Products You May Like

With risk-off sentiment and rising treasury yields, Dollar is extending recent rally as focus now turns to US non-farm payrolls report. 2-yaer year hit the highest level since 2007 overnight while 10-year yield also breaks above 3.2 handle. While Dollar is strong, Euro is also resilient, holding in range against the greenback and maintaining most gains against others. Yen is so far the worst performer for the week, followed by Sterling and Swiss Franc.

Technically, while most attention is on Dollar pairs today, we’ll keep an eye on EUR/CHF too. It lost much upside momentum after hitting 0.9833. Extended decline from there, and break of 0.9696 support, will argue that the rebound from 0.9550 has completed. That could also be a signal of the end of rally in Euro in crosses, and the readiness for downside breakout in EUR/USD.

In Asia, at the time of writing, Nikkei is down -0.06%. Hong Kong HSI is down -0.91%. China Shanghai SSE is up 0.01%. Singapore Strait Times is down -0.62%. Japan 10-year JGB yield is down -0.0002 at 0.240. Overnight, DOW rose 0.46%. S&P 500 rose 0.30%. NASDAQ dropped -0.26%. 10-year yield rose 0.132 to 3.265.

BCC expects negative UK GDP growth in Q2, Q3, Q4, inflation to peak at 14%

The British Chambers of Commerce said in a release that the UK economy is expected to “plunge into recession” before the end of 2022, with inflation “spiking to 14%”. Also, “lingering weakness in growth expected to continue into 2024”.

BCC downgraded UK GDP growth forecast for 2022 from 3.5% to 3.3%. Also, a recession is forecast for the UK this year, with negative economic growth for Q2, Q3, and Q4. It expects the economy to return to 0.2% growth in 2023, and 1% growth in 2024.

Inflation is projected to reach 14% in Q4 2022, upgraded from prior forecast of 10%. CPI is forecast to slow to 5% in 2023, and then return to BoE’s 2% target in 2024.

BCC also expects BoE interest rate to increase from 2% in 2022 to 3% in 2023 and 2024.

Fed Bostic: Soft landing is a very hard thing to do

Atlanta Fed President Raphael Bostic said yesterday that “Inflation is high, inflation is too high and we have got to bring it down to our target… So we have got some work to do. We have got to figure out how fast we are going to move our policy to try to arrest that inflation and to wrestle it back down to 2%.”

“When you bring demand down, that has the risk of slowing the economy down so that the economy stops growing, where it loses all of its momentum, and then you might get to a situation that some would describe as recessionary,” he said.

He added that soft landing is “a very hard thing to do. I think it’s only happened maybe once or twice in the history of this country. Ultimately that’s the best of all possible worlds.”

US to release NFP today, EUR/USD ready for breakout?

The US non-farm payroll day is today. Markets are expecting 290k job growth in August, slowed from July’s 528k. Unemployment rate is forecast to be unchanged at 3.5%. Average hourly earnings growth are expected to slow from 0.5% mom to 0.3% mom.

Looking at related economic data, ADP reported showed only 132k private job growth, well below expectations of 300k. However, ISM manufacturing employment improved notably from 49.9 to 52.8, back in expansion. Four-week moving average of initial jobless claims ticked down to 247k.

A disastrous NFP print is not expected today. Anything between 150 and 350k wouldn’t alter the current paths of the markets. However, another month of strong earnings growth should reinforce Fed’s swift tightening path with another 75bps hike this month.

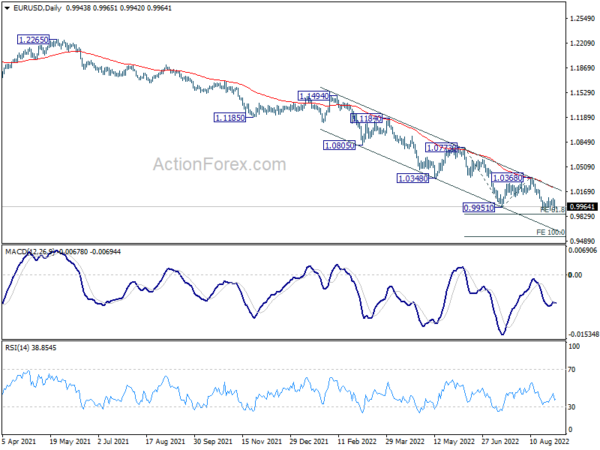

As for market reactions, a major focus is on whether EUR/USD would finally break out from range to resume larger down trend, and accelerate away from parity.

