Products You May Like

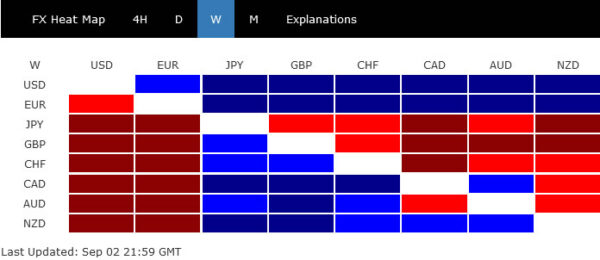

Dollar and Euro ended as double winners of the week. The greenback was boosted by solid economic data from the US, including non-farm payrolls, risk aversion, and rising yields. On the other hand, ECB policy makers were singing a hawkish chorus which prompted expectation of a 75bps rate hike at the September 8 meeting.

Yen was the biggest looser on the back of rising benchmark yields in the US and Europe. BoJ is also clearly maintaining a dovish stance. Yen was also pressured on heightened geopolitical tension in the Taiwan Strait, with repeated military provocation by China using drones.

But Sterling was not too far away from Yen, as UK’s outlook, which is already in recession, looks dim. Swiss Franc is paring some of recent gains, as Euro recovered. Commodity currencies were mixed, with Canadian Dollar having a mild upper hand against Aussie, for expectation of a 75bps BoC hike and a 50bps RBA hike this week.

NASDAQ’s steep fall continued, could it challenge 10k support level

NASDAQ had the third straight week of decline as fall from 13183.08 accelerated lower. Prior rejection by 55 week EMA (now at 12962.21) is clearly a medium term term bearish signal. But it should be noted that there is an important cluster support level slightly above 10k psychological level.

The cluster include 55 month EMA at 10548.59, 61.8% retracement of 6631.42 (2020 low) to 16212.22 (2021 high) at 10291.28, and 38.2% retracement of 1265.52 (2009 low) to 16212.22 at 10502.58.

So, while deeper fall is expected as long as 55 day EMA (now at 12179.80) holds, and breach of 10565.13 low cannot be ruled out. There should be strong support around 10k to bring reversal. And, if happens, firm break of 10k will indicate that something dramatic is happening.

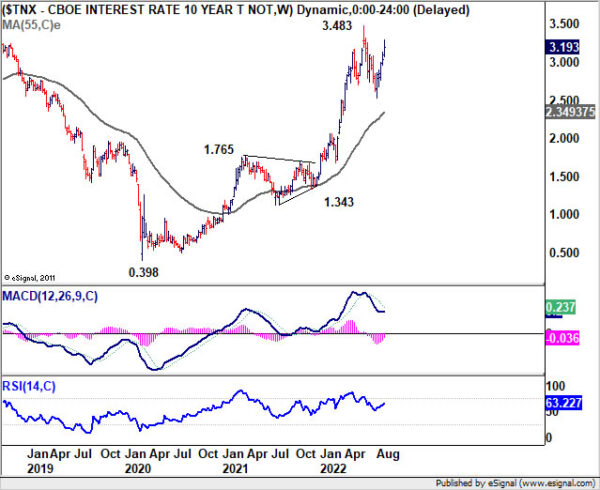

10-year yield extended rebound, but 3.483 should still cap upside

10-year yield’s rebound from 2.525 extended last week, break through 3.101 resistance and hit as high as 3.295. While further rise is in favor for the near term, firm break of 3.483 high is still not anticipated yet. There should be one more falling leg before corrective pattern from 3.483 completes. Break of 3.008 support will suggest that such third leg has started back towards 2.525.

However, the up trend resumption in USD/JPY is making this view shaky. Decisive break of 3.483 will resume larger up trend from 0.398 (2020 low). Such development, if happens, will reinforce USD/JPY’s rally towards 1998 high at 147.68.

Dollar index extending up trend towards 112.63

Dollar index’s up trend continued last week but that was surprisingly due to upside break out in USD/JPY, rather than downside breakout in EUR/USD. Anyway, near term outlook will stay bullish as long as 107.58 support holds. Next target is 100% projection of 101.29 to 109.29 from 104.63 at 112.63.

In the bigger picture, current rise in DXY is part of the decade long up trend from 70.69 (2008 low). Theoretically, such up trend should target 100% projection of 72.69 to 103.82 from 89.20 at 120.33, which close to 2001 high at 121.02. But this bearish case would require down trend resumption in EUR/USD before becoming more solid.

