Products You May Like

The strong set of job market data seemed to have cleared much concern over recession in the US, and set the tone for the financial markets. Benchmark treasury yields jumped as traders added bets on Fed continuing with the current pace of tightening beyond neutral. Stocks markets were resiliently firm despite that and look set to extend near term rebound.

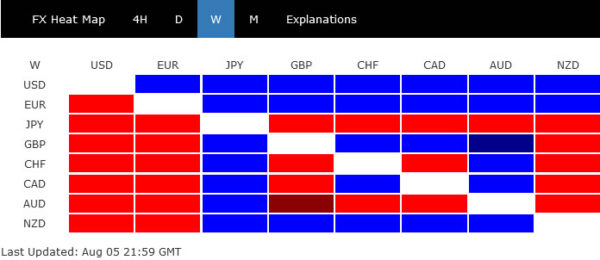

In the currency markets, Dollar ended as the strongest, even though rising yield was countered by risk-on sentiment. But it couldn’t break out of range against the steady Euro. Yen was the worst performing, pressured by the development in both stocks and bonds markets. Sterling and Aussie were mixed after respect central banks’ rate hikes. The Pound didn’t end up too badly considering the grim outlook of UK economy as painted by BoE.

Overall, risk-on sentiment could continue in the coming week. Dollar should remain firm but need fresh inspiration from consumer inflation data. Yen’s extended selloff could be the most apparent theme.

Market repricing 75bps hike by Fed in Sep after NFP

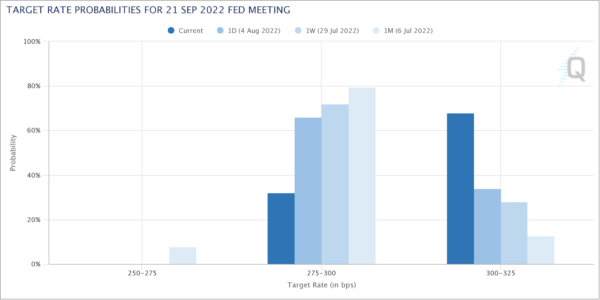

There have been talks of Fed slowing the tightening pace starting from the September meeting. But such speculations receded after an all-round strong non-farm payroll on Friday. The 528k job growth was much higher than the average gain of 388k over the prior four months, with total employment level reaching its pre-pandemic level. Unemployment rate dropped further to 3.5% while average hourly earnings printed a strong 0.5% mom growth. That put an end to whether a recession has started in the US.

Traders were quick in repricing the chance of another 75bps rate hike by Fed in September. There’s now 68% chance of seeing federal funds rate at 3.00-3.25% out of the meeting, comparing to just 28% chance a week ago.

US 10-year yield already in second leg of medium term consolidation?

US 10-year yield rebounded notably after NFP to close at 2.840. Immediate focus is on 55 day EMA (now at 2.868) in the coming days. Sustained break there would argue that fall from 3.483 has already completed at 2.525, ahead of 50% retracement of 1.343 to 3.483 at 2.413.

In this case, TNX should be already in the second leg of the medium term consolidation pattern from 3.483, and further rebound should be seen to to 3.000 handle and above. Rejection by 55 day EMA, however, will bring another down leg towards 2.413 before bottoming.

DOW facing key resistance in the next few days

Major US stock indexes edged higher last week, and were not bothered by expectation of another big Fed hike in September. The coming days will be crucial in determining the near term outlook for stocks. DOW’s rebound from 29653.39 is set to extend to take on 33272.34 resistance, which is close to 55 week EMA (now at 33164.20).

Sustained trading above these levels will argue that whole correction from 36952.65 has completed at 29653.29, after hitting 38.2% retracement of 18213.65 to 36952.65 at 29794.35. In this case, further rally should be seen to 35492.22/36952.65 resistance zone next.

However, rejection by 33272.45, followed by break of 31705.36 support, should set up another test on 26953.29 low at least.

Dollar index supported by 55 day EMA, staying well inside rising channel

Dollar index recovered last week as it responded to the rise in benchmark yield on the one hand. But momentum was capped by risk-on sentiment on the other hand. Nonetheless, the support from 55 day EMA (now at 105.19) was a bullish sign. DXY is also kept well within the medium term rising channel.

107.42 minor resistance will be the main focus in the coming week. Make or break could depend on the CPI release. Firm break of 107.42 should confirm that pull back from 109.29 has completed, and retest of this high should be seen then. Though, even in this case, up trend resumption through 109.29 would probably more depend on the next set of job and inflation data.

But anyway, near term risk for DXY will now be on the upside as long as 55 day EMA holds.

