Products You May Like

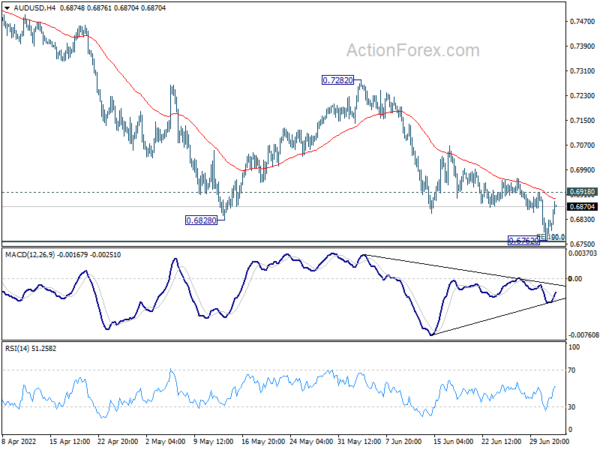

Australian Dollar recovers broadly today, following recovery in European markets. Meanwhile, traders are also preparing for tomorrow’s RBA rate hike. New Zealand Dollar is also mildly firmer. On other hand, Yen is turning softer with Swiss Franc and Dollar. Euro and Sterling are mixed for now. Overall, trading is subdued with US on holiday.

Technically, for Aussie, eyes will be on 0.6918 minor resistance in AUD/USD and 1.5059 minor support in EUR/AUD. Break of these levels will but a sign of short term bottoming in Aussie. In that case, stronger rebound would likely be seen broadly. Reactions to tomorrow’s RBA will be the key to the move.

In Europe, at the time of writing, FTSE is up 1.22%. DAX is up 0.24%. CAC is up 0.85%. Germany 10-year yield is up 0.1081 at 1.341. Earlier in Asia, Nikkei rose 0.84%. Hong Kong HSI dropped -0.13%. China Shanghai SSE rose 0.53%. Singapore Strait Times rose 0.80%. Japan 10-year JGB yield rose 0.0056 to 0.226.

Eurozone Sentix investor confidence dropped to -26.4, dynamics reminiscent of crisis year 2008

Eurozone Sentix Investor Confidence dropped from -15.8 to -26.4 in July, worse than expectation of -20.0. That’s the lowest level since May 2020. Current situation index dropped from -7.3 to -16.5, worst since March 2021. Expectations index dropped from -24.0 to -35.8, lowest since December 2008.

Sentix said: “In every respect, the dynamics are reminiscent of the crisis year 2008, and what was then the collapse of the financial system is now the danger of the collapse of the European energy supply. While the financial system essentially consists of money, which can be printed by its own central bank in any amount as needed, a lack of gas is not so easy to replace.

“Moreover, practically all sectors of the economy would be negatively affected by a gas or electricity blackout. So it is time for governments to realise the gravity of the situation and take effective countermeasures. One way or another, they cannot rely on the ECB this time. Rather, the states should rely on war diplomacy”.

Eurozone PPI up 0.7% mom, 36.3% yoy in May

Eurozone PPI rose 0.7% mom, 36.3% yoy in May, versus expectation of 1.0% mom, 36.7% yoy. For the month, industrial producer prices increased by 1.7% for intermediate goods, by 1.3% for non-durable consumer goods, by 0.9% for durable consumer goods and by 0.6% for capital goods, while they decreased by -0.2% in the energy sector. Prices in total industry excluding energy increased by 1.3%.

EU PPI rose 0.8% mom, 36.4% yoy. Among Member States for which data are available, the highest monthly increases in industrial producer prices were recorded in Finland (+5.5%), Estonia (+5.4%) and Lithuania (+4.9%). Decreases were observed in Ireland (-19.4%), Slovakia (-4.4%), the Netherlands (-0.8%), Bulgaria and France (-0.1% both).

Swiss CPI accelerated to 3.5% yoy in Jun, highest since 2008

Swiss CPI rose 0.5% mom in June, above expectation of 0.3% mom. The monthly rise was due to several factors including rising prices for fuel, heating oil, and fruiting vegetables. Over the 12-month period, CPI accelerated from 2.9% yoy to 3.4% yoy, above expectation of 3.2% yoy. That’s also the highest level since July 2008.

Looking at some more details, core inflation rose 0.2% mom, 1.9% yoy. Domestic products inflation rose 0.3% mom, 1.7% yoy. Imported production inflation rose 1.2% mom, 8.5% yoy.

