Products You May Like

Risk-off sentiment is back in Asia today, after US stocks were sold off on poor consumer confidence data. In the currency markets, trading is relatively subdued, with Euro and Dollar trading in soft tone. Canadian Dollar and Swiss Franc are the strongest ones for the week. In particular, Swiss Franc is extending up trend against Yen and Sterling. Kiwi is currently the worst performing, followed by Yen and Sterling. Euro and Dollar are mixed.

Technically, EUR/JPY appears to be rejected by 144.23 resistance. Break of 141.39 minor support will bring deeper fall back towards 137.83 support level. If that happens, selloff off in Euro could overnight Yen, which could be seen in renewed pressure in EUR/CHF, and push EUR/USD back towards 1.0339 long term support.

In Asia, at the time of writing, Nikkei is down -1.10%. Hong Kong HSI is down -1.63%. China Shanghai SSE is down -0.77%. Singapore Strait Times is up 0.37%. Japan 10-year JGB yield is down -0.0026 at 0.231. Overnight, DOW dropped -1.56%. S&P 500 dropped -2.01%. NASDAQ dropped -2.98%. 10-year yield rose 0.012 to 3.206.

BoJ Kuroda: Japan not much affected by global inflationary trend

BoJ Governor Haruhiko Kuroda said, “Unlike other economies, the Japanese economy has not been much affected by the global inflationary trend, so monetary policy will continue to be accommodative,” according to the recording released by the Bank for International Settlements (BIS).

After 15 years of deflation that lasted through 2013, businesses have be “very cautious” in raising prices and wages. “The economy recovered and companies recorded high profits. The labour market became quite tight. But wages didn’t increase much and prices didn’t increase much,” he added.

Also released, Japan retail sales rose 3.6% yoy in May, below expectation of 4.0% yoy. On seasonally adjusted basis, sales rose 0.6% mom.

Australia retail sales rose 0.9% mom in May, higher prices added to growth

Australia retail sales rose 0.9% mom in May, above expectation of 0.4% mom. That’s the fifth consecutive monthly growth.

Ben Dorber, Director of Quarterly Economy Wide Statistics said, “There was growth across five of the six retail industries in May as spending remained resilient. Higher prices added to the growth in retail turnover in May. This was most evident in cafes, restaurants and takeaway food services and food retailing.”

Looking ahead

Swiss Credit Suisse economic expectations, Eurozone M3 and economic sentiment, Germany CPI flash will be released in European session. Later in the day, US will release Q1 GDP final.

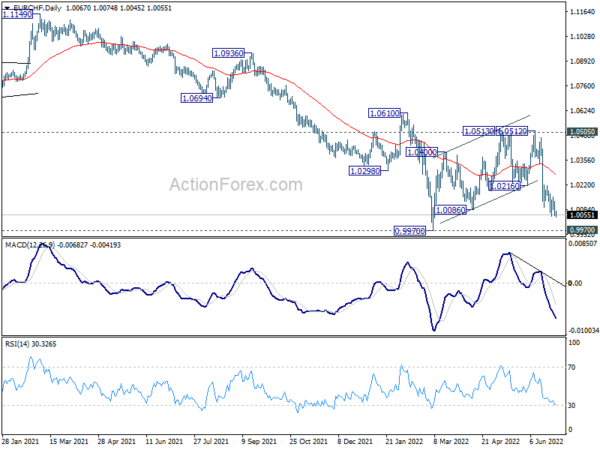

EUR/CHF Daily Outlook

Daily Pivots: (S1) 1.0042; (P) 1.0086; (R1) 1.0117; More….

EUR/CHF’s fall from 1.0512 is still in progress and further decline should be seen to retest 0.9970 low. Decisive break there will resume larger down trend. On the upside, however, above 1.0214 minor resistance will delay the bearish case, and turn bias back to the upside for stronger rebound.

In the bigger picture, as long as 1.0505 support turned resistance (2020 low) holds, long term down trend from 1.2004 (2018 high) is expected to continue. Next target is 100% projection of 1.2004 to 1.0505 to 1.1149 at 0.9650. However, firm break of 1.0505 will suggest medium term bottoming, and bring stronger rebound towards 1.1149 structural resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y May | 3.60% | 4.00% | 3.10% | |

| 01:30 | AUD | Retail Sales M/M May | 0.90% | 0.40% | 0.90% | |

| 08:00 | CHF | Credit Suisse Economic Expectations Jun | -52.6 | |||

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y May | 6.10% | 6.00% | ||

| 09:00 | EUR | Eurozone Economic Sentiment Indicator Jun | 103 | 105 | ||

| 09:00 | EUR | Eurozone Services Sentiment Jun | 12.7 | 14 | ||

| 09:00 | EUR | Eurozone Industrial Confidence Jun | 4.7 | 6.3 | ||

| 09:00 | EUR | Eurozone Consumer Confidence Jun F | -23.6 | -23.6 | ||

| 12:00 | EUR | Germany CPI M/M Jun P | 0.30% | 0.90% | ||

| 12:00 | EUR | Germany CPI Y/Y Jun P | 7.90% | 7.90% | ||

| 12:30 | USD | GDP Annualized Q1 F | -1.50% | -1.50% | ||

| 12:30 | USD | GDP Price Index Q1 F | 8.10% | 8.10% | ||

| 14:30 | USD | Crude Oil Inventories |