Products You May Like

Yen’s selloff accelerates today as US stocks are set to stage a rebound after the long weekend. For now, Euro is the strongest one with help from rebound against Sterling and Swiss Franc. It’s followed by Canadian Dollar, which is supported by slightly better than expected retail sales data. On the other hand, Kiwi and Aussie are the weakest one, following Yen.

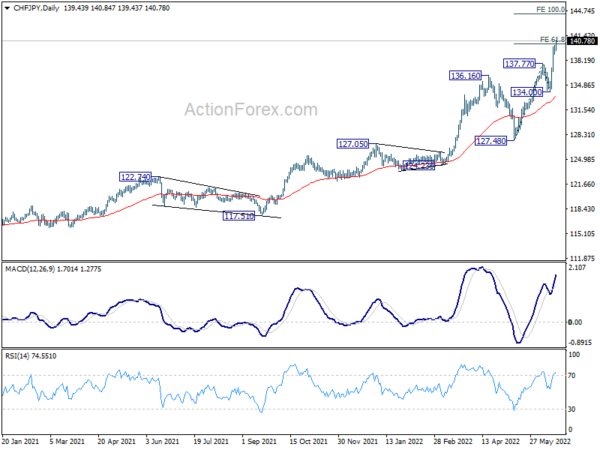

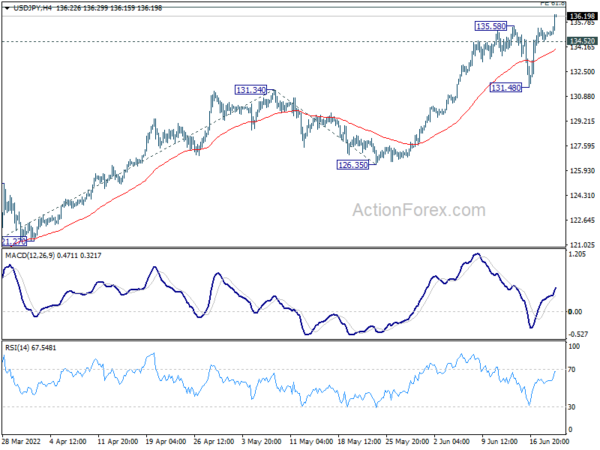

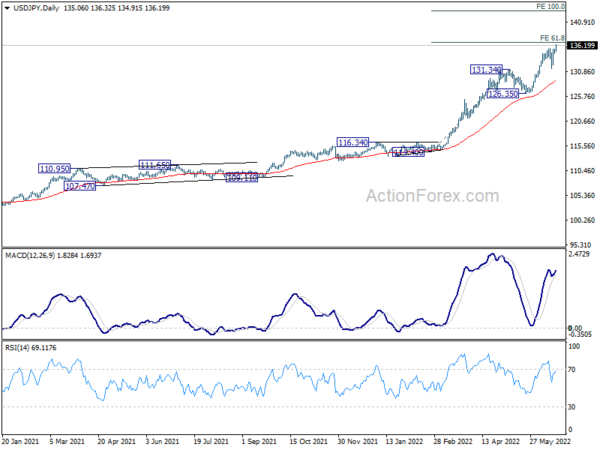

Technically, CHF/JPY’s rally continues today and breaks through 61.8% projection of 127.48 to 137.77 from 134.00 at 140.35. Next target is 100% projection of 144.29. USD/JPY’s break of 135.58 indicates up trend resumption. Now focus is on 144.23 resistance in EUR/JPY and 168.67 resistance in GBP/JPY. Break of these levels will also confirm resumption of recent up trends.

In Europe, at the time of writing, FTSE is up 0.45%. DAX is up 0.33%. CAC is up 0.86%. Germany 10-year yield is up 0.031 at 1.780. Earlier in Asia, Nikkei rose 1.84%. Hong Kong HSI rose 1.87%. China Shanghai SSE dropped -0.26%. Singapore Strait Times rose 0.68%. Japan 10-year JGB yield rose 0.0032 to 0.236.

Canada retail sales up 0.9% mom in Apr, to rise 1.6% mom in May

Canada retail sales rose 0.9% mom to CAD 60.7B in April, slightly above expectation of 0.8% mom. Sales were up in 6 of 11 subsectors. Excluding gasoline stations and motor vehicle and parts dealers, sales rose 1.0% mom.

Preliminary data suggests that sales rose 1.6% mom in May.

