Products You May Like

The economic data today was all about global PMIs from S&P Global and there was a similar theme in all of them:

Each one aside from the UK disappointed.

But it wasn’t until the US release that risk trades began to suffer. Why?

The market actually wants to see some economic softness because it will mean lower inflation and, by extension, interest rates. However there’s a limit. Most of those releases look like a soft landing but the US print looks like a recession. I think the market would have been forgiving if that was a reading on manufacturing because it’s suffering from a pandemic boom-and-bust but services are supposed to be holding up.

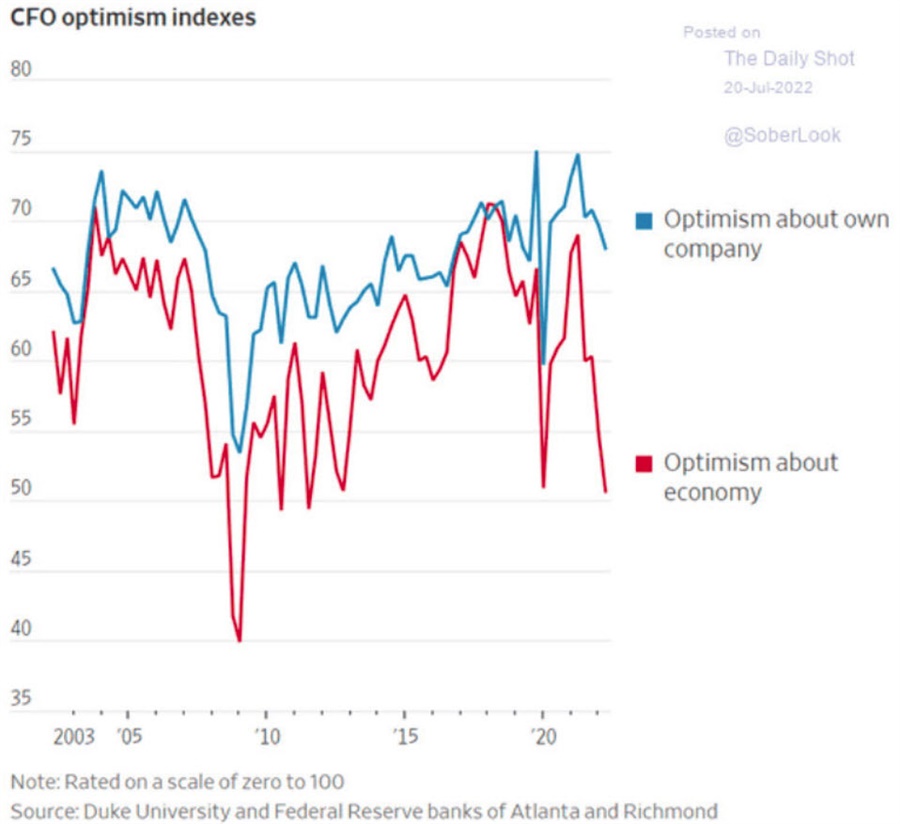

My hope is that this chart is the real tell:

There’s pessimism and uncertainty in the air but corporate and household balance sheets are strong.

But at the moment, the market is looking at a higher probability of a hard landing. Europe is in energy crisis, China is stuck fighting a hopeless covid battle and the idea that the US was much stronger is being put to the test.

So who is the loser in all of that?

Counter-intuitively it’s the Australian dollar. It’s a country that’s highly-levered to the global economy, particularly demand for raw materials. If we do get a hard landing in the US, it bodes poorly for the rest of the world and we can see that in the reversal in AUD today.

One thing that has caught my eye is that copper prices are up 0.6% today. Generally copper is a great barometer of global economic growth. It’s fallen badly since early June and was at the leading edge of pricing in a slowdown but it has stabilized lately and that’s worth watching.