Products You May Like

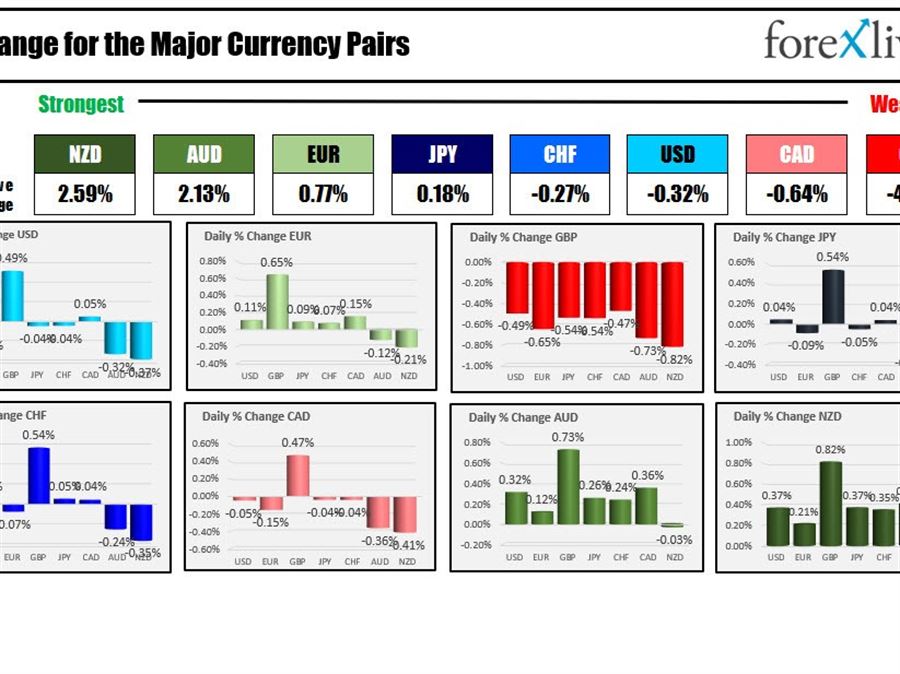

The strongest to weakest of the major currencies

The NZD is the strongest and the GBP is the weakest as the North American session begins. The USD is mixed with modest gains and losses verse the EUR, JPY, CHF and CAD, and a bigger gain vs the GBP and bigger declines vs the AUD and the NZD. The GBP is weaker despite the 50 basis point hike by the BOE. The helped by dire expectations for growth and inflation too. The central bank forecaset inflation to peak at 13% and sees 5 quarter of negative economic output starting in Q4. That is not a good forecast.

In other unsettling news, China showed its anger over Pelosi’s visit to Taiwan with the start of 4-days of live fire drills in the waters around Taiwan. The firing will disrupt shipping channels from the nation which could exasperate supply chain issues. Gold is higher in reaction to the risks.

US stocks are little changed by giving up earlier pre-market gains. US yields are lower. Crude oil is marginally higher.

A snapshot of the markets currently shows:

- spot gold is up $22.56 1.28% at 1787.70

- spot silver is up $0.31 or 1.6% at $20.36

- WTI crude oil is trading up $0.48 and $91.14

- Bitcoin is down -570 or 2.4% at $22,840

In the premarket for US stocks, the major indices are little changed. The major indices rose sharply yesterday erasing losses from the 1st 2 days of the calendar month

- Dow industrial average is unchanged after yesterdays 416.33 point rise

- S&P index is unchanged after rising 63.90 points yesterday

- NASDAQ index is up 9.5 points after yesterdays 319.4 point rise

In the European equity markets, the major indices are higher (helped little by the strong close in the US yesterday)

- German DAX, up 0.97%

- France’s CAC up 0.73%

- UK’s FTSE 100 up 0.54%

- Spain’s Ibex up 0.38%

- Italy’s FTSE MIB up 0.68%

In the US debt market, yields are marginally lower after an up and down session yesterday saw yields 1st move to the upside and then give up gains into the close:

- 2 year 3.053%, -1.6 basis points

- 5 year 2.799% -2.9 basis points

- 10 year 2.685% -2.1 basis point

- 30 year 2.945%, -0.3 basis points

In the European debt market, the yields are also lower. The US to German 10 year spread has raptor up to about 190 basis points.