Products You May Like

Yen is recovering slightly in Asian session today, digesting recent steep selloff. The climax selling is temporarily past as focuses turn to ECB policy decision today and US CPI tomorrow. Euro is trading mixed for the moment, except versus Yen and Swiss Franc. To be specific, it’s range bound against Dollar, Sterling, Aussie and Canadian. The reaction to ECB would be important to decide the next move in Euro for the near term.

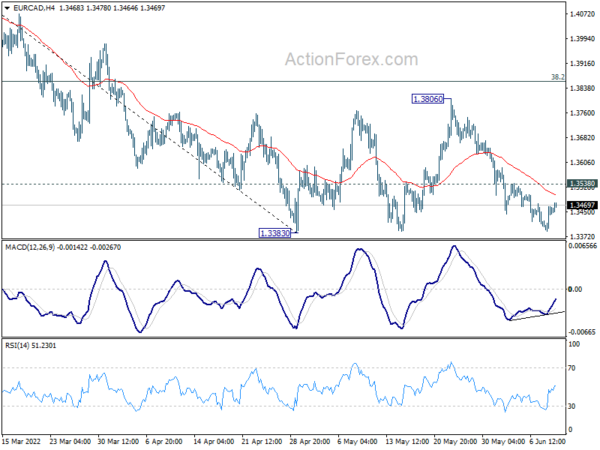

Technically, levels to watch include 1.0786 resistance in EUR/USD, 0.8617 resistance in EUR/GBP, 1.4965 minor resistance in EUR/AUD and 1.3538 minor resistance in EUR/CAD. Powerful break of these levels together will confirm that Euro bulls are fully on board, at least for the near term. Otherwise, there might still be some reservations among them.

In Asia, Nikkei closed up 0.18%. Hong Kong HSI is down -0.90%. China Shanghai SSE is down -1.07%. Singapore Strait Times is down -0.31%. Japan 10-year JGB yield is up 0.0031 at 0.251. Overnight, DOW dropped -0.81%. S&P 500 dropped -1.08%. NASDAQ dropped -0.73%. 10-year yield rose 0.057 to 3.029.

BCC: UK inflation to hit 10% in Q4, no GDP growth in Q2 & Q3 with contraction in Q4

In the new economic forecasts, British Chambers of Commerce projected that UK inflation rate will reach 10% in Q4 this year, “comfortably outpacing average earnings growth”. That would be the highest since CPI records began in 1989. CPI is only expected to finally fall back to BoE’s target of 2% by the end of 2024. BoE interest rate is expected to rise to 2% in 2022, and 3% in 2023.

GDP growth in 2022 was downgraded slightly from 3.6% to 3.5%. Quarter on quarter GDP growth is expected to ” flatline with no growth expected in Q2 and Q3 before contracting by 0.2% in Q4″. Growth is expected to slow sharply to just 0.6% for 2023, before recovering slightly to 1.2% in 2024.

Alex Veitch, Director of Policy at the British Chambers of Commerce, said: “Our latest forecast indicates that the headwinds facing the UK economy show little sign of reducing with continued inflationary pressures and sluggish growth. The war in Ukraine came just as the UK was beginning a Covid recovery; placing a further squeeze on business profitability.”

IMF: Recent Yen depreciation reflect fundamentals

IMF Japan mission chief Ranil Salgado said Yen’s recent movements “reflect fundamentals”, adding, “we see both positive and negative effects in yen depreciation.”

He noted that risks to inflation in Japan are on the upside. But, “inflation in the medium-term will remain well below the BOJ’s target once the cost-push factors go away,” he said.

“We consider it appropriate for the BOJ to maintain monetary easing until inflation is achieved in a stable and durable manner.”

EUR/USD ready for range breakout? Some ECB previews

ECB policy decision and press conference are the major focuses of the day. The central bank is widely expected to announce the end of net asset purchases after this month. That would set the stage for a rate hike “some after after” in July.

Markets are expecting a 25bps rate hike in July, followed by a 50bps move in September. That would bring interest rate comfortably back into positive territory, finally after eight years of negative rate policy. President Lagarde will affirm the latter view, but she’d keep the options open on the pace of tightening.

Suggested readings on ECB:

