Products You May Like

In a market environment where bad news is good news, 528K new jobs (vs 250K estimate), unemployment rate of 3.5% vs. 3.6% estimate, average hourly earnings 0.5% vs. 0.3% estimate (and a revision to the priro month to 0.4% from 0.3%), average workweek 34.6% vs. 34.5% estimates, that is not exactly bad news. In fact it looks like pretty good news to me.

The problem with good news is the strong jobs gains are inflationary. Especially with the unemployment at 3.5%.

Inflation is Fed enemy number 1 which was reinforce by all the comments from Fed officials this week.

Although jobs are a lagging indicator, it nevertheless is a proxy for inflation as workers are still getting paid, can therefore spend and are not worried.

The lower commodity prices seen of late can be thought of as extra stimulus for the US workers who are benefitting more from the demand destruction outside the US and perhaps some shocks from $5 a gallon, which is now under $4 in most places. The strong (US) could be getting stronger, with thanks to the weak (outside the US) who are leading to lower prices. .

As a result, interest rates moved higher.

- The 2 year yield is up 19.1 basis point me an up 35 basis points this week at 3.238%

- The 10 year yield is up 13.7 basis points today and 17.3 basis points for the week at 2.827%

- The 30 year yield is up 9.8 basis points today and 5.4 basis points for the week at 3.066%

Having said that, yields are still well off the highs for the year:

- The 2 year high is up at 3.454$%

- 10 year high is at 3.497%

- 30 year high is 3.493%

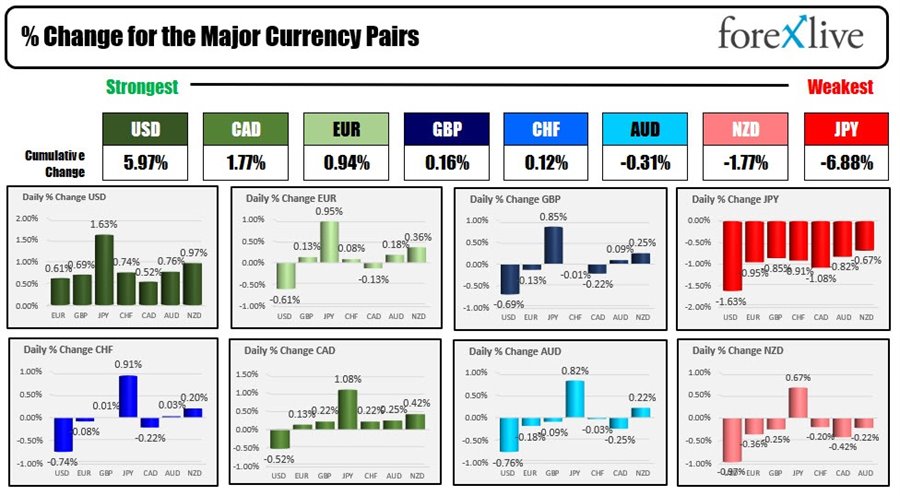

Nevertheless, the run higher in yields, helped to send the USD higher as well. Although the greenback is ending as the strongest of the majors (see the ranking of the strongest to weakest below), the run to the upside seen in the first two hours after the decline could not be sustained and the greenback came off the highs.

The USD is the strongest and the JPY is the weakest

Slowing the rise, was the stock market rebound. After opening lower with the Nasdaq down about -200 points,a grind higher ensued leading to gains in all three indices at one point. Admittedly, the gains were all – or mostly – given back before another grind higher took the Dow into positive territory into the close, the S&P near unchanged and the Nasdaq (which still enjoyed a 2.1% gain for the week), to where it ended down just 0.5% (at the low the index was down -1.53%). Snatching victory from the jaws of defeat.

Now, the markets must still make it through the CPI next week, along with more Fedspeak.

If the Fed officials were warning of tighter policy yet to come, what will they say next after +528K?

Also, if the markets do not behave in their eyes (and they may be looking at the market, and say our fear of inflation is even more elevated), they may look to speed up the bond selling, pushing rates up themselves, taking the froth out of the market, balancing the balance sheet, and ensuring the fatted calf does not get any fatter.

They still have that card in hand. Remember, if bad times required bond buying from the Fed, good times should require bond selling.

There are more chapters to this book that have yet to be written.

Thank you for your support this week. We truly appreciate you, and have a safe and fun weekend.