Products You May Like

The markets are relatively steady in Asian session today, as focus turns to ECB rate hike. Dollar has been paring some gains overnight as risk aversion receded mildly. Both Euro and Swiss Franc are generally firming up. On the other hand, There is little sign of life for Yen, as it’s staying pressured across the board. Sterling is also not too far away, while commodity currencies are mixed, with Canadian on the upper hand.

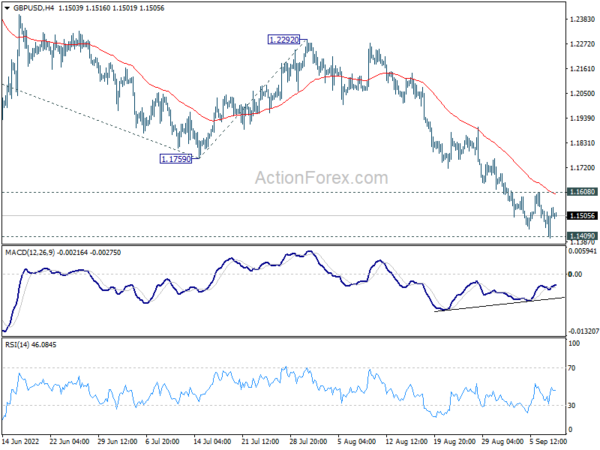

Technically, in addition to Euro pairs, GBP/USD is one to watch today too, as it’s now pressing pandemic low at 1.1409. Selloff is slowing for now. Indeed, considering bullish convergence condition in 4 hour MACD, break of 1.1608 minor resistance will suggest short term bottoming, after defending the key support. In that case, a sustainable rebound should follow as traders cover their short position and take profits. On the other hand, firm break of 1.1409 would trigger downside re-acceleration.

In Asia, at the time of writing, Nikkei is up 2.34%. Hong Kong HSI is down -0.49%. China Shanghai SSE is up 0.15%. Singapore Strait Times is up 0.82%. Japan 10-year JGB yield is up 0.001 at 0.248. Overnight, DOW rose 1.40%. S&P 500 rose 1.83%. NASDAQ rose 2.14%. 10-year yield dropped -0.075 to 3.265.

Fed Brainard: Monetary policy will need to be restrictive for some time

Fed Vice Chair Lael Brainard said yesterday that “monetary policy will need to be restrictive for some time to provide confidence that inflation is moving down” to 2% target. She added Fed will need “several months of low monthly inflation readings to be confident that inflation is moving back down to 2%.”

“Our resolve is firm,” Brainard said. “If history is any guide, it is important to avoid the risk of pulling back too soon,” and easing interest rates before inflation is under control.

Boston Fed President Susan Collins said, “It’s really premature right now to be too specific about exactly what the right policy move will be in September… I will reiterate that we need to do more, we’ve not yet seen significant declines in prices, and that’s what we’re going to be looking for.”

RBA Lowe: Case for slower tightening becomes stronger as rate rises

RBA Governor Philip Lowe reiterated in a speech that “further increases in interest rates will be required over the months ahead”. But policy is “not on a pre-sent path” due to uncertainties. Also, “all else equal, the case for a slower pace of increase in interest rates becomes stronger as the level of the cash rate rises.”

Lowe also highlighted three sources of uncertainty to the economy. The first is the “global economic environment”, including the US, Europe and China. He said, “some slowing in the global economy will help bring inflation down, but a sharp slowing would make the job of delivering a soft landing here in Australia much harder.”

The second source is “how inflation expectations and the inflation psychology in Australia adjust to the period of high inflation”. The third is “how households respond to higher interest rates”.

ECB to hike 75bps? A Look at EUR/CHF

ECB is expected to deliver another rate hike today. A 75bps is not fully priced in, but that’s the more likely outcome after recent chorus of hawkish rhetorics. The markets would be eager to know more about two things going forward, the terminal rate of the current tightening cycle, and the pace to get there. But it’s unlikely for President Christine Lagarde to reveal much on the two questions. Nevertheless, Lagarde might indicate a discussion on ending the reinvestment phase of the APP, which could be a hawkish sign.

Here are some previews on ECB:

Regarding market reactions, the next move in EUR/CHF is worth some attention. On the bearish side, break of 0.9696 minor support will signal completion of the rebound from 0.9550, and the readiness for down trend resumption through this low. In case of another rebound, sustained break of 38.2% retracement of 1.0512 to 0.9550 at 0.9917 is needed to confirm a bullish turn. Otherwise, Euro’s rally elsewhere could be somewhat capped.

