Products You May Like

IBM shares slid as much as 4% in extended trading on Monday after the company trimmed its 2022 cash forecast. It still beat on the top and bottom lines.

Here’s how the company did:

- Earnings: $2.31 per share, adjusted, vs. $2.27 per share as expected by analysts, according to Refinitiv.

- Revenue: $15.54 billion, vs. $15.18 billion as expected by analysts, according to Refinitiv.

IBM’s revenue rose 9% year over year in the quarter, according to a statement. Income from continuing operations increased to $1.47 billion from $810 million in the year-ago quarter. IBM spun off its managed infrastructure services business into publicly traded Kyndryl in November, and sales to Kyndryl boosted IBM’s revenue.

“We’re planning for about five to six points of revenue growth from the sales to Kyndryl in 2022,” Jim Kavanaugh, IBM’s finance chief, said on a conference call with analysts.

Management called for $10 billion in free cash flow for all of 2022, down from the range of $10 billion to $10.5 billion that it provided in April. Kavanaugh blamed the strong dollar and the suspension of business in Russia.

“That was a very highly-profitable business for us and that’s going to cost a couple hundred million dollars worth of free cash flow and profit by the way in 2022,” he said.

Executives reiterated their plan for constant-currency revenue growth at the high end of their mid-single-digit model for the year. Currency negatively impacted reported revenue by over 6% of growth, or $900 million, which was $200 more than spot rates had indicated three months ago, Kavanaugh said.

IBM reported $6.17 billion in software revenue in the second quarter, up 6% but below the $6.3 billion consensus among analysts polled by StreetAccount.

The company’s consulting division generated $4.81 billion in revenue, jumping nearly 10% and surpassing the StreetAccount consensus of $4.67 billion.

IBM’s infrastructure unit, which includes mainframe computers, contributed $4.24 billion in revenue, up almost 19% and well above the $3.79 billion StreetAccount consensus. On May 31, IBM started selling its latest mainframe, the z16. Each mainframe cycle generally brings revenue growth at the beginning as customers upgrade, followed by a decline. Sales of z Systems products rose 69%, compared with a decline of 19% in the first quarter.

Also in the quarter, IBM announced a plan to acquire cybersecurity startup Randori, and Francisco Partners closed its acquisition IBM’s Watson health care data and analytics assets in a deal reportedly worth more than $1 billion.

IBM’s gross margin narrowed to 53.4% from 55.2% in the year-ago quarter. The company said the competitive labor market impacted results in its consulting arm, continuing a trend it saw earlier in the year. The company has been working to deal with this by charging higher rates in contracts, and it’s expecting a full-year pre-tax margin of 9% to 10%, which would be up over 1 percentage point year over year.

“Consulting, which makes up well over half of IBM’s workforce, is most impacted by the inflationary labor market and increasing labor cost as we bring new talent on board and increase capacity,” Kavanaugh said. “We are starting to capture the reality of these higher costs in our pricing, but given the time from contract signing to revenue realization, it’s taking some time to see it in our margins.”

Prior to the after-hours move, IBM shares were up 3% so far this year, while the S&P 500 index tumbled about 20%.

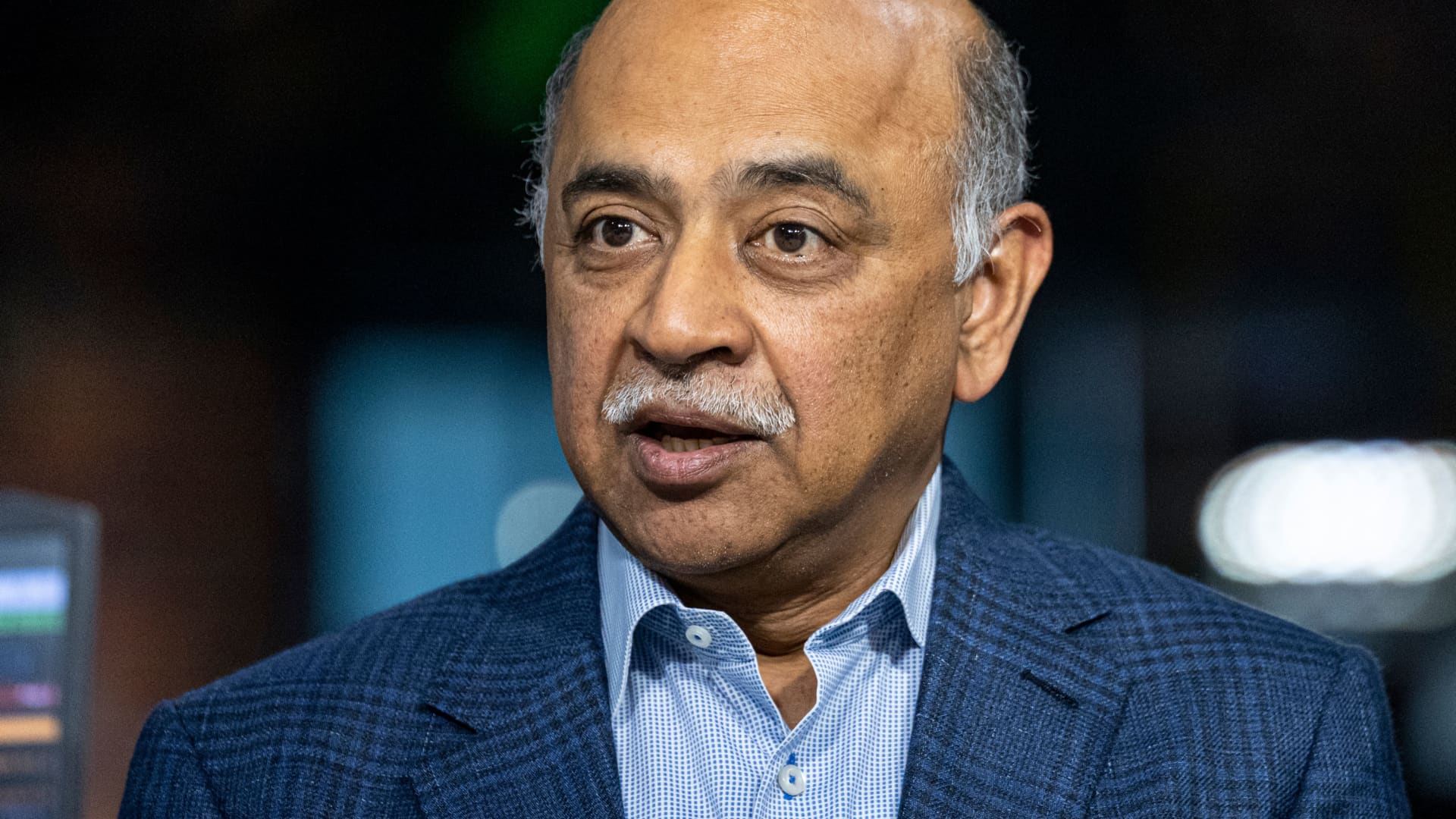

WATCH: We’re not seeing a slowdown in the B2B space, says IBM CEO