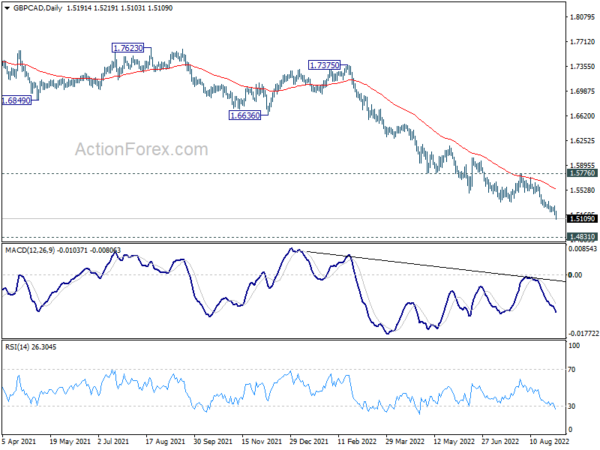

Canadian Dollar also strong on BoC expectations

While Dollar and Euro was strong, Canadian Dollar performed not too badly. The Loonie is supported by expectation of BoC rate hike of 75bps on September 7.

GBP/CAD’s down trend continued last week with daily MACD showing further downside acceleration. Outlook will stay bearish as long as 1.5776 resistance holds. Next target is 1.4831 long term support (2010 low). This coincides with 61.8% projection of 2.0971 (2015 high) to 1.5746 (2016 low) from 1.8047 (2020 high) at 1.4818. This 1.4818/31 should provide strong support to bring rebound, at least on first attempt.

However, sustained break of 1.4831 will will indicate multi-decade down trend resumption for 100% projection at 1.2822 in the medium term.

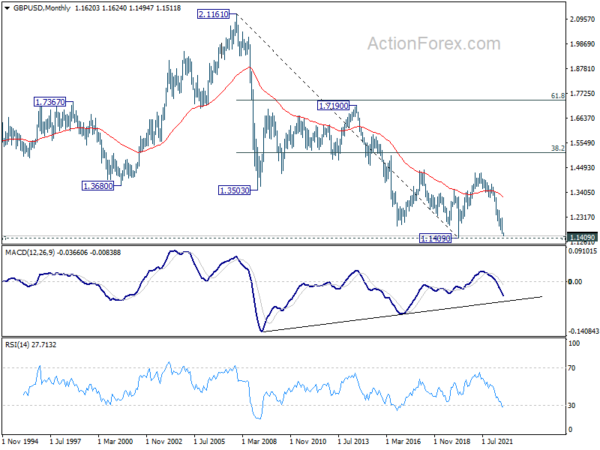

Also, the development in GBP/CAD would very much depends on whether GBP/USD would break through 1.1409 (2020 low) decisively, and subsequent downside momentum.

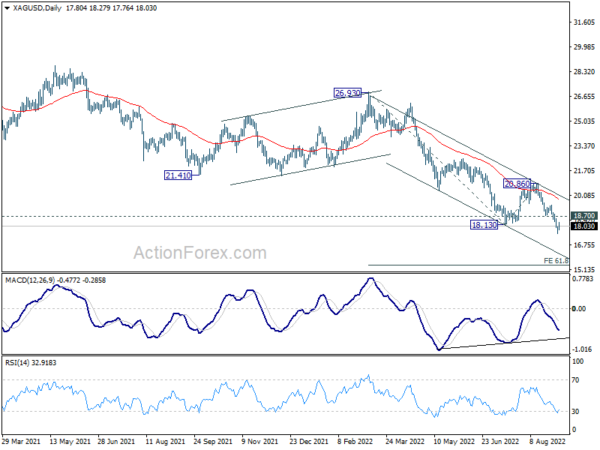

Silver resumed down trend, Gold still holding above 1680

Silver’s down trend resumed by breaking through 18.13 low last week and hit as low as 17.54. Near term outlook will stay bearish as long as 18.70 resistance holds. Next target is 61.8% projection of 26.93 to 18.13 from 20.86 at 15.42. Also, prior rejection by 55 month EMA is clearly a bearish sign. While it’s too early to tell, the case of more decline towards 2020 low at 11.67 is now opened.