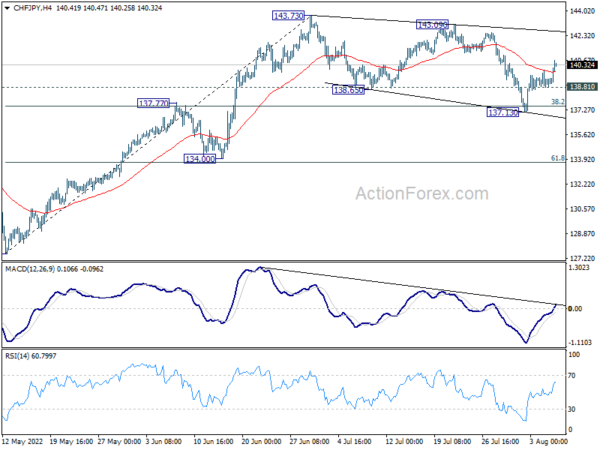

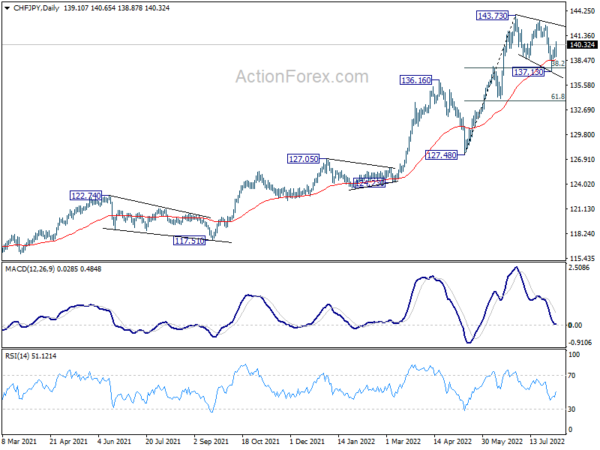

CHF/JPY finished corrective pattern at 137.13

The next development in Yen is also worth a note. The rebound in Yen might have ended as major global benchmark yields stabilized and recovered. On the other hand, Japan 10-year JGB yield has indeed closed lower at 0.163, farther away from BoJ’s 0.25% cap.

Even CHF/JPY managed to extend the rebound from 137.13 last week, with a close above 4 hour 55 EMA, as well as 55 day EMA. The development argues that corrective pattern from 143.73 might have completed with three waves down to 137.13 already, above 136.16 resistance turned support, and after breaching 38.2% retracement of 127.48 to 143.73 at 137.52.

Further rally is expected as long as 138.81 support holds. Break of 143.09 resistance will suggest that larger up trend is ready to resume. If that happens, there should be upside breakouts in some other Yen crosses in tandem.

USD/JPY Weekly Outlook

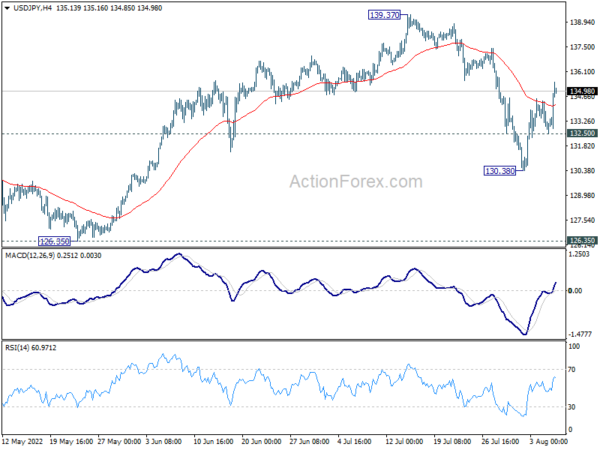

USD/JPY’s correction from 139.37 extended to as low as 130.38 last week but rebounded strongly since then. Initial bias is mildly on the upside this week for retesting 139.37 high. Upside should be limited there to bring another fall, as the third leg of the consolidation pattern from 139.37. On the downside, below 132.50 minor support will resume the fall from 139.37 towards 126.35 structural support.

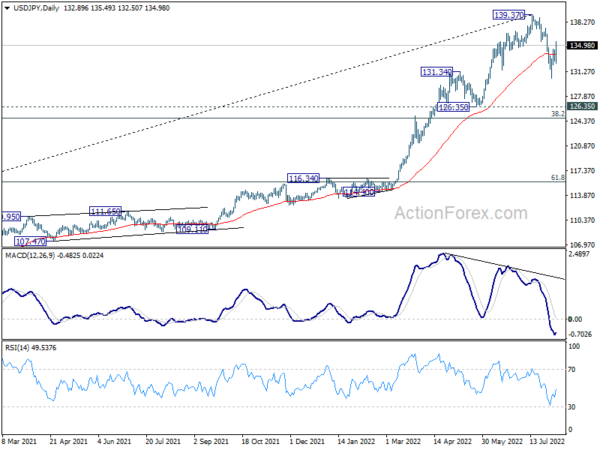

In the bigger picture, fall from 139.37 medium term top is seen as correcting whole up trend from 101.18 (2020 low). While deeper decline cannot be ruled out, outlook will stays bullish as long as 55 week EMA (now at 121.84) holds. Long term up trend is expected to resume through 139.37 at a later stage, after the correction finishes.

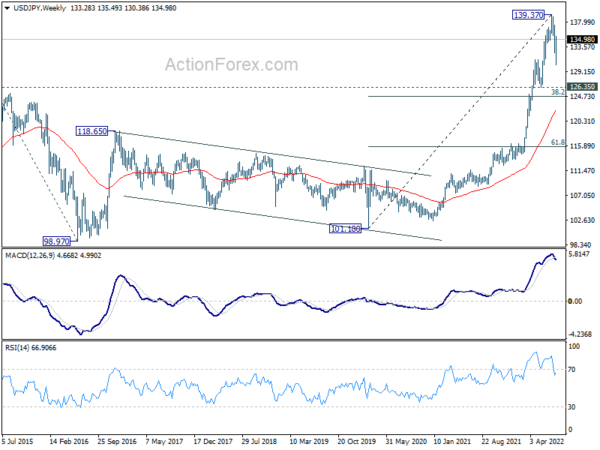

In the long term picture, rise from 101.18 is seen as part of the up trend from 75.56 (2011 low). Further rally is expected to 100% projection of 75.56 (2011 low) to 125.85 (2015 high) from 98.97 at 149.26, which is close to 147.68 (1998 high). This will remain the favored case as long as 55 week EMA (now at 122.31) holds.