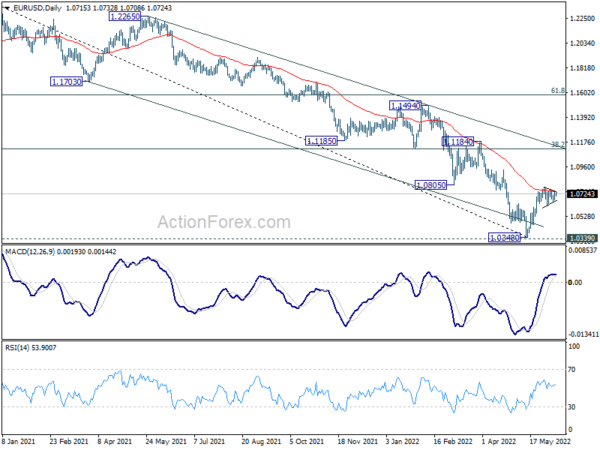

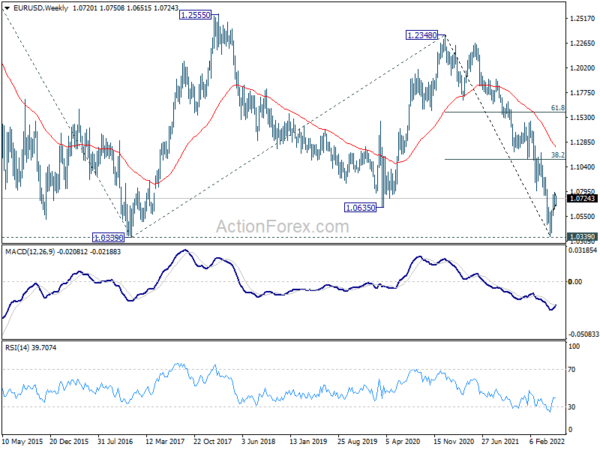

EUR/USD’s reaction to ECB is definitely worth a watch today. It should first be noted that EUR/USD had just bounced off above 1.0339 (2017 low) in May. An upside breakout from the near term range today will have 1.0805 support turned resistance and 55 day EMA taken out firmly. That should confirm medium term bottoming at 1.0348. In this case, even as a correction to the down trend from 1.2348, EUR/USD should rise further to channel resistance (now at 1.1159), which is close to 38.2% retracement of 1.2348 to 1.0348 at 1.1112.

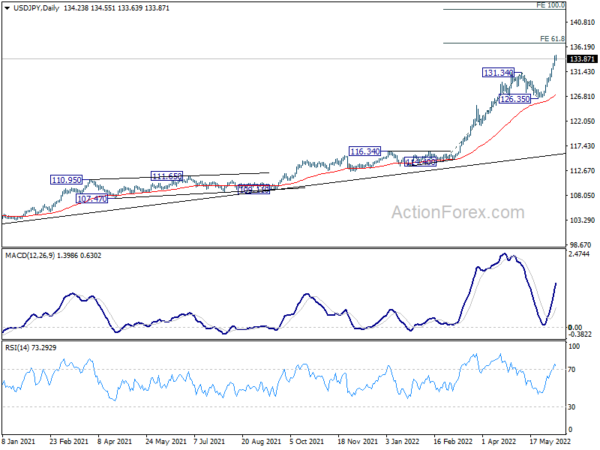

USD/JPY Daily Outlook

Daily Pivots: (S1) 133.05; (P) 133.76; (R1) 134.97; More…

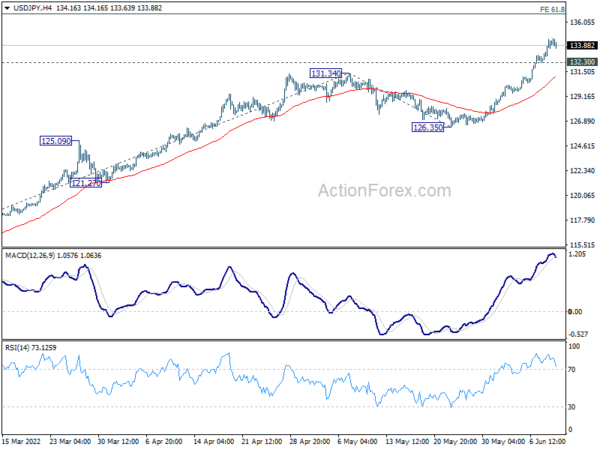

USD/JPY is retreating mildly but intraday bias stays on the upside. Current up trend should target 61.8% projection of 114.40 to 131.34 from 126.35 at 136.81. Firm break there will target 100% projection at 143.29. On the downside, below 132.30 minor support will turn intraday bias neutral to bring consolidations first, before staging another rally.

In the bigger picture, current rally is seen as part of the long term up trend form 75.56 (2011 low). Next target is 100% projection of 75.56 (2011 low) to 125.85 (2015 high) from 98.97 at 149.26, which is close to 147.68 (1998 high). This will remain the favored case as long as 126.35 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance May | 73% | 76% | 80% | |

| 23:50 | JPY | Money Supply M2+CD Y/Y May | 3.20% | 3.60% | 3.60% | 3.40% |

| 02:00 | CNY | Trade Balance (USD) May | 78.8B | 59.0B | 51.1B | |

| 02:00 | CNY | Exports (USD) Y/Y Apr | 16.90% | 8% | 3.90% | |

| 02:00 | CNY | Imports (USD) Y/Y May | 4.10% | 2% | 0.00% | |

| 02:00 | CNY | Trade Balance (CNY) May | 502.9B | 400B | 325B | |

| 02:00 | CNY | Exports (CNY) Y/Y May | 15.30% | 13.10% | 1.90% | |

| 02:00 | CNY | Imports (CNY) Y/Y May | 2.80% | -9% | -2.00% | |

| 06:00 | JPY | Machine Tool Orders Y/Y May P | 23.70% | 25.00% | ||

| 11:45 | EUR | ECB Interest Rate Decision | 0.00% | 0.00% | ||

| 11:45 | EUR | ECB Deposit Rate Decision | -0.50% | -0.50% | ||

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | USD | Initial Jobless Claims (Jun 3) | 208K | 200K | ||

| 14:30 | USD | Natural Gas Storage | 94B | 90B |