On the data front

UK RICS house price balance dropped from 62 to 53 in August, below expectation of 61. Japan Q2 GDP growth was finalized at 0.9% qoq while GDP deflator was finalized at -0.3% yoy. Japan current account deficit came in at JPY -0.63T. Australia trade surplus narrowed from AUD 17.67B to AUD 8.37B in July, versus expectation of AUD 14.50B.

Looking ahead, Swiss unemployment rate, France trade balance will be released in European session. US will release jobless claims.

EUR/USD Daily Outlook

Daily Pivots: (S1) 0.9918; (P) 0.9965; (R1) 1.0053; More…

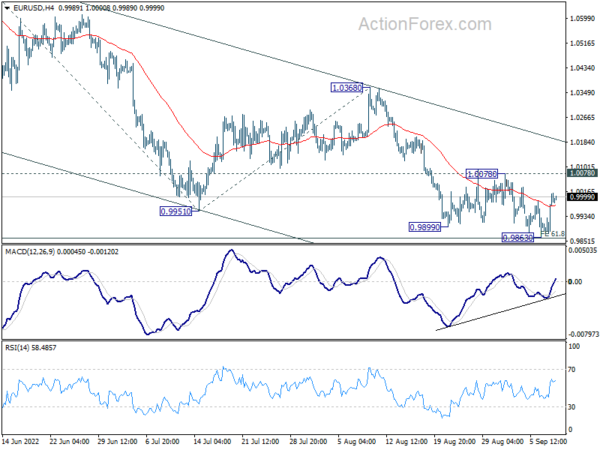

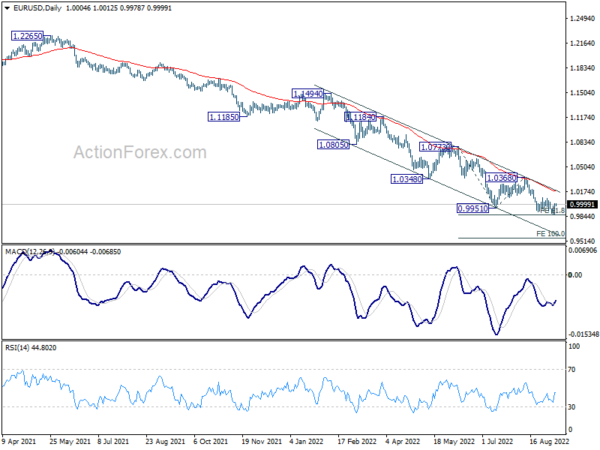

EUR/USD recovers notably, but stays below 1.0078 resistance. Intraday bias remains neutral and further decline is expected. Decisive break of 61.8% projection of 1.0773 to 0.9951 from 1.0368 at 0.9860 should prompt downside acceleration to 100% projection at 0.9546. On the upside, however, firm break of 1.0078 will indicate short term bottoming, and turn bias back to the upside for 1.0368 resistance instead.

In the bigger picture, down trend from 1.6039 (2008 high) is still in progress. Next target is 100% projection of 1.3993 to 1.0339 from 1.2348 at 0.8694. In any case, outlook will stay bearish as long as 1.0368 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Aug | 53% | 61% | 63% | 62% |

| 23:50 | JPY | Bank Lending Y/Y Aug | 1.90% | 1.90% | 1.80% | 1.70% |

| 23:50 | JPY | GDP Q/Q Q2 F | 0.90% | 0.70% | 0.50% | |

| 23:50 | JPY | GDP Deflator Y/Y Q2 F | -0.30% | -0.40% | -0.40% | |

| 23:50 | JPY | Current Account (JPY) Jul | -0.63T | 0.02T | 0.84T | |

| 01:30 | AUD | Trade Balance (AUD) Jul | 8.73B | 14.50B | 17.67B | |

| 05:00 | JPY | Eco Watchers Survey: Current Aug | 45.5 | 44 | 43.8 | |

| 05:45 | CHF | Unemployment Rate Aug | 2.10% | 2.20% | 2.20% | |

| 06:45 | EUR | France Trade Balance (EUR) Jul | -12.2B | -13.1B | ||

| 12:15 | EUR | ECB Main Refinancing Rate | 1.25% | 0.50% | ||

| 12:30 | USD | Initial Jobless Claims (Sep 2) | 243K | 232K | ||

| 12:45 | EUR | ECB Press Conference | ||||

| 14:30 | USD | Natural Gas Storage | 55B | 61B | ||

| 15:00 | USD | Crude Oil Inventories | -2.0M | -3.3M |