ECB Rehn: Sharply rising inflation justifies expedite policy normalization

ECB Governing Council member Olli Rehn said, “with inflation rising sharply, there has been good reason to expedite the normalization of monetary policy,”

“The impacts of Russia’s brutal war are being felt around the world, and people are having to pay higher prices for energy and food,” he said.

BoE Pill sees tightening of monetary policy over the coming months

BoE Chief Economist Huw Pill said today, “we will do what we need to do to get inflation back to target. And at least in my view, that will require further tightening of monetary policy over the coming months.”

“When we assess inflation pressure, we need to take into account the exchange rate,” he added. “We see ourselves as steering a narrow path between persistent inflation pressure and recession.”

“Terms of trade shock means UK will be poorer, UK must decide how that reduction in income will be distributed.”

RBA Lowe: Going to be some years before inflation back in target range

RBA Governor Philip Lowe said the larger than expected 50bps hike at last meeting was driven by “additional information suggesting a further upward revision to an already high inflation forecast”.

He also emphasized, “as we chart our way back to 2 per cent to 3 per cent inflation, Australians should be prepared for more interest rate increases.”

“In the next month or so, we’ll be doing a full forecast update, but it’s going to be some years, I think, before inflation is back in the 2-3 per cent range, he added.

“I don’t see a recession on the horizon,” Lowe said. “If the last two years has taught us anything, it’s that you can’t rule anything out. But our fundamentals are strong, the position of the household sector is strong, and firms are wanting to hire people at record rates. It doesn’t feel like a precursor to a recession,” he said.

New Zealand Westpac consumer confidence dropped to 78.7 in Q2, record low

New Zealand Westpac consumer confidence dropped sharply from 92.1 to 78.7 in Q2. That’s the lowest level on record, and well below long-term average at 110.2.

Westpac said: “The pressure on household finances and sharp fall in confidence reinforces our expectations for a downturn in household spending – and economic growth more generally – over the coming months”.

“The RBNZ’s own projections show the cash rate rising to 3.9%, while financial markets have started to price in the chance that it could go as high as 4.5%…

“If there is a more abrupt slowdown in spending than the RBNZ anticipates, then it’s likely that increases in the cash rate will be more measured.”

Japan PM Kishida and opposition Tamaki agree BoJ to keep loose monetary policy

Japan Prime Minister Fumio Kishida asked opposition DDP’s Yuichiro Tamaki on monetary policy. Tamaki said the BOJ must keep current ultra-low interest rates, arguing that tightening monetary policy was “unthinkable”. Kishida said afterwards, “I agree with you on the point that Japan shouldn’t alter monetary policy,”

Kishida also said, “monetary policy affects not just currency rates, but the economy and smaller firms’ businesses. Such factors must be taken into account comprehensively.”

Separately, Finance Minister Shunichi Suzuki said, “I’m concerned about the rapid yen weakening seen recently.” He added that the government will “closely liaise” with BoJ on watching the exchange markets with “even greater sense of urgency”.

“We will respond appropriately if necessary while keeping close communication with currency authorities from other countries,” Suzuki said.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 134.62; (P) 135.03; (R1) 135.52; More…

USD/JPY’s up trend resumes by breaking through 135.58 today. Intraday bias is back on the upside for 61.8% projection of 114.40 to 131.34 from 126.35 at 136.81. Firm break there will target 100% projection at 143.29. On the downside, below 134.52 minor support will turn intraday bias neutral first. But outlook will remain bullish as long as 131.48 support holds.

In the bigger picture, current rally is seen as part of the long term up trend from 75.56 (2011 low). Next target is 100% projection of 75.56 (2011 low) to 125.85 (2015 high) from 98.97 at 149.26, which is close to 147.68 (1998 high). This will remain the favored case as long as 126.35 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | Westpac Consumer Survey Q2 | 78.7 | 92.1 | ||

| 01:30 | AUD | RBA Meeting Minutes | ||||

| 06:00 | CHF | Trade Balance (CHF) May | 3.12B | 3.78B | 4.13B | 4.03B |

| 08:00 | EUR | Eurozone Current Account Apr | -5.8B | -3.2B | -1.6B | |

| 12:30 | CAD | New Housing Price Index M/M May | 0.50% | 0.40% | 0.30% | |

| 12:30 | CAD | Retail Sales M/M Apr | 0.90% | 0.80% | 0.00% | 0.20% |

| 12:30 | CAD | Retail Sales ex Autos M/M Apr | 1.30% | 0.50% | 2.40% | 2.60% |

| 14:00 | USD | Existing Home Sales May | 5.41M | 5.61M |