Products You May Like

Canadian Dollar softens mildly in early US session after consumer inflation data. While CPI hit another near four-decade high, the reading was far below market expectations. On the other hand, New Zealand and Australian Dollar remains generally firm. Dollar is recovering slightly but stays as the worst performer for the week so far, as it’s near term correction. Overall all trading is relatively subdued and could wait until tomorrow’s ECB rate decision to revive some volatility.

Technically, Euro is losing some upside momentum ahead of Dollar, Yen and Sterling. It’s also looking vulnerable against Aussie. Break of 1.4759 support in EUR/AUD could prompt deeper selloff towards 1.4318 low. In this case, EUR/USD and EUR/GBP could also be dragged back to 0.9951 and 0.8401 support respectively.

In Europe, at the time of writing, FTSE is down -0.36%. DAX is down -0.81%. CAC is down -0.53%. Germany 10-year yield is down -0.052 at 1.226. Earlier in Asia, Nikkei rose 2.67%. Hong Kong HSI rose 1.11%. China Shanghai SSE rose 0.77%. Singapore Strait Times rose 1.68%. Japan 10-year JGB yield rose 0.0020 to 0.244.

Canada CPI accelerated to 8.1% yoy, 7 of 9 major components up 3% or more

Canada CPI accelerated from 7.7% yoy to 8.1% yoy in June, missing expectation of 8.8% yoy. Excluding gasoline, CPI accelerated from 6.3% yoy to 6.5% yoy. That’s still the highest level since January 1983. Statistics Canada said the acceleration was mainly due to higher prices for gasoline, however, price increases remained broad-based with seven of eight major components rising by 3% or more.

CPI common rose from 4.5% yoy to 4.6% yoy, above expectation of 4.2% yoy. CPI median was unchanged at 4.9% yoy, below expectation of 5.1% yoy. CPI trimmed was unchanged at 5.5% yoy, below expectation of 5.6% yoy.

UK CPI rose to 9.4% yoy in Jun, goods up 12.7% yoy, services up 5.2% yoy

UK CPI accelerated from 9.1% yoy to 9.4% yoy in June, above expectation of 9.3% yoy. That’s also the highest level since the series began in January 1991. Indicative model estimates that it’s the highest since 1982, when it was 11%.

The CPI all goods index rose by 12.7% yoy, accelerated from 12.4%. CPI all services rose 5.2% yoy, accelerated from 4.9%. CPI core (excluding energy, food, alcohol, and tobacco) slowed from 5.9% yoy to 5.8% yoy, below expectation of 6.0% yoy.

Also published from the UK, PPI input was at 1.8% mom, 24.0% yoy, versus expectation of 0.9% mom, 23.5% yoy. CPI output was at 1.4% mom, 16.5% yoy, versus expectation of 2.0% mom, 16.8% yoy. CPI output core was at 0.8% mom, 15.2% yoy, versus expectation of 2.0% mom, 15.5% yoy.

RBA Lowe: Further increase in rates required over the month ahead

RBA Governor Philip Lowe said in a speech that the robust post-COVID recovery is “now behind us” given that inflation is high and labor market is very tight. RBA thus have withdrawn some emergency insurance and raised cash rate by 125bps over the past three meetings to 1.35%.

RBA “expects that further increase will be required over the months ahead”, to “help establish a more sustainable balance between demand and supply in the Australian economy.

Australia Westpac leading index dropped to 0.40%, economic slowdown ahead

Australia Westpac leading index dropped from 0.56% to 0.40% in June, indicating economic slowdown later in the year, but momentum is still above trend in the near term.

Westpac currently expects growth to slow from 4% in 2022 to 2% in 2023, but that is highly dependent on the profile of RBA’s tightening cycle.

Westpac expects RBA to opt for a fourth successive rate hike on August 2, and a third success time by 50bps. The current cycle is the first time cash rate has been lifted by 50bps or higher since 1990.