Elsewhere

Germany trade balance and Eurozone PPI will be released in European session. Canada labor productivity, US non-farm payroll and factory orders will be featured later in the day.

USD/JPY Daily Outlook

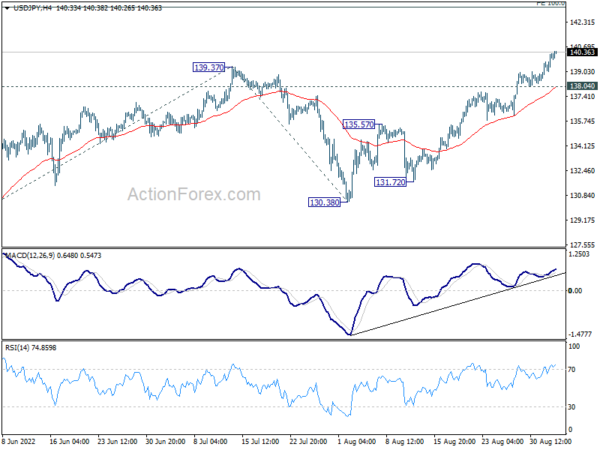

Daily Pivots: (S1) 139.24; (P) 139.74; (R1) 140.70; More…

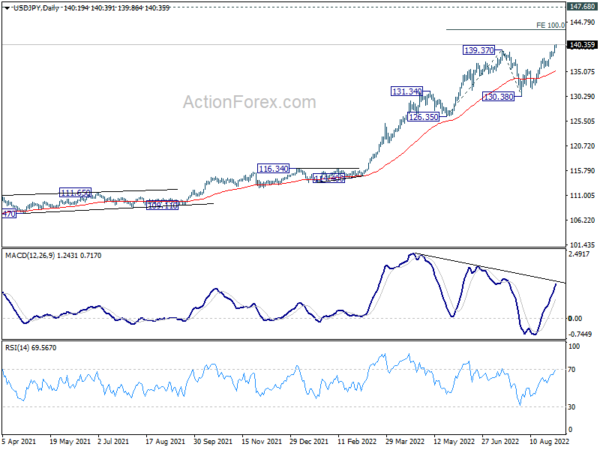

USD/JPY’s firm break of 139.37 resistance confirms up trend resumption. Intraday bias stays on the upside for 100% projection of 126.35 to 139.37 from 130.38 at 143.40 next. Sustained break there could bring upside acceleration of 147.68 long term resistance. On the downside, below 138.04 minor support will turn intraday bias neutral and bring consolidations first, before staging another rally.

In the bigger picture, up trend from 101.18 is still in progress, as part of the whole up trend from 75.56 (2011 low). Further rise should be seen to 147.68 (1998 high). For now, break of 130.38 support is needed to be the first indicate of medium term topping. Otherwise, outlook will stay bullish even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Terms of Trade Index Q2 | -2.40% | 0.20% | 0.50% | 0.60% |

| 06:00 | EUR | Germany Trade Balance (EUR) Jul | 4.6B | 6.4B | ||

| 09:00 | EUR | Eurozone PPI M/M Jul | 2.50% | 1.10% | ||

| 09:00 | EUR | Eurozone PPI Y/Y Jul | 35.80% | 35.80% | ||

| 12:30 | CAD | Labor Productivity Q/Q Q2 | 0.10% | -0.50% | ||

| 12:30 | USD | Nonfarm Payrolls Aug | 290K | 528K | ||

| 12:30 | USD | Unemployment Rate Aug | 3.50% | 3.50% | ||

| 12:30 | USD | Average Hourly Earnings M/M Aug | 0.30% | 0.50% | ||

| 14:00 | USD | Factory Orders M/M Jul | 0.20% | 2.00% |