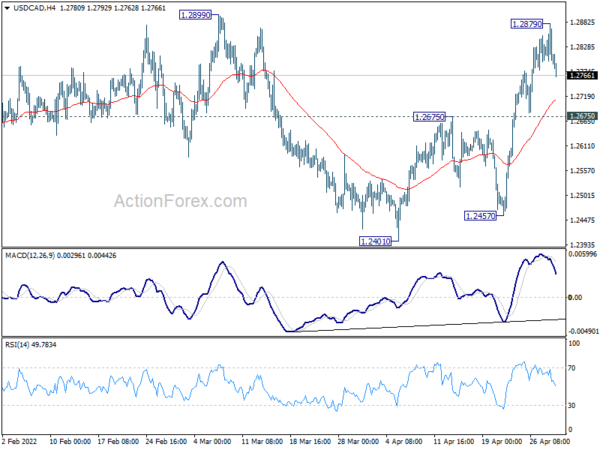

Technically, a focus today will be Canadian Dollar’s reaction to GDP data. USD/CAD is retreating from 1.2879 but further rise is still in favor as long as 1.2675 support holds. However, break of 1.2675 will bring deeper fall back to 1.2401/2457 support zone, to extend medium term range trading. At the same time, EUR/CAD is probably picking up downside momentum, for next target at 161.8% projection of 1.5096 to 1.4162 from 1.4633 at 1.3122.

France GDP stagnated in Q1 with sharp decline in household consumption

France GDP stagnated with 0.0% qoq growth in Q1, below expectation of 0.3% qoq. Households’ consumption expenditure sharply decreased (-1.3% after +0.6%) while gross fixed capital formation (GFCF) slightly decelerated (+0.2% after +0.3%). Finally, internal demand excluding inventory changes contributed to -0.6 points to GDP growth, after +0.5 points in the previous quarter.

Also from France, consumer spending dropped -1.3% mom in March, worse than expectation of -0.1% mom. CPI accelerated from 5.1% yoy to 5.4% yoy in April, above expectation of 5.1% yoy.

Swiss KOF economic barometer rose to 101.7, contrast between corona easing and war

Swiss KOF Economic Barometer improved from 99.7 to 101.7 in April, above expectation of 99.3. It’s back above long-term average of 100 after dipping below that level in March. Outlook for the Swiss economy is therefore rather favorable in the short term.

KOF said, accommodation and food service activities and the other services sector are responsible for the rise. On the other hand, indicators for foreign demand are currently the strongest drag.

It added, “this contrast highlights the tension between Corona easing and international burdens, especially the Ukraine war.”

Also from Swiss, retail sales dropped -6.6% yoy in March, below expectation of 13.3% yoy rise

Looking ahead

Eurozone GDP Q1 GDP and CPI are the main focuses in European session. Later in the day, Canada will release GDP. US will release personal income and spending, with PCE inflation. .

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2773; (P) 1.2826; (R1) 1.2862; More…

A temporary top is formed at 1.2879, ahead of 1.2899 resistance, with current retreat. Intraday bias in USD/CAD is turned neutral first. Further rise will remain mildly in favor as long as 1.2675 resistance turned support holds. Above 1.2879 should resume rise from 1.2401 towards 1.3022 fibonacci level. Decisive break there will carry larger bullish implications. However, break of 1.2675 will dampen this bullish view and bring deeper fall back to 1.2401 support instead.

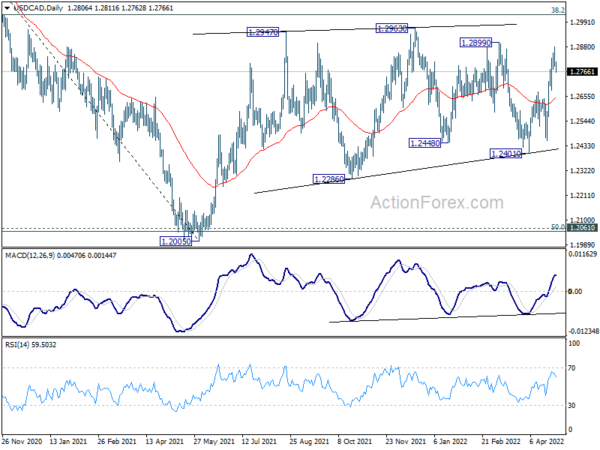

In the bigger picture, focus stays on 38.2% retracement of 1.4667 (2020 high) to 1.2005 (2021 low) at 1.3022. Sustained break there should confirm that the down trend from 1.4667 has completed after defending 1.2061 long term cluster support. Further rise would then be seen towards 61.8% retracement at 1.3650. However, rejection by 1.3022 will maintain medium term bearishness. Break of 1.2005 will resume the down trend from 1.4667 and that carries larger bearish implications too.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Private Sector Credit M/M Mar | 0.40% | 0.60% | 0.60% | |

| 01:30 | AUD | PPI Q/Q Q1 | 1.60% | 1.50% | 1.30% | |

| 01:30 | AUD | PPI Y/Y Q1 | 4.90% | 4.20% | 3.70% | |

| 05:30 | EUR | France Consumer Spending M/M Mar | -1.30% | -0.10% | 0.90% | |

| 05:30 | EUR | France GDP Q/Q Q1 P | 0.00% | 0.30% | 0.70% | 0.80% |

| 06:00 | EUR | Germany Import Price Index M/M Mar | 5.70% | 3.20% | 1.30% | |

| 06:30 | CHF | Real Retail Sales Y/Y Mar | -6.60% | 13.30% | 12.80% | 12.50% |

| 07:00 | CHF | KOF Leading Indicator Apr | 101.7 | 99.3 | 99.7 | |

| 08:00 | EUR | Germany GDP Q/Q Q1 P | 0.20% | -0.30% | ||

| 08:00 | EUR | Italy GDP Q/Q Q1 P | -0.20% | 0.60% | ||

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Mar | 6.20% | 6.30% | ||

| 09:00 | EUR | Eurozone GDP Q/Q Q1 P | 0.30% | 0.30% | ||

| 09:00 | EUR | Eurozone CPI Y/Y Apr P | 7.50% | 7.40% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Apr P | 3.10% | 2.90% | ||

| 12:30 | CAD | GDP M/M Feb | 0.80% | 0.20% | ||

| 12:30 | USD | Personal Income M/M Mar | 0.40% | 0.50% | ||

| 12:30 | USD | Personal Spending Mar | 0.60% | 0.20% | ||

| 12:30 | USD | PCE Price Index M/M Mar | 0.60% | |||

| 12:30 | USD | PCE Price Index Y/Y Mar | 6.40% | |||

| 12:30 | USD | Core PCE Price Index M/M Mar | 0.30% | 0.40% | ||

| 12:30 | USD | Core PCE Price Index Y/Y Mar | 5.30% | 5.40% | ||

| 12:30 | USD | Employment Cost Index Q1 | 1.10% | 1.00% | ||

| 13:45 | USD | Chicago PMI Apr | 61.5 | 62.9 | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Apr F | 65.7 | 65.7 |