Australia expects resource and energy export earnings to make successive records this year and next

Australia’s Department of Industry, Science and Resources said in a new quarterly report that resources and energy exports earnings are expected deliver two successive record years in 2021-2022 and 2022-2023, before falling slightly in 2023-24 to a third highest ever figure.

Resources and energy export earnings are estimated to be at AUD 405B in 2021-22, AUD 419B in 2022-23, and then notably lower at AUD 338B in 2023-24. The growth was mainly driven by higher prices as volume would remain below 2019-20 high throughout the forecast period.

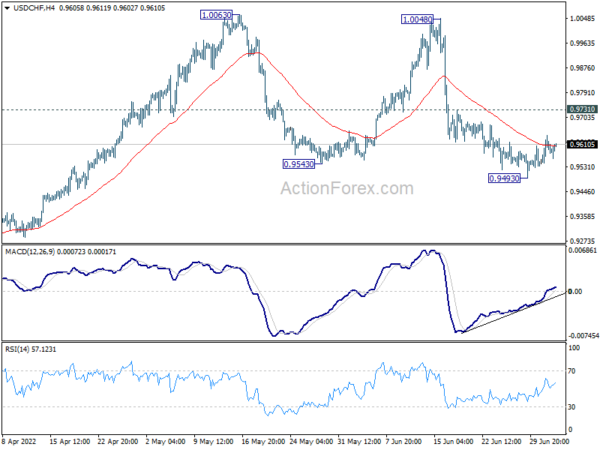

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9543; (P) 0.9593; (R1) 0.9644; More…

Intraday bias in USD/CHF stays neutral and outlook is unchanged. Price actions from 1.0063 are still seen as a consolidation pattern. On the upside, break of 0.9731 resistance will argue that such consolidation has completed and bring stronger rally back to retest 1.0063 high. However, another fall below 0.9493 will dampen this view and target 0.9459 resistance turned support.

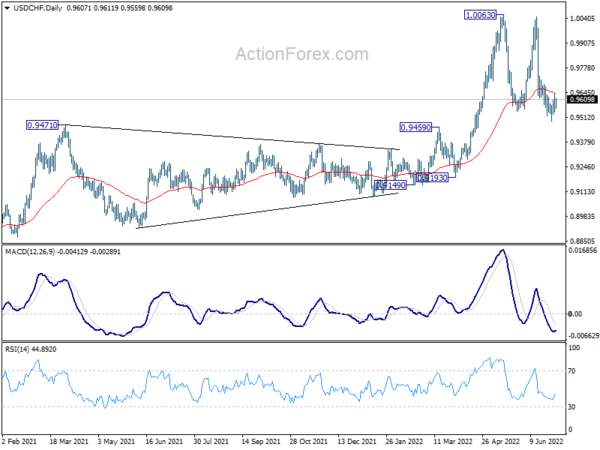

In the bigger picture, down trend from 1.0342 (2016 high) should have completed with three waves down to 0.8756 (2021 low) already. Rise from 0.8756 is likely a medium term up trend of its own. Next target is 1.0237/0342 resistance zone. This will remain the favored case as long as 0.9471 resistance turned support holds. However, sustained break of 0.9471 will extend long term range trading with another falling leg.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Jun | 3.90% | 4.90% | 4.60% | |

| 01:00 | AUD | TD Securities Inflation M/M Jun | 0.30% | 1.10% | ||

| 01:30 | AUD | Building Permits M/M May | 9.90% | -1.80% | -2.40% | -3.90% |

| 06:00 | EUR | Germany Trade Balance (EUR) May | -1.0B | 4.2B | 3.5B | |

| 06:30 | CHF | CPI M/M Jun | 0.50% | 0.30% | 0.70% | |

| 06:30 | CHF | CPI Y/Y Jun | 3.40% | 3.20% | 2.90% | |

| 08:30 | EUR | Eurozone Sentix Investor Confidence Jul | -26.4 | -20 | -15.8 | |

| 09:00 | EUR | PPI M/M May | 0.70% | 1.00% | 1.20% | |

| 09:00 | EUR | PPI Y/Y May | 36.30% | 36.70% | 37.20% | |

| 13:30 | CAD | Manufacturing PMI Jun | 56.8 | |||

| 14:30 | CAD | BoC Business Outlook Survey |