USD/CAD Mid-Day Outlook

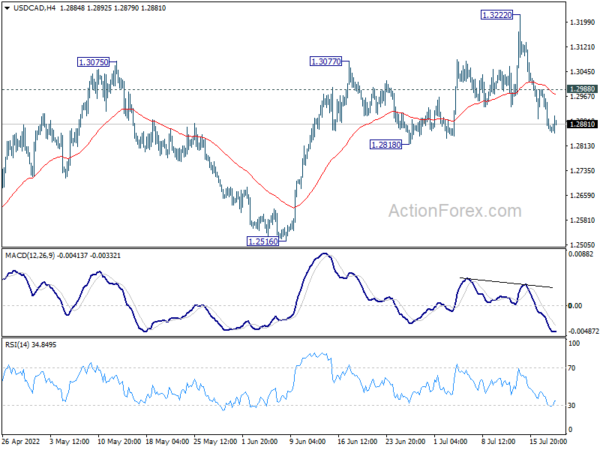

Daily Pivots: (S1) 1.2829; (P) 1.2910; (R1) 1.2951; More…

USD/CAD recovers mildly but stays well below 1.2988 minor resistance. Intraday bias stays on the downside for 1.2818 support. Firm break there will bring deeper fall back to 1.2516 key support. On the upside, above 1.2988 minor resistance will turn bias back to the upside for retesting 1.3222 instead.

In the bigger picture, down trend from 1.4667 (2020 high) should have completed at 1.2005, after defending 1.2061 long term cluster support. Rise from there should target 61.8% retracement of 1.4667 to 1.2005 (2021 low) at 1.3650. This will remain the favored case now as long as 1.2516 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Westpac Leading Index M/M Jun | -0.20% | -0.06% | ||

| 06:00 | EUR | Germany PPI M/M Jun | 0.60% | 1.00% | 1.60% | |

| 06:00 | EUR | Germany PPI Y/Y Jun | 32.70% | 35.50% | 33.60% | |

| 06:00 | GBP | CPI M/M Jun | 0.80% | 0.70% | 0.70% | |

| 06:00 | GBP | CPI Y/Y Jun | 9.40% | 9.30% | 9.10% | |

| 06:00 | GBP | Core CPI Y/Y Jun | 5.80% | 6.00% | 5.90% | |

| 06:00 | GBP | RPI M/M Jun | 0.90% | 1.50% | 0.70% | |

| 06:00 | GBP | RPI Y/Y Jun | 11.80% | 12.80% | 11.70% | |

| 06:00 | GBP | PPI Input M/M Jun | 1.80% | 0.90% | 2.10% | 2.40% |

| 06:00 | GBP | PPI Input Y/Y Jun | 24.00% | 23.50% | 22.10% | 22.40% |

| 06:00 | GBP | PPI Output M/M Jun | 1.40% | 2.00% | 1.60% | |

| 06:00 | GBP | PPI Output Y/Y Jun | 16.50% | 16.80% | 15.70% | 15.80% |

| 06:00 | GBP | PPI Core Output M/M Jun | 0.80% | 2.00% | 1.50% | |

| 06:00 | GBP | PPI Core Output Y/Y Jun | 15.20% | 15.50% | 14.80% | 15.00% |

| 08:00 | EUR | Eurozone Current Account (EUR) May | -4.5B | 4.5B | -5.8B | -3.9B |

| 12:30 | CAD | Industrial Product Price M/M Jun | -1.10% | 2.60% | 1.70% | 1.80% |

| 12:30 | CAD | Raw Material Price Index Jun | -0.10% | 0.00% | 2.50% | 2.70% |

| 12:30 | CAD | CPI M/M Jun | 0.70% | 1.10% | 1.40% | |

| 12:30 | CAD | CPI Y/Y Jun | 8.10% | 8.80% | 7.70% | |

| 12:30 | CAD | CPI Common Y/Y Jun | 4.60% | 4.20% | 3.90% | 4.50% |

| 12:30 | CAD | CPI Median Y/Y Jun | 4.90% | 5.10% | 4.90% | 4.90% |

| 12:30 | CAD | CPI Trimmed Y/Y Jun | 5.50% | 5.60% | 5.40% | 5.50% |

| 14:00 | USD | Existing Home Sales Jun | 5.40M | 5.41M | ||

| 14:00 | EUR | Eurozone Consumer Confidence Jul P | -25 | -23.6 | ||

| 14:30 | USD | Crude Oil Inventories | 2.1M | 3.3M |