Products You May Like

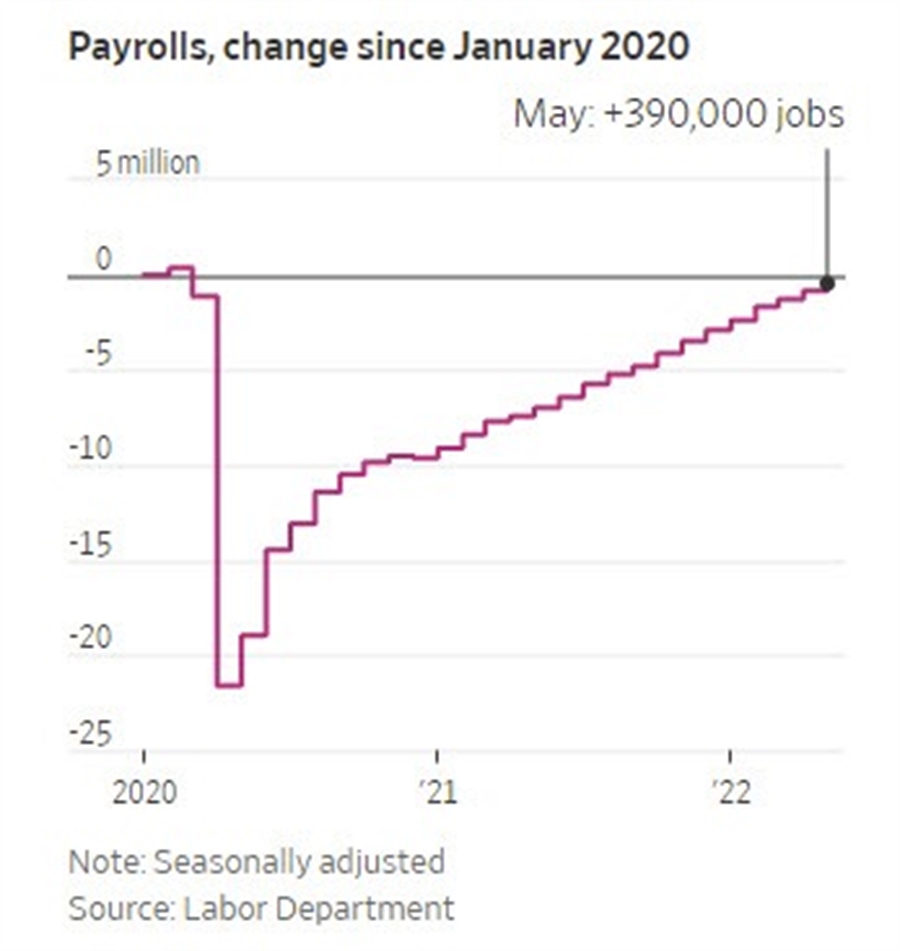

The US employment data was released today with nonfarm payroll adding another 390K jobs. That comes after a 436K jobs increase in the prior month (was 428K). The expectations for the month was for 325K. Although lower than the prior month, it still represented a solid gain at this point in the cycle. Since January 2020 just before the impact from the pandemic, the number jobs gained have nearly erased the number jobs lost.

Other component pieces showed that the unemployment rate stayed steady at 3.6% (expected 3.5%). The participation rate increased to 62.3% from 62.5% contributed to the unchanged level in the unemployment rate. Average hourly earnings increase by 0.3% vs. 0.4% estimate. The year on year came in as expected at 5.2% (down from 5.5% last month). The underemployment rate moved up to 7.1% from 7.0%.

The May job gain was the slowest pace of growth since April of last year. Within the details, jobs fell by -61,000 in retail. The biggest gainer was leisure and hospitality which added 84,000 jobs. Consumers are shifting from buying on goods to buying services.

More recently, companies such as Twitter, Netflix, and Tesla whose Elon must said today that he plans on cutting 10% of the salary jobs, have said they look to trim jobs.

It is hard to call the job data soft, but let’s say there was a slowing of the trend which is a start.

The reaction the market saw stocks moving to the downside, and yields higher.

Looking at the major indices:

- Dow industrial average fell -349.4 points or -1.05% at 32898.90. Last Friday the index closed at 33212.97

- S&P index fell -68.38 points or -1.64% at 4108.43. Last week the index closed at 4158.33

- NASDAQ index fell -304.15 points or -2.47% at 12012.74. Last week the index closed at 12131.13

- Russell 2000 fell -14.62 points or -0.77% at 1883.05. Last week the index close at 1887.85

If you reword to put a positive spin on the price action in the stock market, the major indices all closed above their 200 hour moving average despite the week’s declines.

In the US debt market, yields move higher but came off the highest levels today. For the week, however, yields were sharply higher as traders rethought the idea of a pause in September:

- 2 year 2.661%, +2.7 basis points. The 2 year the yield is up from the last Friday’s closing level 2.484% for a gain of 18 basis points.

- 5 year yield 2.942%, +3.1 basis points. The 5 year yield is up from 2.692% last Friday or 25 basis points

- 10 year yield 2.946%, +3.3 basis points. The 10 year yield is up from 2.743% last Friday or +20 basis points

- 30 year yield 3.094%, +1.5 basis points. The 30 year yield is up from 2.972% last Friday or +12.2 basis points.

In the forex, the USD is the strongest of the majors while the JPY is the weakest.

- USDJPY: The USDJPY moved to the highest level since May 9 and in the process moved above the May 11 high of 130.80. The high price today reached 130.973. The pair is closing just above the May 11 high of 130.80. On the way to the upside, the price moved above a swing area between 130.49 and 130.553. That level will be a close risk level on Monday. Stay above is more bullish. On the topside the high prices from April and May at 131.242 and 131.342 are topside targets. They also represent 20 year highs for the USDJPY. This week, Microsoft lower their expectations for earnings and revenues on the back of a higher dollar. With the USDJPY trading near 20 highs, looking at that currency is a chief problem for multinationals who have not properly hedge their exposure.

- EURUSD: The EURUSD trade above and below its 100 and 200 hour moving averages currently at 1.0718. The current prices trading right around that level and punting to next week’s price action to determine more bullish more bearish bias. Move above the moving averages would be more bullish. Move below the moving averages would be more bearish. Of significance on the topside today was at the high price stalled against the high price from May 27. Keeping below the cycle high at 1.07857 from Mondays trade, gave the sellers the shorter-term bias control. However getting and staying below the 100 and 200 hour moving averages will still be eyed in early trading next week.

- GBPUSD: The GBPUSD use the 100 hour moving average as a ceiling both late yesterday and into today. That moving average currently comes in at 1.25647. The 200 hour moving averages at 1.25761. Stay below those moving averages keeps the sellers more in control. After the nonfarm payroll report, the price moved down to test a swing level at 1.2524. The price bounced back higher to retest the 100 hour moving average one last time before moving back to the downside and through the 1.2524 level. Bearish break. That level will be a close risk level early in the trading week. The price is closing the week near session lows at 1.2488. On the downside getting below the 38.2% retracement of the move up from the May 13 low at 1.24705 and staying below that level will be key for sellers/bears.

Thank you for support this week. Have a great and safe weekend