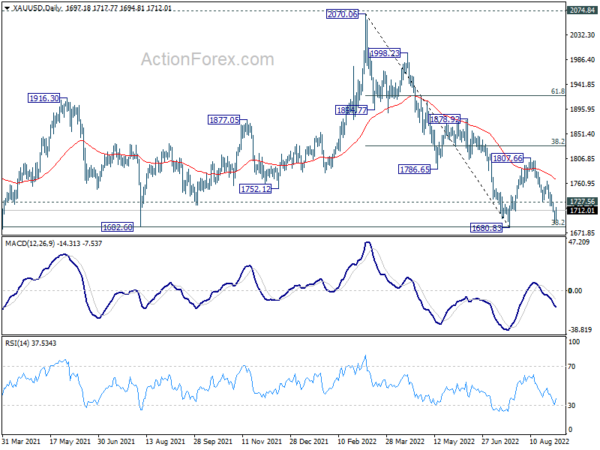

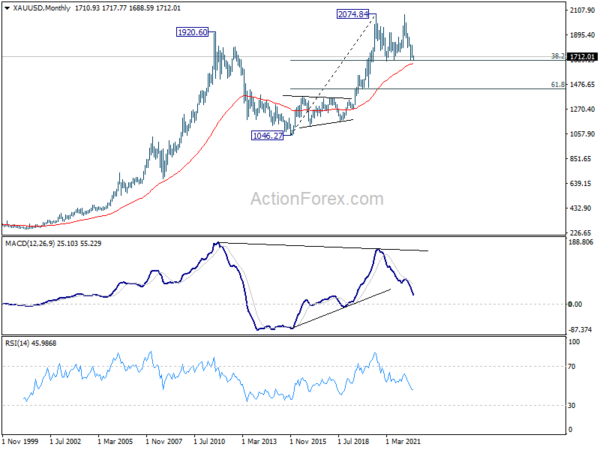

Gold also declined notably last week on the back of Dollar’s strength. There is still hope of support from 1680.83 cluster level to bring rebound. This coincides with 38.2% retracement of 1046.27 (2015 low) to 2074.84 at 1681.92, and in proximity to 55 month EMA (now at 1654.00).

However, sustained break of 1654/80 support zone will complete a double top pattern (2074.84, 2070.06). That could prompt deeper selloff to 61.8% retracement of 1046.27 to 2074.84 at 1439.18. If that happens, it would likely be accompanied by some upside acceleration in Dollar.

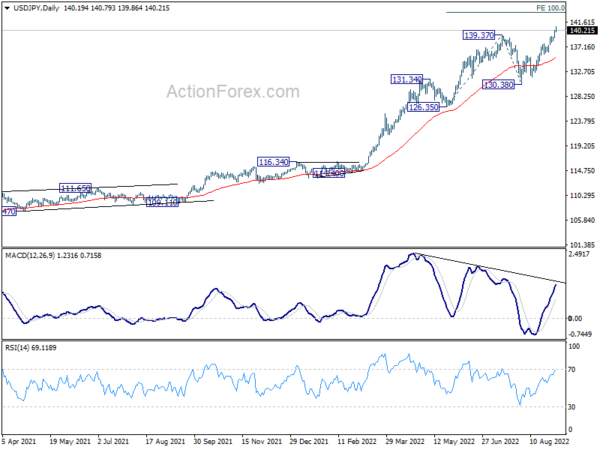

USD/JPY Weekly Outlook

USD/JPY’s up trend resumed last week by breaking through 139.37 and hit as high as 140.79. Initial bias stays on the upside this week. Next target is 100% projection of 126.35 to 139.37 from 130.38 at 143.40. Sustained break there could bring upside acceleration of 147.68 long term resistance. On the downside, below 138.04 minor support will turn intraday bias neutral and bring consolidations first, before staging another rally.

In the bigger picture, up trend from 101.18 is still in progress, as part of the whole up trend from 75.56 (2011 low). Further rise should be seen to 147.68 (1998 high). For now, break of 130.38 support is needed to be the first indication of medium term topping. Otherwise, outlook will stay bullish even in case of deep pull back.

In the long term picture, rise from 101.18 is seen as part of the up trend from 75.56 (2011 low). Further rally is expected to 100% projection of 75.56 (2011 low) to 125.85 (2015 high) from 98.97 at 149.26, which is slightly above 147.68 (1998 high). This will remain the favored case as long as 55 week EMA (now at 124.31) holds.