Products You May Like

Dollar is extending recent up trend against Yen after non-farm payroll report, but struggles to gain against others so far. Instead, Euro shines again on news that Russia looks set to resume gas supplies to Europe through Nord Stream 1. The common currency is retaining its number one place for the week so far, followed by Dollar. Yen is the worst, followed by Swiss Franc and Sterling. But, there are still a few hours to go before weekly close.

In Europe, at the time of writing, FTSE is up 1.20%. DAX is up 2.08%. CAC is up 1.29%. Germany 10-year yield is up 0.19 at 1.581. Earlier in Asia, Nikkei dropped -0.04%. Hong Kong HSI dropped -0.74%. China Shanghai SSE rose 0.05%. Singapore Strait Times dropped -0.57%. Japan 10-year JGB yield rose 0.0023 to 0.243.

US NFP grew 315k in Aug, unemployment rate rose 0.2% to 3.7%

US non-farm payroll employment grew 315k in August, slightly above expectation of 300k. Total employment was 240k above the pre-pandemic level.

Unemployment rose 0.2% to 3.7%, above expectation of 3.5%. Number of unemployed persons increased 344k to 6m. Labor force participation rate rose 0.3% to 62.4%, but remained -1.0% below its pre-pandemic level.

Average hourly earnings rose 0.3% mom, 5.2% yoy, matched expectations.

Eurozone PPI up 4.0% mom, 37.9% yoy in Jul

Eurozone PPI rose 4.0% mom in July, up from June’s 1.3% mom, above expectation of 2.5% mom. For the year, PPI rose 37.9% yoy, accelerated from 36.0% yoy, well above expectation of 35.8% yoy.

For the month, industrial producer prices increased by 9.0% mom in the energy sector, by 1.2% mom for non-durable consumer goods, by 0.9% mom for durable consumer goods, by 0.8% mom for capital goods and by 0.1% mom for intermediate goods. Prices in total industry excluding energy increased by 0.6% mom.

EU PPI rose 3.7% mom, 37.8% yoy. The highest monthly increases in industrial producer prices were recorded in Ireland (+26.1%), Hungary (+9.4%) and Bulgaria (+8.0%), while the largest decreases were observed in Portugal (-1.5%), Sweden (-1.2%) and Luxembourg (-0.9%).

EUR/USD Mid-Day Outlook

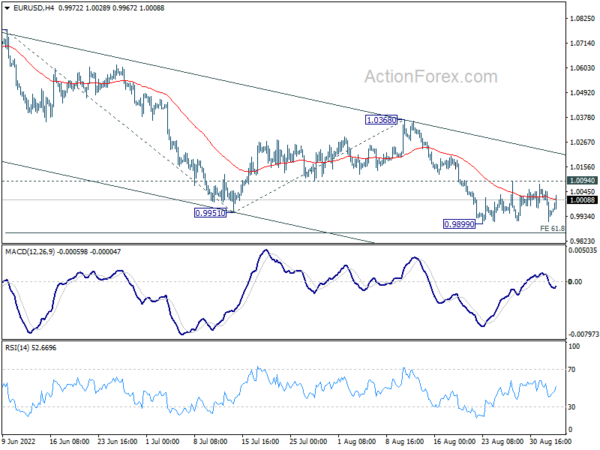

Daily Pivots: (S1) 0.9886; (P) 0.9972; (R1) 1.0033; More…

EUR/USD recovered ahead of 0.9899 support and intraday bias stays neutral. Still, further decline is expected with 1.0094 resistance intact. On the downside, break of 0.9899 will resume larger down trend to 61.8% projection of 1.0773 to 0.9951 from 1.0368 at 0.9860. Firm break there should prompt downside acceleration to 100% projection at 0.9546. However, firm break of 1.0094 minor resistance will dampen this bearish view, and turn bias back to the upside for 1.0368 resistance instead.

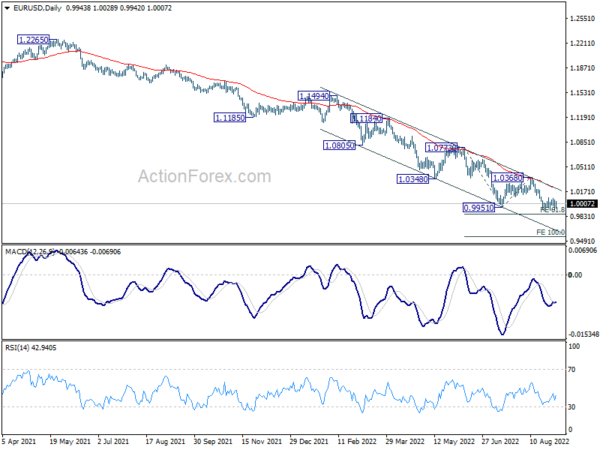

In the bigger picture, down trend from 1.6039 (2008 high) is still in progress. Next target is 100% projection of 1.3993 to 1.0339 from 1.2348 at 0.8694. In any case, outlook will stay bearish as long as 1.0368 resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Terms of Trade Index Q2 | -2.40% | 0.20% | 0.50% | 0.60% |

| 06:00 | EUR | Germany Trade Balance (EUR) Jul | 5.4B | 4.6B | 6.4B | |

| 09:00 | EUR | Eurozone PPI M/M Jul | 4.00% | 2.50% | 1.10% | 1.30% |

| 09:00 | EUR | Eurozone PPI Y/Y Jul | 37.90% | 35.80% | 35.80% | 36.00% |

| 12:30 | CAD | Labor Productivity Q/Q Q2 | 0.20% | 0.10% | -0.50% | -0.60% |

| 12:30 | USD | Nonfarm Payrolls Aug | 315K | 290K | 528K | 526K |

| 12:30 | USD | Unemployment Rate Aug | 3.70% | 3.50% | 3.50% | |

| 12:30 | USD | Average Hourly Earnings M/M Aug | 0.30% | 0.30% | 0.50% | |

| 14:00 | USD | Factory Orders M/M Jul | 0.20% | 2.00% |