Products You May Like

Euro is attempting to rally after ECB surprisingly pre-commit to rate hikes in July and September. Germany 10-year yield also jumps to 1.45% in reaction. Commodity currencies turn slightly weaker on overall sluggish market sentiment. Dollar is mixed for now, and will need some fresh inspiration from tomorrow’s CPI release. Meanwhile, Yen continues to digest recent losses, await next move.

Technically, EUR/AUD’s break of 1.4965 minor resistance suggests that pull back from 1.5277 is over at 1.4759, and rebound from 1.4318 is in another rising leg to 1.5345 key resistance. EUR/CAD’s breach of 1.3538 minor resistance also suggest short term bottoming at 1.3387, just ahead of 1.3383 low. Now, focus is on when EUR/USD will break through 1.0786 temporary top, and when EUR/GBP will break through 0.8617 resistance.

In Europe, at the time of writing, FTSE is down -0.82%. DAX is down -1.24%. CAC is down -1.05%. Germany 10-year yield is up 0.0842 at 1.440. Earlier in Asia, Nikkei rose 0.04%. Hong Kong HSI dropped -0.66%. China Shanghai SSE dropped -0.76%. Singapore Strait Times dropped -0.50%. Japan 10-year JGB yield rose 0.0024 to 0.250.

ECB ends net APP purchase, to hike 25bps in Jul, again and maybe larger in Sep

ECB leaves interest rates unchanged today as widely expected. That is, The main refinancing rate, marginal lending facility rate and deposit rate are held at 0.00%, 0.25% and -0.50% respectively. However, it explicitly said, “the Governing Council intends to raise the key ECB interest rates by 25 basis points at its July monetary policy meeting.”

Besides, ECB said is expects to “raise the key ECB interest rates again in September”. The size would depend on the updated medium-term inflation outlook by then. “If the medium-term inflation outlook persists or deteriorates, a larger increment will be appropriate at the September meeting,” it added. Beyond September, “a gradual but sustained path of further increases in interest rates will be appropriate.”

Also as expected, ECB decided to end net asset purchases as of July 1, 2022. It will “continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when it starts raising the key ECB interest rates and, in any case, for as long as necessary to maintain ample liquidity conditions and an appropriate monetary policy stance.”

In the new economic projections, annual inflation will hit 6.8% in 2022, then decline to 3.l5% in 2023 and then 2.1% in 2024. Excluding energy and food, inflation is projected to it 3.3% in 3022, then slow to 2.8% in 2023 and then 2.3% in 2024. Inflation projections were revised up “significantly” due to surging energy and food prices, including due to the impact of war”.

GDP growth is projected at 2.8% in 2022, 2.1% in 2023 and 2.1% in 2024 (revised down slightly for 2022 and 2023, but up for 2024).

US initial jobless claims rose to 229k, continuing claims unchanged at 1.3m

US initial jobless claims rose 27k to 229k in the week ending June 4, above expectation of 208k. Four-week moving average of initial claims rose 8k to 215k.

Continuing claims was unchanged at 1306k in the week ending May 28. Four-week moving average of continuing claims dropped -9k to 1318k, lowest since January 10, 1970 when it was 1310k.

EUR/USD Mid-Day Outlook

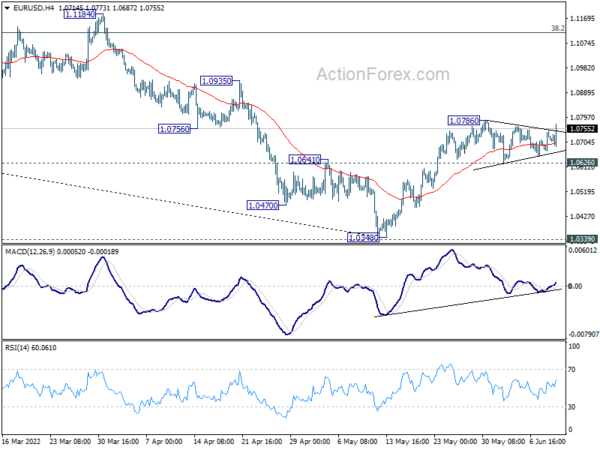

Daily Pivots: (S1) 1.0676; (P) 1.0712 (R1) 1.0752; More…

EUR/USD rises notably today but stays in range below 1.0786 temporary top so far. Intraday bias remains neutral first. On the upside, break of 1.0786 will resume the rebound from 1.0348. Sustained trading above 55 day EMA (now at 1.0745) and 1.0805 support turned resistance will carry larger bullish implication. Intraday bias will be back on the upside for 1.1112 fibonacci resistance. On the downside, break of 1.0626 minor support will indicate rejection by 55 day EMA, and turn bias back to the downside for retesting 1.0348.

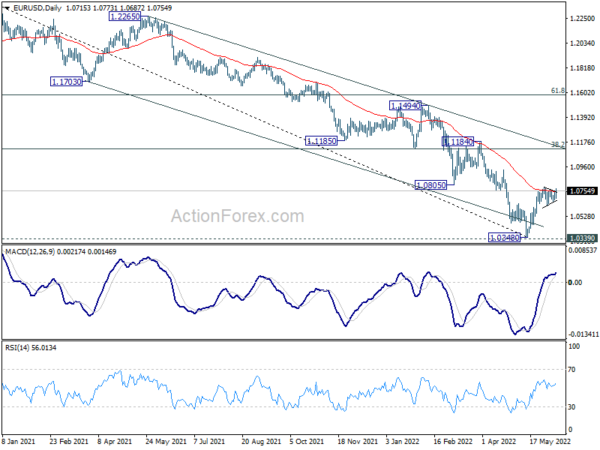

In the bigger picture, focus stays on 1.0339 long term support (2017 low). Decisive break there will resume whole down trend from 1.6039 (2008 high). Next target is 61.8% projection of 1.3993 to 1.0339 from 1.2348 at 1.0090. However, firm break of 1.0805 support turned resistance will delay this bearish case. Rise from 1.0348 is at least a correction to the down trend from 1.2348. Stronger rebound would be seen to 38.2% retracement of 1.2348 to 1.0348 at 1.1112.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance May | 73% | 76% | 80% | |

| 23:50 | JPY | Money Supply M2+CD Y/Y May | 3.20% | 3.60% | 3.60% | 3.40% |

| 02:00 | CNY | Trade Balance (USD) May | 78.8B | 59.0B | 51.1B | |

| 02:00 | CNY | Exports (USD) Y/Y Apr | 16.90% | 8% | 3.90% | |

| 02:00 | CNY | Imports (USD) Y/Y May | 4.10% | 2% | 0.00% | |

| 02:00 | CNY | Trade Balance (CNY) May | 502.9B | 400B | 325B | |

| 02:00 | CNY | Exports (CNY) Y/Y May | 15.30% | 13.10% | 1.90% | |

| 02:00 | CNY | Imports (CNY) Y/Y May | 2.80% | -9% | -2.00% | |

| 06:00 | JPY | Machine Tool Orders Y/Y May P | 23.70% | 25.00% | ||

| 11:45 | EUR | ECB Interest Rate Decision | 0.00% | 0.00% | 0.00% | |

| 11:45 | EUR | ECB Deposit Rate Decision | -0.50% | -0.50% | -0.50% | |

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | USD | Initial Jobless Claims (Jun 3) | 229K | 208K | 200K | 202K |

| 14:30 | USD | Natural Gas Storage | 94B | 90B |